Project Summary

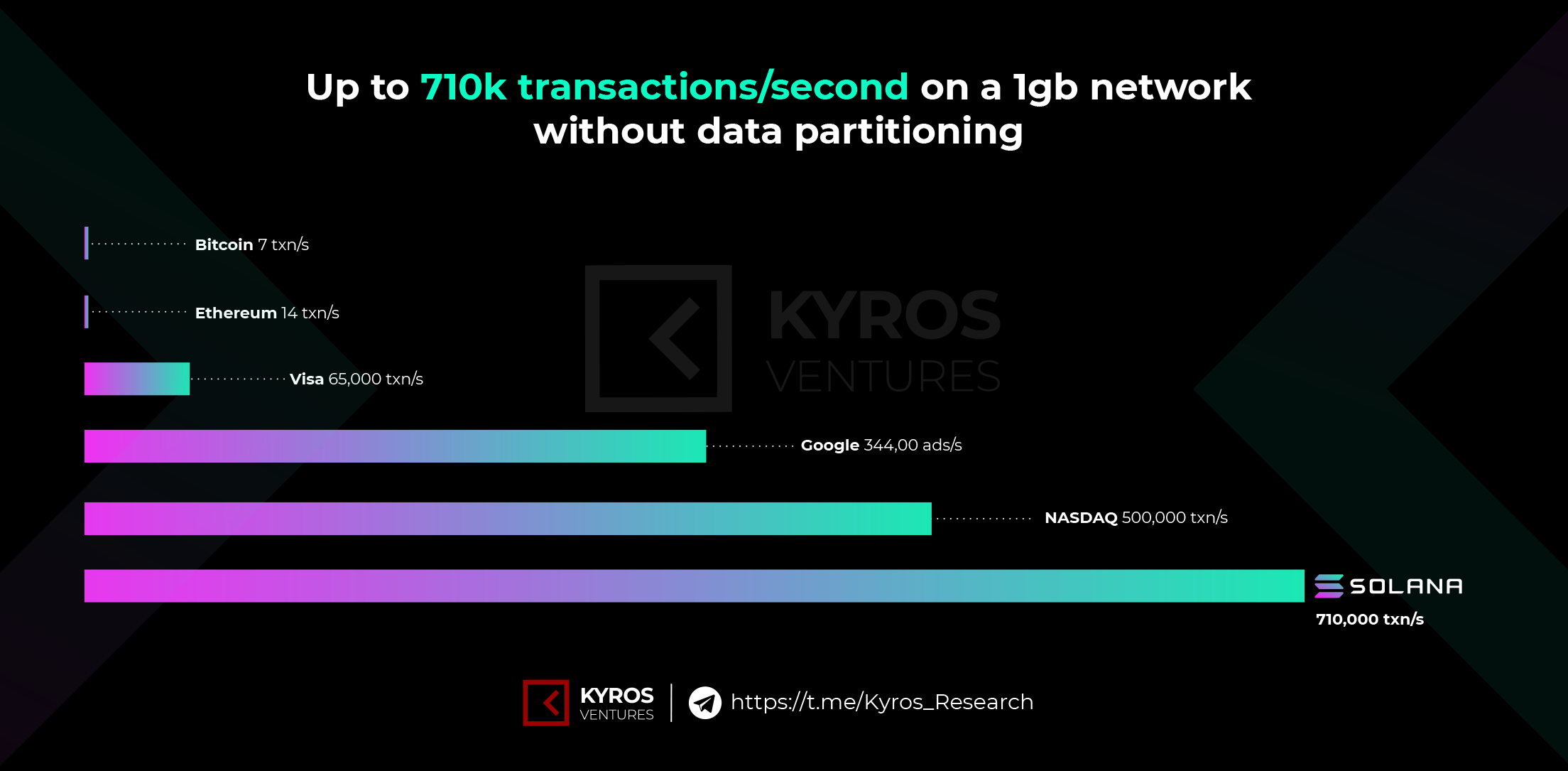

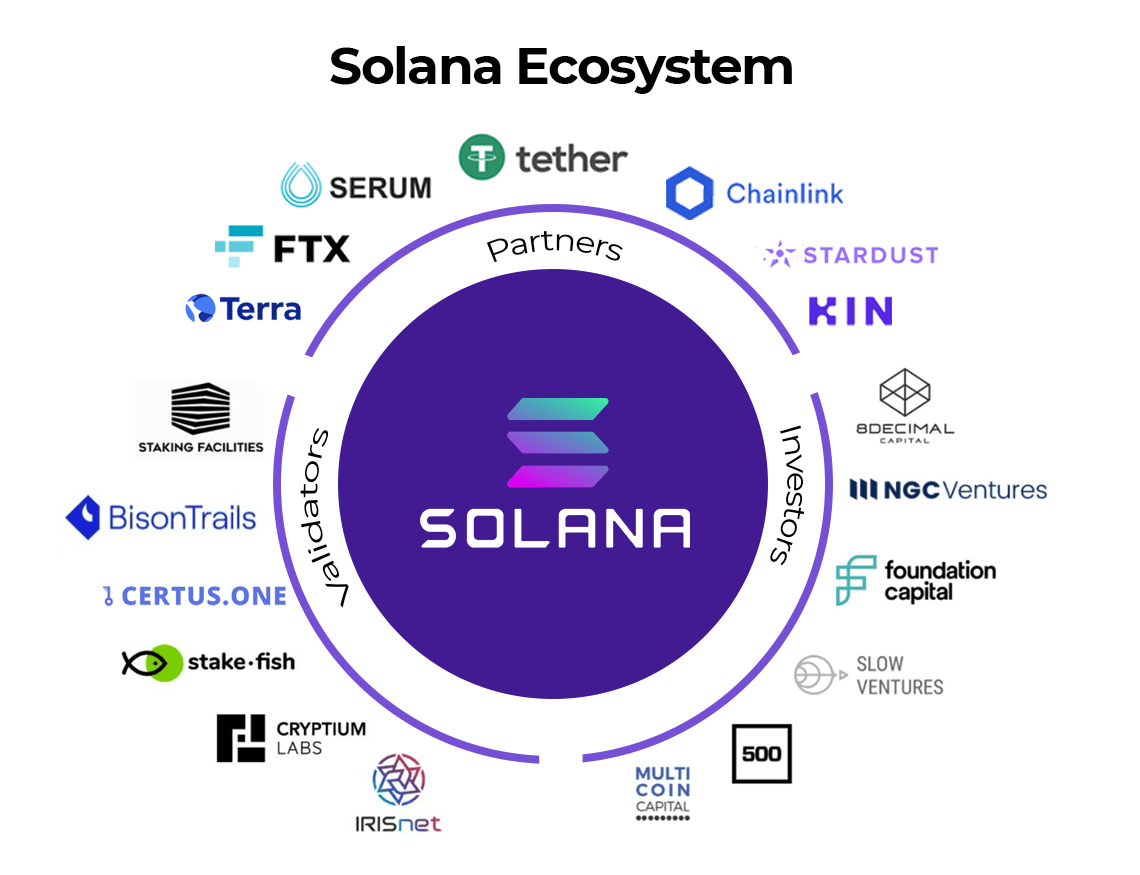

- Lightning-fast blockchain without sharding (Figure 1)

- Proven top-performance blockchain with eight-core innovations

- Trusted by crypto giants and enterprises like Chainlink, Terra, and KIN Foundation

- Backed by a world-class network of investors and validators

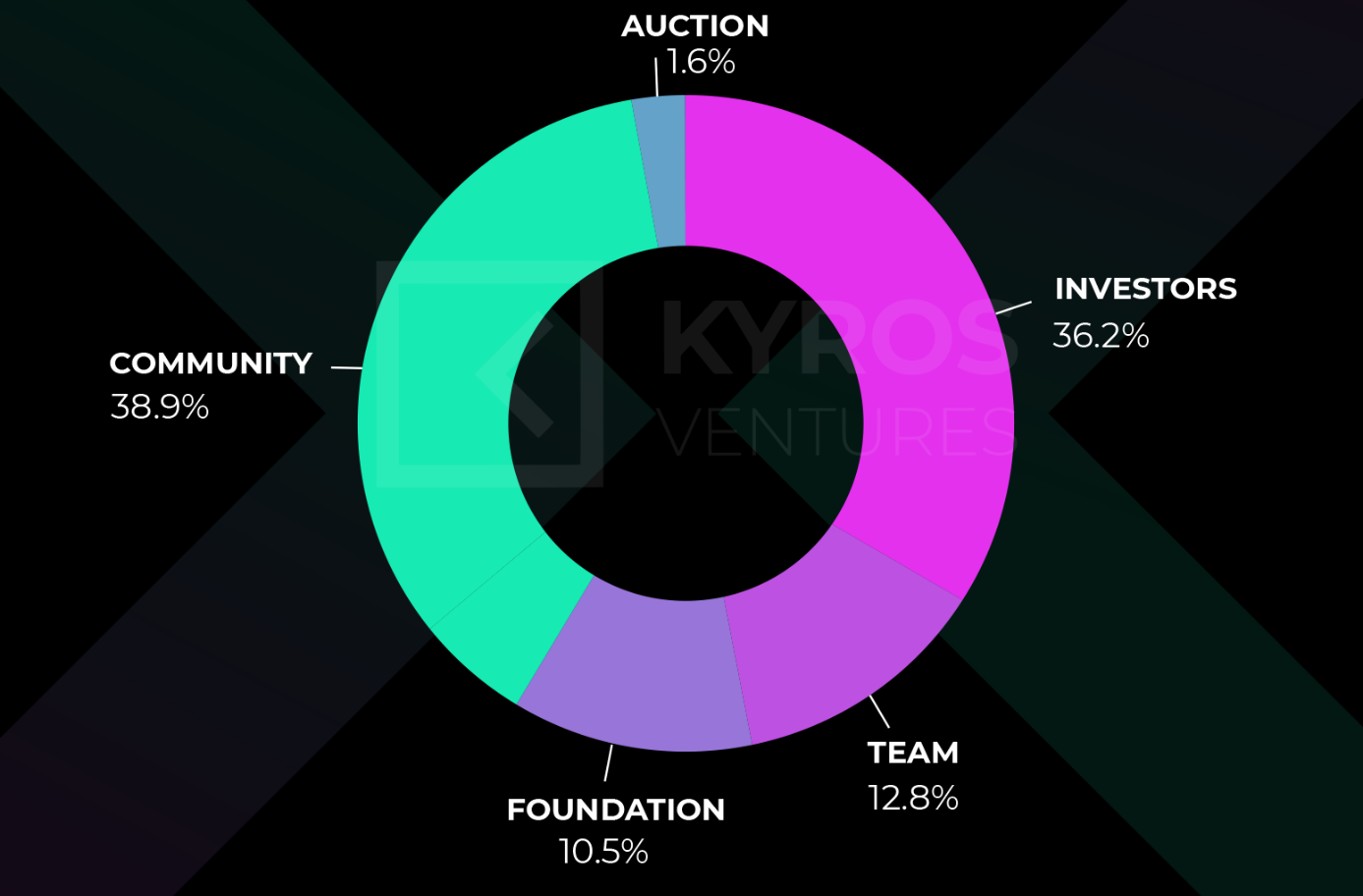

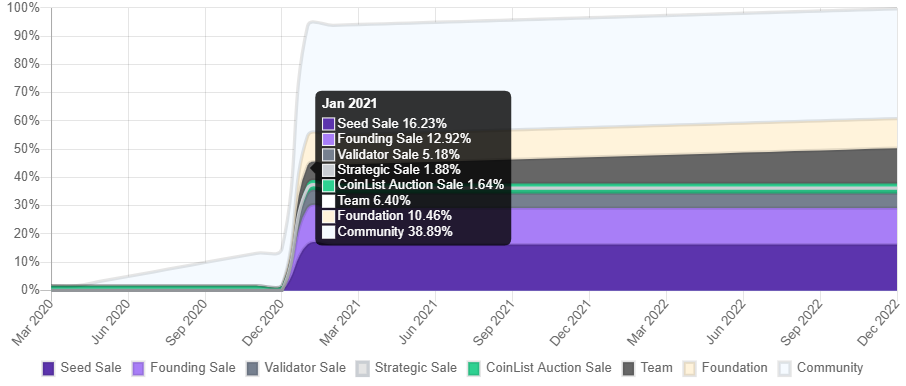

At the time of writing, SOL token specifications are as following:

- Current market cap (MC): $96.5M

- Circulating supply (CS): 33.6M SOL

- Total supply (TS): 488.6M SOL

- Token distribution as illustrated in Figure 2

Team

Key founding members:

- Anatoly Yakovenko, Co-founder and CEO, is the creator of Solana. He led the development of operating systems at Qualcomm, distributed systems at Mesosphere, and compression at Dropbox. He also holds five patents for Solana (1), Dropbox (1), and Qualcomm (3).

- Raj Gokal, Co-founder and COO of Solana, is a veteran entrepreneur with 10+ years in product management and finance. Raj served as Director of Project Management at Omada Health. During that time, the company grew tenfold and completed a $48M Series C round.

- Greg Fitzgerald is Co-founder and CTO of Solana. Greg spent 11 years at Qualcomm, where he contributed to the development of their LLVM toolchain and led the web and messaging infrastructure team.

- Eric Williams (Ph.D.) is co-founder and Heads data science & token economics. The Berkeley alumni received his Ph.D. from Columbia while Higgs-hunting at CERN. He completed a postdoc at Memorial Sloan Kettering Cancer Center and led data science at Omada Health.

- The team also has personals with managerial experience in cryptocurrency trading. This resource can effectively growth-hack relevant ecosystem projects like Serum.

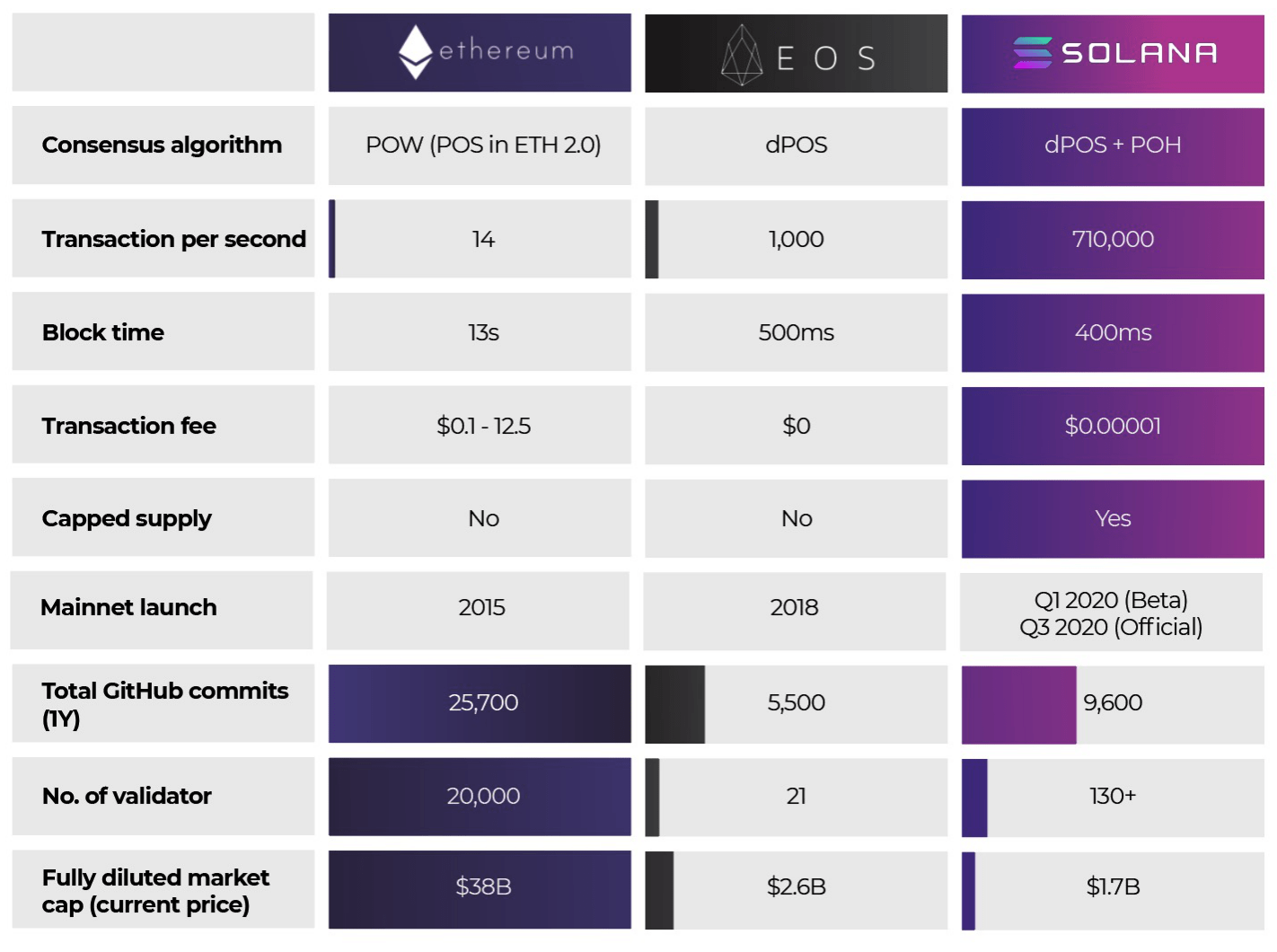

Comparable Projects

Solana vs. Ethereum

| Similarities: Both Ethereum and Solana are public blockchains with similar native token economics. | |

Differences:

| Ethereum still has more considerable development resources with nine different teams working on ETH 2.0, shown by higher GitHub commit activity (25.7k vs. 9.6k of Solana). |

| Ethereum’s market cap is around $42B, according to CoinGecko, at the time of writing. If Solana reaches that market cap at full distribution, the price of SOL will get the $80 mark. | |

Solana vs. EOS

Similarities:

| |

| Differences: | EOS mainnet was already launched from 2018, with over 500 dApps as of Sep 06 (dApp Radar). |

| EOS’s market cap is around $2.6B, according to CoinGecko, at the time of writing. If Solana reaches that market cap at full distribution, the price of SOL will be $5.6. | |

Comparison Table

Figure 3 demonstrates the vital differences/advantages of Solana in comparison with Ethereum and EOS at the time of writing.

Upcoming News

Development Progress

- Mainnet

After running on Beta for six months, Solana’s official mainnet launch, scheduled in Q3 2020, is the most expected and most important event for the project since inception.

- Integration of USDT

Most recently, Tether, the company behind the world’s most prominent stablecoins USDT, announced that Tether (USDT) would be the first stablecoin to launch on Solana. Solana is the eighth and latest blockchain that USDT supports as its partner recognizes for being “the fastest-growing blockchain for both market capitalization and use.” We expect USDT trading available on Solana as soon as the mainnet launches, releasing the billions of dollar daily volume beast from Ethereum’s slow and costly transactions cage.

- Ecosystem build-up

Besides USDT, the team continues to focus on its key project, Serum, while supporting migration from existing partners (Stardust) and new applications/initiatives building on top of Solana blockchain.

- Serum Project

Solana’s partnership with FTX in the Serum project has stunned the crypto world for its ultimate goal of building the world’s first completely decentralized derivatives exchange. Within a couple of weeks, the duo creators have launched Serum live to make an official debut to $34B 12-month volume market. Soon, we can expect Solana to contribute toward Serum’s ecosystem development by introducing more DeFi components into the platform, from yield farming to Swipe integration. Ultimately, the growth of the Serum project will push the expansion of Solana as its very first blockchain use case.

SOL Token Release Schedule

Solana Foundation will unlock the majority of SOL tokens by Jan 7, 2021, pumping its circulating supply to approximately 457M SOL. The circulating supply includes a monthly unlock of 8M SOL for community growth initiatives (details in the monthly Transparency Report). We must closely watch this event and Solana team execution. The event causes a massive surge in unlocked token supply in such a short period (one month), from 14.8% to 93.6% of Total Initial Supply, as depicted in Figure 4.

Optimistic Reasoning

- Sustainable ecosystem growth, having more and more business partnerships with industry giants (Chainlink – March 2020, Terra – April 2020, Kin – June 2020, Serum – July 2020, and so on), is a driving force toward the Solana market cap surge (Figure 5).

The more projects joining Solana’s ecosystem, the higher demand for SOL token since these projects have to build on top of the Solana blockchain. We can project SOL demand from observing what happened with Ethereum when ICO and DeFi trends boomed. Take the Serum project as an example. In case the project successfully achieves its targets, we can expect a skyrocketing amount of Solana on-chain transactions. Hence increasing transaction fee inflow is a healthy income source for the platform.

- Solana, as a multi-round funded startup, has proven its progress and value, captured by world-class tech VCs like 500 Startups, Multicoin Capital, NGC Ventures, and primarily Foundation Capital and Slow Ventures (Crunchbase). The two prominent VCs have successfully grown and exited several deals in the technology industry, notably named Twitter, Uber, and Netflix. We can expect Solana to benefit a similar way from such a valuable network of investors. Milestone: raised 20M Series A in July 2019.

- Strong growth in the validator network when continuing partnering with top-notch staking services providers like BisonTrails, Certus.One, stake.fish, IRISnet, and many others. Solana team has successfully boosted its validator network, from 50 to 130+ in under six months. If the team can carry on this momentum, we project a larger amount of token to be staked by incoming validators, thereby an upward drive toward the token price.

Pessimistic Reasoning

- The total unlocked supply will be around 457.4M SOL (93.6% of the total initial supply) by Jan 7, 2021 (Solana transparency report). If Solana’s team cannot facilitate a smooth token release/unlock schedule, there’ll be a sudden surplus of token supply. Such an event will cause immense downward pressure on the token price and, more likely, a price shock to bring SOL price back to equilibrium.

- Chance of missing a crucial deadline of the mainnet launch since the team used to deliver a late release of Incentivized Testnet on Q3/2019.

- Loss/Change in crucial personnel may cause delayed delivery of the roadmap, thus negative market sentiments.

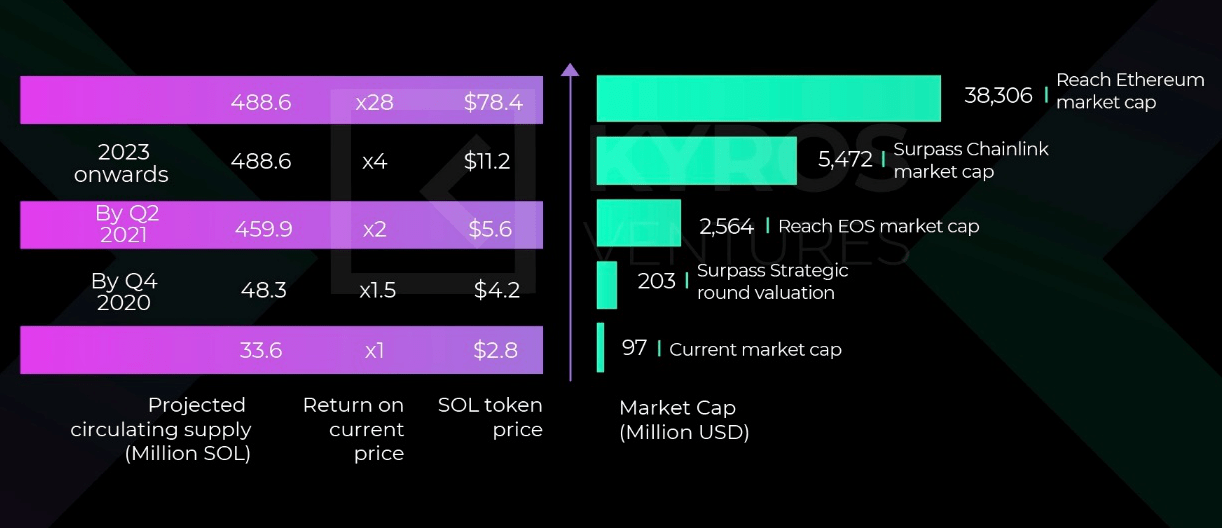

Executive Summary – Pricing Estimates

Comparable Milestones

- If Solana reaches the EOS market cap of $2.75B, the price of SOL will be above $5.6 – 2x the current price.

- If Solana reaches the Ethereum market cap of $39.4B, the price of SOL will be around $78.4 – 28x the current price.

- Condition: full distribution of 488.6M SOL to the circulating supply, excluding the number of burnt tokens.

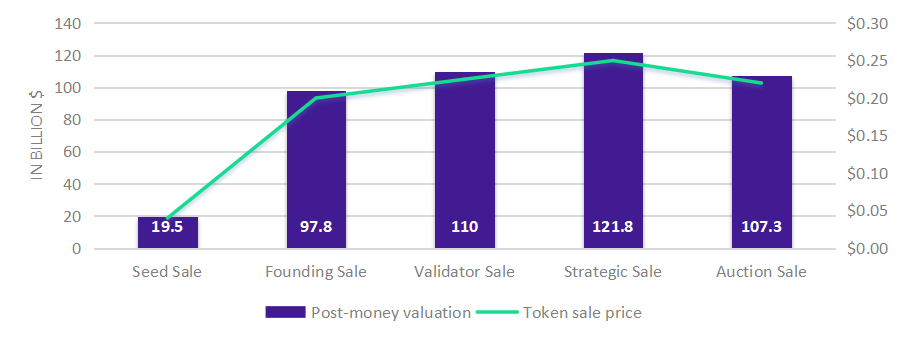

Past Round Valuation Milestones

Assuming that all investments are token sales (not equity), or Solana’s investors value SOL token entirely upon their funding amounts, we can estimate SOL market cap valuation from the last round as Figure 6.

At a market cap of $96.5M, SOL token is currently undervalued as compared with the valuation of the last four rounds.

Projection Milestones

Approach: Both SOL token price and SOL token circulating supply are variables.

Both SOL token price and SOL token circulating supply are subjects to change over time. Thus Figure 7 visualizes in three scenarios how the SOL market cap could be:

- By Q4 2020, CS will be around 48.3M SOL; then SOL price can x1.5 (before mainnet)

- By Q2 2021, CS will be around 459.9M SOL (94.1% of total supply), then SOL price can 2x

- From 2023, CS will reach an initial supply cap at 488.6M SOL (assuming no burning), SOL price has chances to get higher milestones (Figure 7)