Executive Summary

- Hedget provides a decentralized protocol as a solution for an options trading platform, aiming to solve an increasing need for hedging products in the $16B DeFi market.

- Hedget is built on top of Ethereum with Chromia’s robust features added to achieve high performance and low transaction fees.

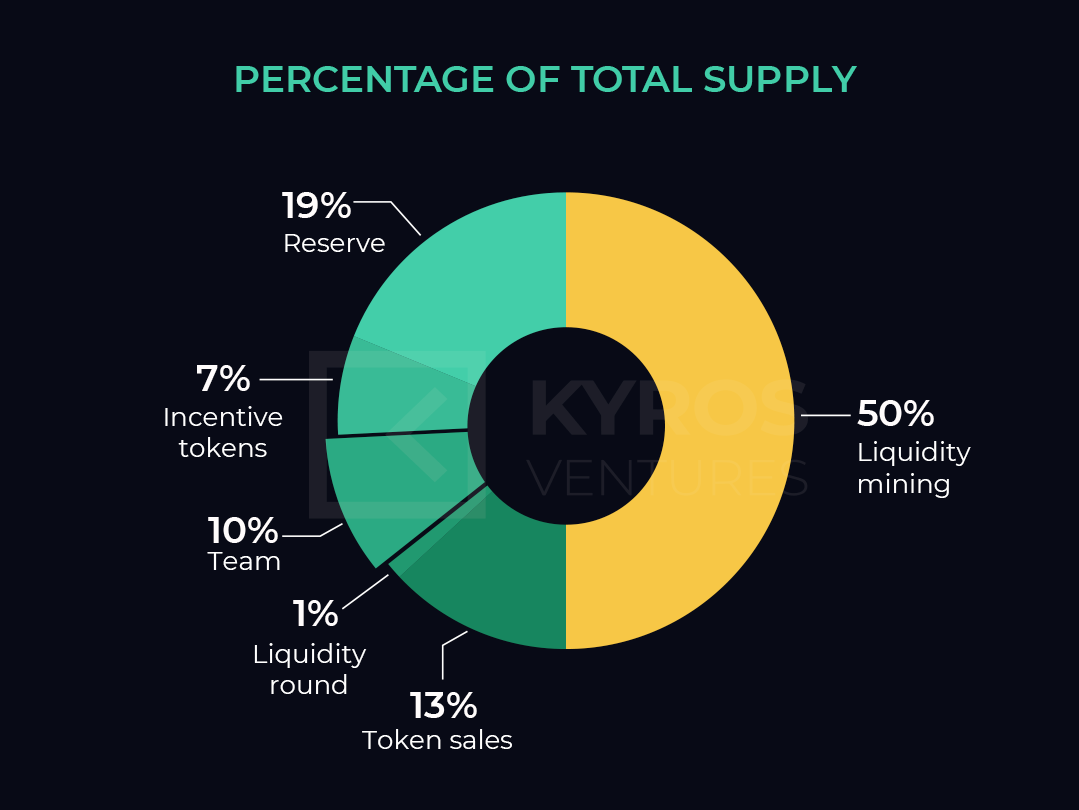

- 50% of the total token supply is locked for liquidity mining rebate for the options’ writer for the first 3-4 years, targeting a healthy ecosystem growth.

- Governing HGET DAO and platform protection are two main goals of the HGET token.

- Hedget is seed funded in a $500,000 round led by two active veteran crypto VCs, namely FBG Capital and NGC Ventures, which previously invested in FTX, Cartesi, CoinFLEX, and AVA Labs. It also welcomed Chromia as a partner and investor. The project will launch another auction round on FTX – leading derivatives exchange well-known for Serum’s IEO (30x at ATH).

- Hedget project launch will benefit from exponential market growth in DeFi, DEX, and Options derivatives recently.

- The world top crypto exchanges have branched into options; however, less competition exists in the DEX field at the moment.

- Comparison with similar projects and relative valuation methods are inputs for Hedget’s market cap projection.

Hedget Protocol

Product

– Highlights

Hedget provides a decentralized Options Trading Platform that allows users to hedge the risk for their crypto holdings as well as their debt positions on other lending protocols such as Compound and Aave. Hedget aims to solve an increasing DeFi market’s need for hedging products. At the time of writing, the total market cap of DeFi has reached $16 billion (DeFi Market Cap [1]).

- Decentralized protocol – non-custodial

- High performance – built on top of Ethereum and Chromia

- Low fees – 50% of tokens locked for liquidity mining rebate

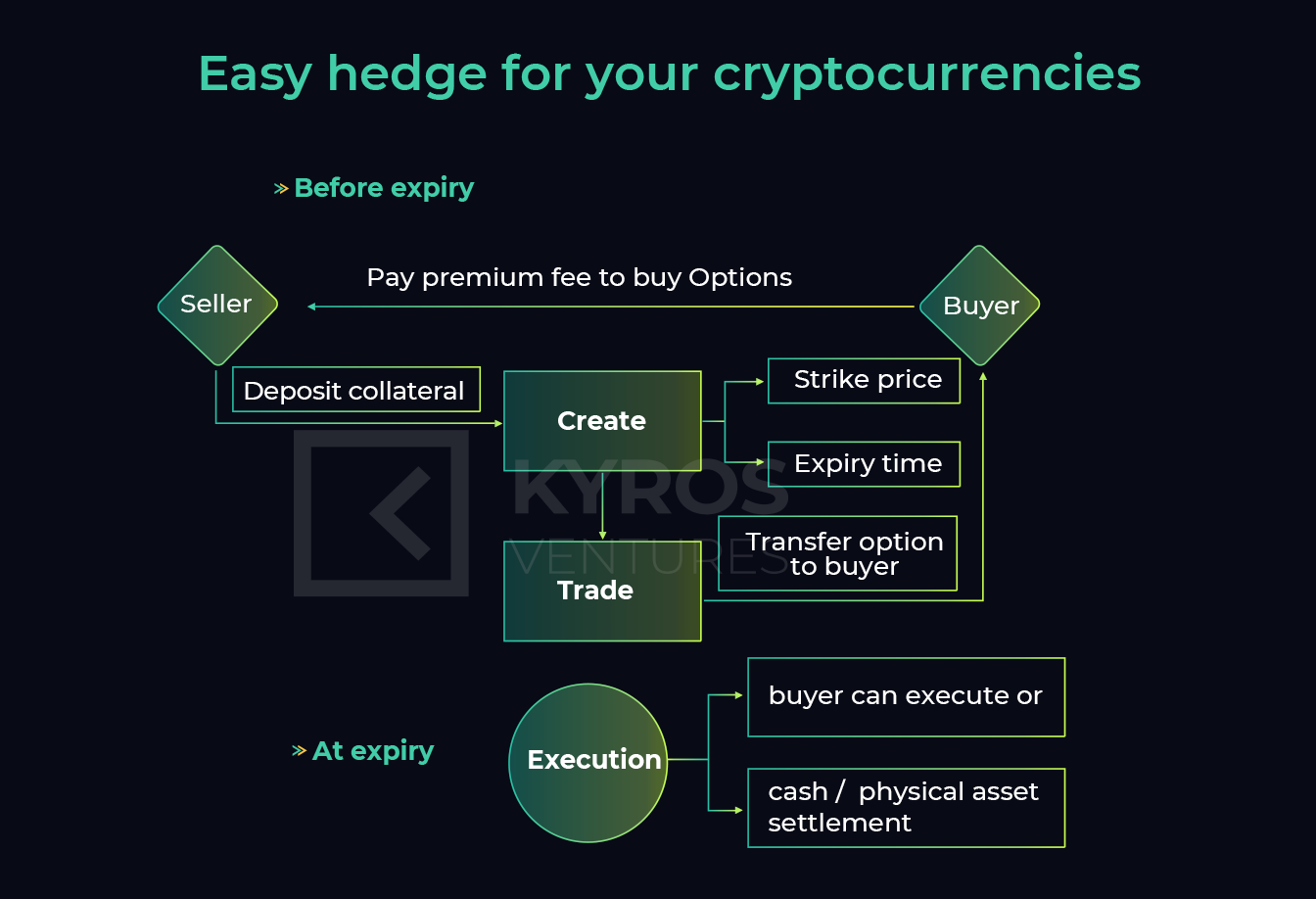

Figure 1 below demonstrates the Hedget options’ mechanism. Hedget customers can buy or sell options to hedge risk corresponding to their needs. The manner in which options work will be discussed in detail later in this paper through a case study.

– Architecture

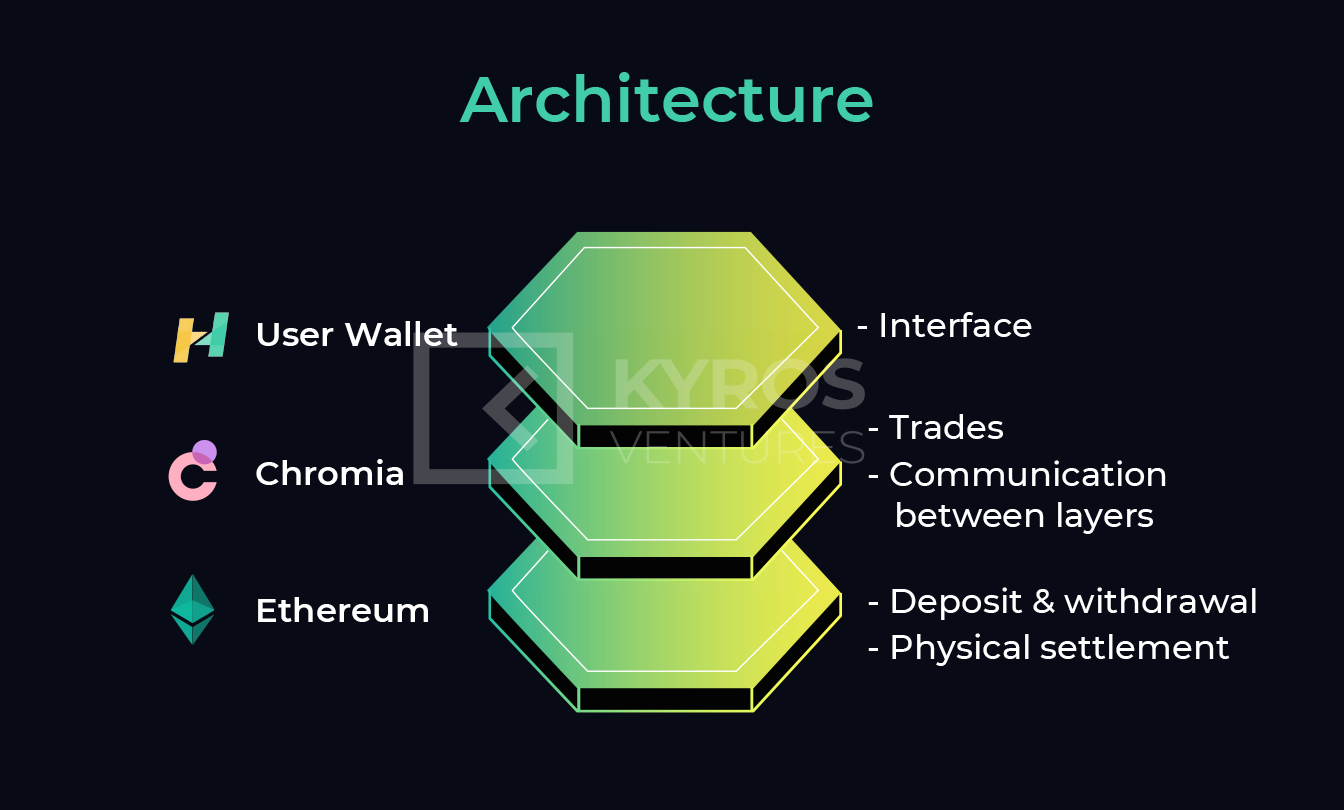

Hedget architecture introduces an effective design to achieve decentralization, high performance, and excellent user experience. On the one hand, token storage is non-custodial, which means only the user has control of his/her funds, whether deposit, withdrawal, or transfer. On the other hand, Chromia Layer 2 features enable higher performance and lower transaction costs, facilitating a better user experience suitable for trading activities while maintaining settlement on Ethereum (Figure 2).

- Ethereum smart contract handles ETH & ERC-20 token deposits and withdrawals, while also implementing the physical settlement.

- Chromia-based blockchain (dApp) handles trades and tracks ownership of contracts. It facilitates communication necessary to perform settlement through Ethereum smart contracts.

- The client-side wallet and trading user interface take commands from the user and carry them out using Ethereum smart contracts and Chromia dApp.

In short, Hedget will operate in a fully decentralized manner and will have all of the great benefits of centralized exchanges, including a user-friendly UI, single sign-on (SSO), the ability to query transactions, etc.

– Options Explained

With this, we discuss how options work by providing a short case study of Alice, who wants to hedge her locked ETH from price downturn risk. Alice’s hedging process has three phases:

- Phase 1: Alice has locked 1 ETH at $300 per ETH for one month on a lending protocol, and she wants to hedge the risk of ETH’s price downturn.

- Phase 2: Alice finds a 1-month Put option on Hedget for the corresponding amount of ETH she has locked, depositing 1 ETH as collateral.

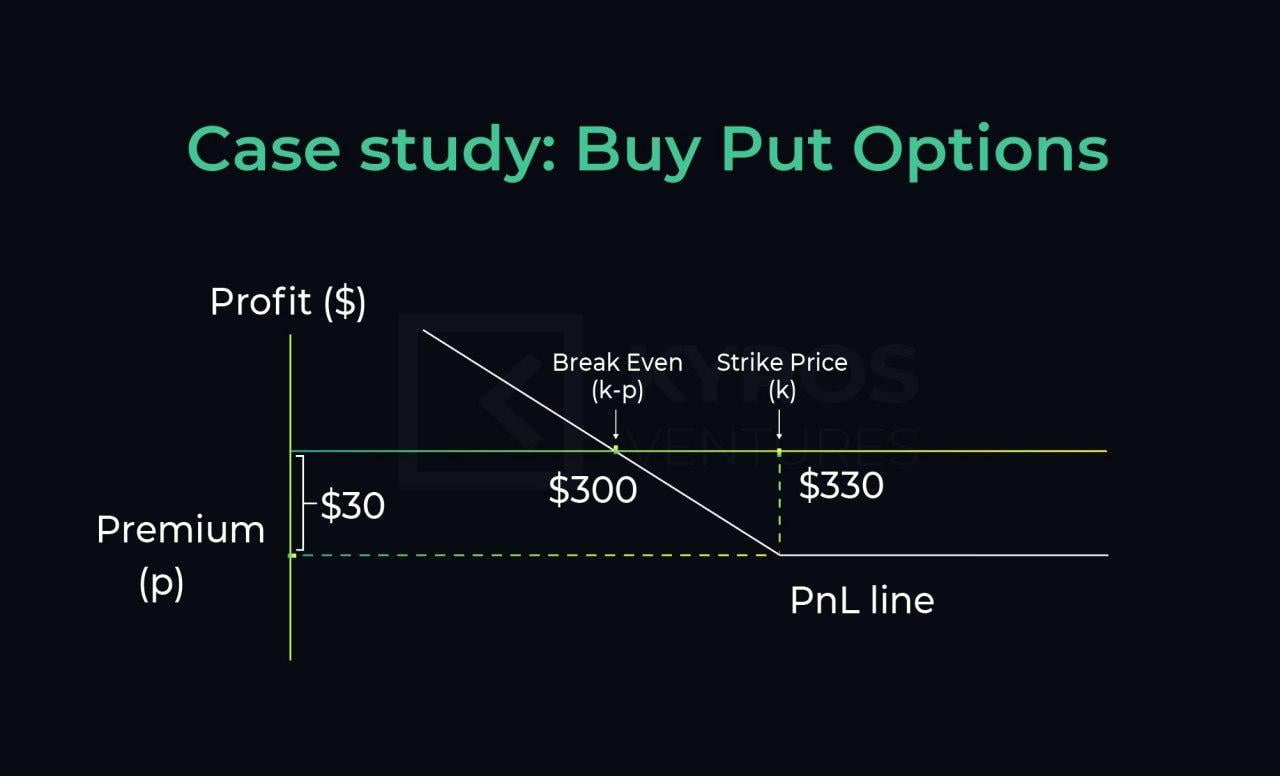

- Phase 3: Alice pays the seller a $30 premium fee for the Put option. In other words, she buys a right to sell ETH at $330, and that right lasts for one month (expiry period) from the date of purchase. Her profit and loss (PnL) line is illustrated in Figure 3.

The possible scenarios are as follows:

- The price of ETH goes below $300: Alice will have a loss in her locked ETH but gain the same amount when she exercises her Put option.

- The price of ETH goes above $330: Alice will accept a maximum loss of $30 by not exercising the Put option, yet making $30+ profit with a higher value of her locked ETH.

- The price of ETH varies in the range $300 – $330: Alice will always gain a total profit of $30 from exercising her Put option and a higher value of her locked ETH.

The case study above outlines how options can allow one to eliminate price fluctuation risk, either to lock profit or to control the desired loss level proactively.

Token Utility

The HGET token is a native utility and governance token of the Hedget platform. The token will be issued on the Ethereum network as an ERC-20 contract and will also be present on a Chromia sidechain. HGET token will have two primary functions:

- HGET DAO governance: To determine fund setup, transaction fees, assets reserves, general functions, and features of the platform.

- Platform protection: To prevent spamming of orders, which can lead to API overloads and order book manipulations. Specifically, a certain amount of HGET tokens will need to be staked. The greater the activity, the more tokens have to be staked.

HGET Tokenomics

According to the project’s whitepaper [2], there will be 10M HGET tokens minted at the launch of the network. The protocol has a fixed token supply. The token distribution is depicted in Figure 4.

- 10% of the tokens will be reserved for the team and advisors; these tokens will be unlocked every month for two years.

- 13% of all tokens will be sold, including 8.77% of the tokens for private sale to be unlocked after public sales end; 4.23% of the tokens are to be distributed to users and investors during the public sale.

- 7% of the tokens will be used for DEX liquidity and trading (such as Uniswap), trading competitions, drops, and other activities to kickstart the usage of Hedget protocol.

- 19% of the tokens will be locked in the reserve fund until two years after the platform is live, and Hedget DAO will determine the usage of these tokens.

- 1% of the tokens are allocated to a liquidity round with Alameda Research [3].

- 50% of the total token supply is locked for liquidity mining rebate for the options’ writer for the first 3-4 years, unlocked on a daily basis when the platform goes live.

Partners & Investors

The four main partners and investors of Hedget are Chromia, Alameda Research, FBG Capital, and NGC Ventures [4]. Each of these entities can unlock the project’s full potential by providing relevant and valuable resources in different aspects.

For instance, Chromia is an excellent match for Ethereum’s Layer 2 solution; Alameda Research-backed platform, FTX, is a leading derivatives exchange that launched the Serum DEX project not too long ago. Crypto investment funds FBG Capital and NGC Ventures were also involved in a $500,000 seed round [5] in early August. Both of these VCs have closed derivatives exchange deals (e.g., FTX, CoinFLEX) in their portfolio that includes a total of 47 projects. Thus, having been involved in similar deals in the past, Hedget’s investors also bring their experience and network to the table.

Chromia

Hedget protocol adds in support on Layer 2 of the current Ethereum chain to enable faster and cheaper transactions thanks to the robust features of Chromia. Its design will allocate settlements to the Ethereum chain while all trading will be performed on Chromia. Hence, Chromia is essentially the L2 for Ethereum used to minimize the transaction fees on the network.

Alameda Research

The news of the FTX auction round of HGET [6] is a great boost toward the project’s reputation and the crypto community’s awareness of Hedget. The Alameda Research-backed platform is well-known for innovative derivatives products and has now become an increasingly popular exchange for high returns on IEO projects. Its first project, Serum, returned 15x on the first listing day after the IEO.

FBG Capital

FBG Capital is a digital asset management firm in the blockchain-based capital market. According to Crunchbase [7], the firm has made 34 early-stage investments in several companies in highly related fields, including a regulated market maker, a derivatives exchange, a dApps platform, a public blockchain, etc. FBG Capital is expected to boost Hedget similarly to FTX.

FBG Capital’s notable portfolio projects include:

- Cartesi – Private round sole investor – $500,000 – April 2019 [8], was featured in Binance Launchpad [9] in April 2020.

- FTX – Seed round co-investor – $8M – August 2019 [10].

NGC Ventures

NGC Ventures is one of the largest and most active institutional investors in the cryptocurrency space. Crunchbase [11] reported that NGC Ventures had completed 13 deals in the fields of fiat-to-crypto solutions, DEX protocol, derivatives exchange, etc. NGC Ventures is expected to be a useful resource for Hedget since the VC firm has worked with and built a good number of exchange-related ventures.

NGC Ventures’ notable portfolio projects include:

- AVA Labs – ICO Co-Lead Investor – $12M – August 2020 [12].

- CoinFLEX – a physically delivered crypto futures exchange – Venture round – $10M – August 2019 [13].

Industry Outlook

Market Overview

In general, the Hedget project benefits from the robust growth of DeFi, DEX, and options derivatives markets.

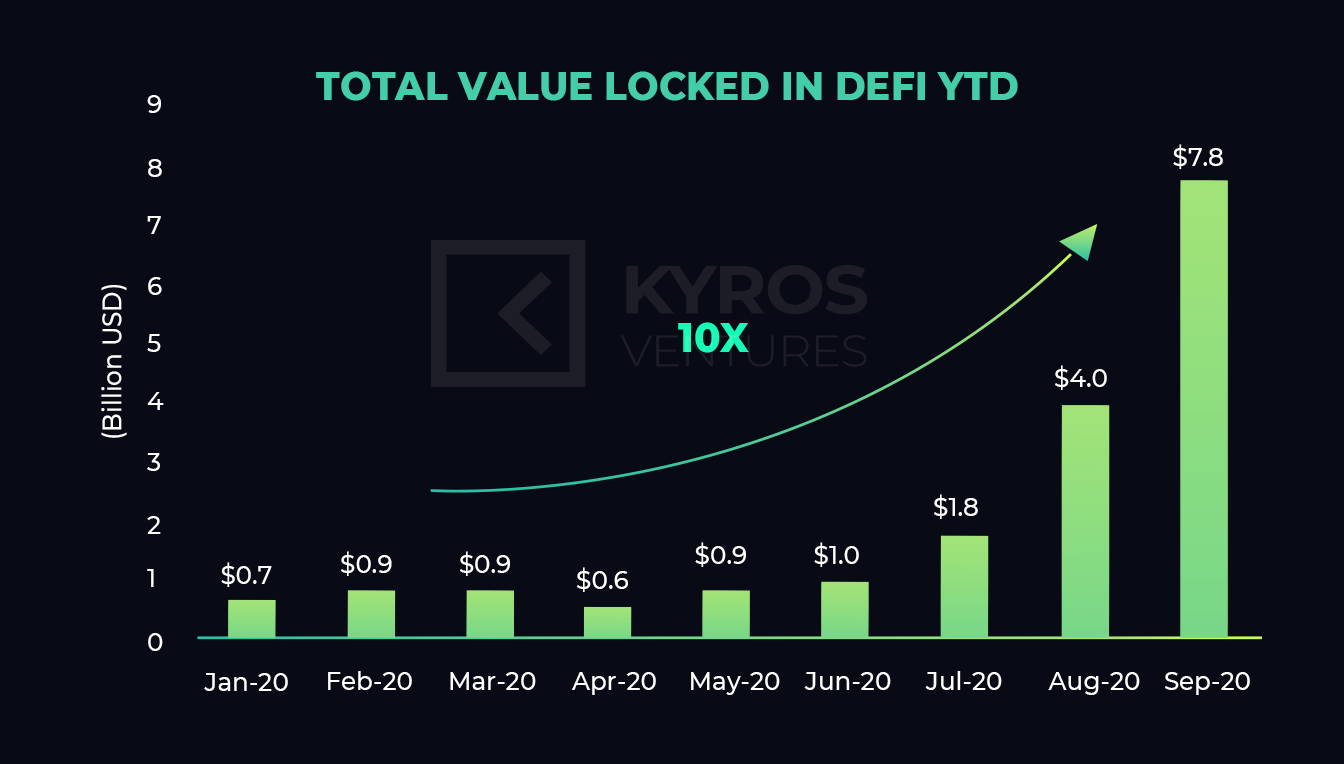

– DeFi

As mentioned in the beginning, the total market capitalization of all DeFi projects has reached $16 billion. The DeFi market’s boom is proven by the skyrocketing Total Value Locked (TVL) metric. At the start of 2020, the TVL in the DeFi sector was $675 million, according to DeFi Pulse [14]. In just eight months, that number has now surpassed the $7 billion mark, or a 10x growth rate year-to-date, and is still rising (Figure 5). The growth also means that billions of dollars’ worth of those locked tokens need to be protected from market fluctuation and downside risk, realizing an exponential growth in demand for derivatives products.

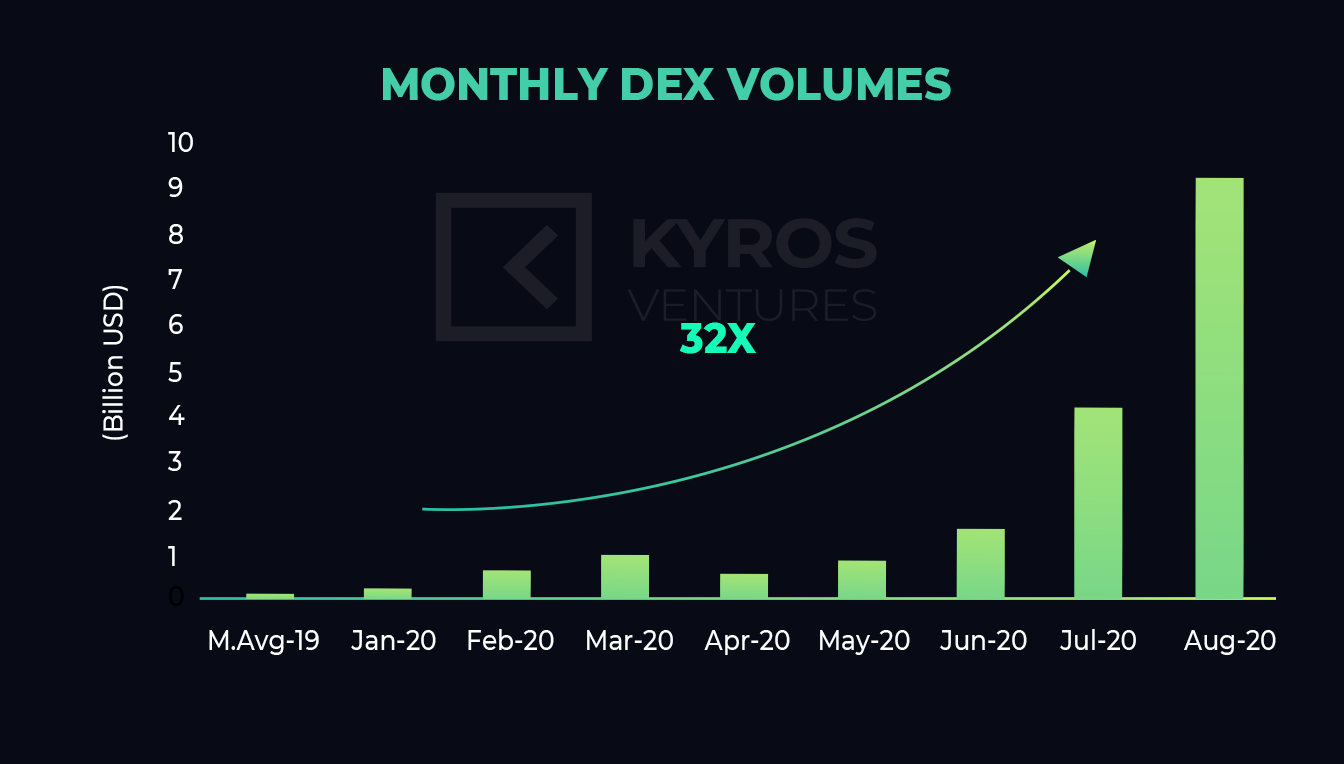

– DEXs

The success of DeFi has an immense contribution from the decentralized exchange (DEX) field. Similar to the growth pattern of DeFi, DEX witnessed a boom in July and August volume (32x growth rate year-to-date) corresponding to the DeFi hype in these months (Figure 6).

The total volume of July and August (2020) alone has exceeded the total volume of the previous 18-month period. As long as DeFi remains a hot topic, the trend is expected to continue.

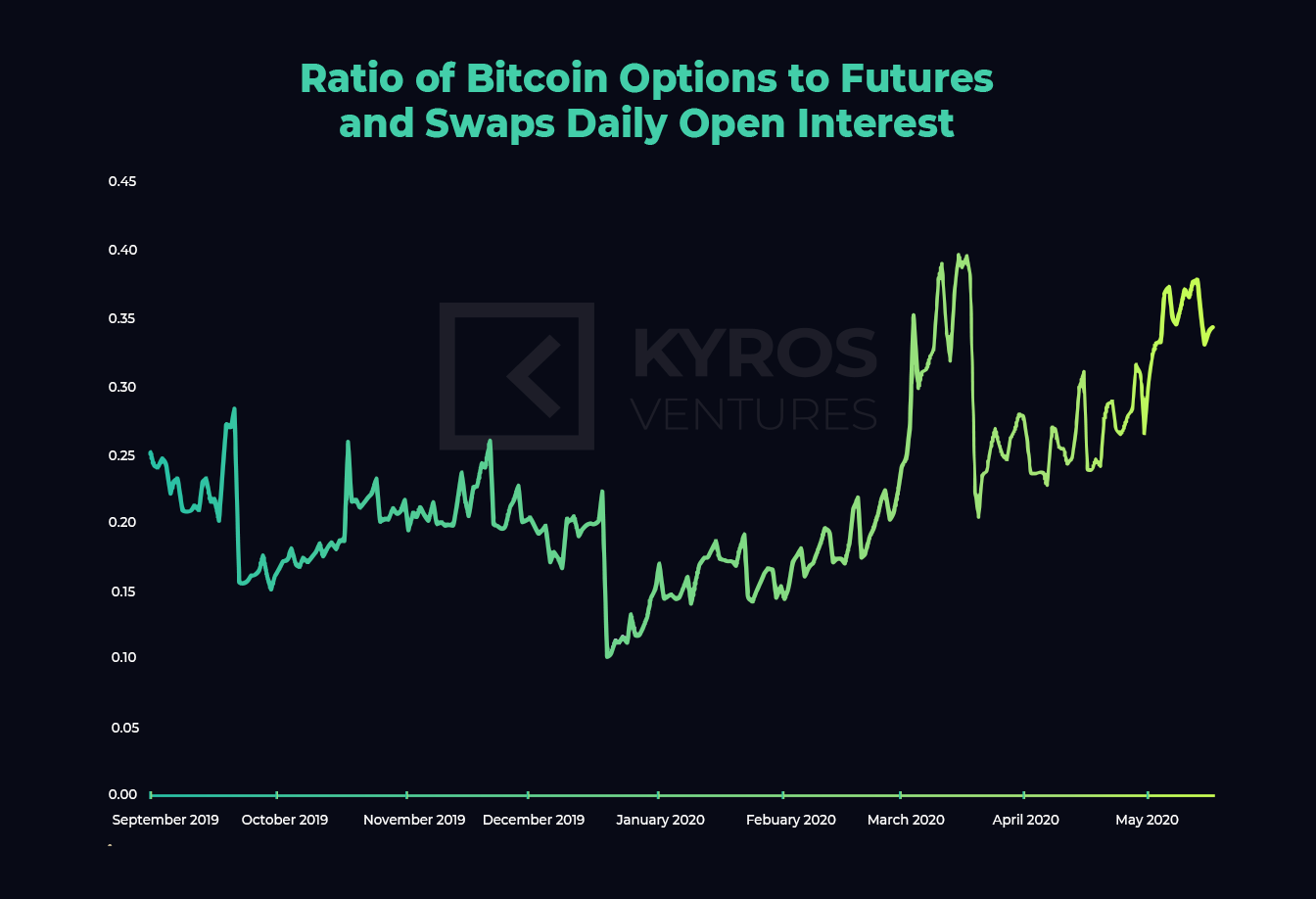

– Options Derivatives

CoinDesk [16] reported that options had outpaced futures and swaps in crypto derivatives trading as the fastest growing crypto derivative product. As shown in Figure 7, the Bitcoin Options to Futures and Swaps ratio on daily open interest has tripled since the beginning of the year, marking increasingly high interest in the product as more and more exchanges are willing to step into the green field.

Competitors

Leading crypto derivatives exchanges have been introducing options for nearly a year; however, less competition exists in the DEX field.

– CEX

FTX, Huobi, Binance, and OKEX have options trading on their platforms. CoinDesk [17] reported that Deribit has been dominant in the Bitcoin options field with an 88% market share. The five leading crypto exchanges (CEX) have launched their options products, marking a healthy growth for the crypto derivatives market as it became more mature and more reflective of the traditional market.

– DEX

Serum, the first IEO on FTX, focuses on derivatives DEX; Synthetix Binary Options will be launched this quarter [18]; MCDEX has a total value locked almost reaching $12M [19] and a market cap of $6.8M [20]; OPYN has grown its cumulative volume to over $30M six months after launch [21].

Options versus Futures

– The Potential of Crypto Options

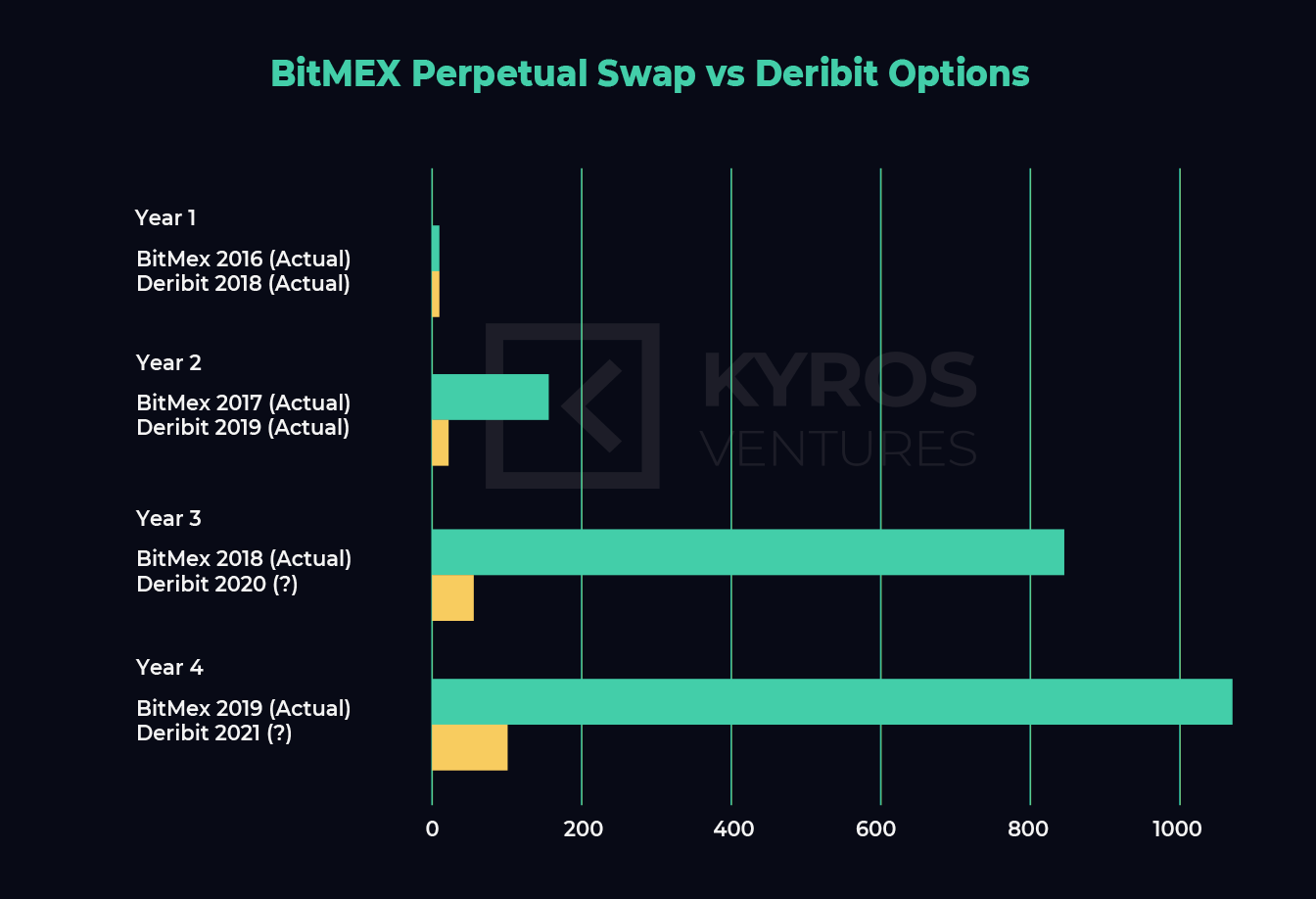

Compared to futures in the early days, there is a lot of room for growth in crypto options. As detailed in the Deribit report [22], the firm expects the options market to reach 5% of the futures volume in 2020-2021, from the current 2% level. The projection is derived from an expectation that options will follow the trend of the future and skyrocket starting from the third year (Figure 8).

– Traditional Market Perspective

Deribit report also mentioned that options trading volumes are 7–8x that of futures in traditional financial exchanges. The ratio is remarkable when we consider crypto options is less than 2% of spot futures. The low current ratio suggests that crypto derivatives markets may follow a similar pattern resulting in the growth of crypto options’ volume.

Metrics of Similar Projects

Serum’s Metrics

Serum aims to be the world’s first completely on-chain cryptocurrency ecosystem with a trustless trading experience through the Serum protocol built on top of the Solana blockchain. The project shares a similar goal with Hedget, which also develops a decentralized protocol but on top of the Ethereum blockchain.

Project Serum [23] reported that before the public sales, the final price of the seed round was roughly $80k per MSRM for roughly 4% of the total supply, raising a total of $20M at a fully diluted post-valuation of $500M. The project’s market cap is around $100M at the time of writing.

MCDEX’s Metrics

MCDEX can be considered as the closest valuation example when analyzing Hedget due to a high degree of similarity in their business models and tokenomics. MCDEX is a fully-decentralized crypto trading platform powered by the Mai Protocol smart contracts, which are also deployed on the Ethereum blockchain. The exchange native token – MCB, listed on Poloniex [24], has the utility of liquidity mining, protocol governance, staking, and so on, similar to the HGET token.

As a result of this, we use Price-to-Book (P/B) value to project the market cap of the HGET token from the P/B ratio of the MCB token. In this paper, we take the “Market Cap” to represent the Price factor, and the “Total value locked” represents the Book value factor, considering parallel concepts in traditional finance and crypto. At the time of writing, MCDEX has $12M TVL on its platform, with a market cap of $6.8M. Therefore, MCB’s Price-to-Book ratio is 0.57, with the market cap representing the Price and TVL the Book value.

Hedget’s Metrics & Market Cap Projection

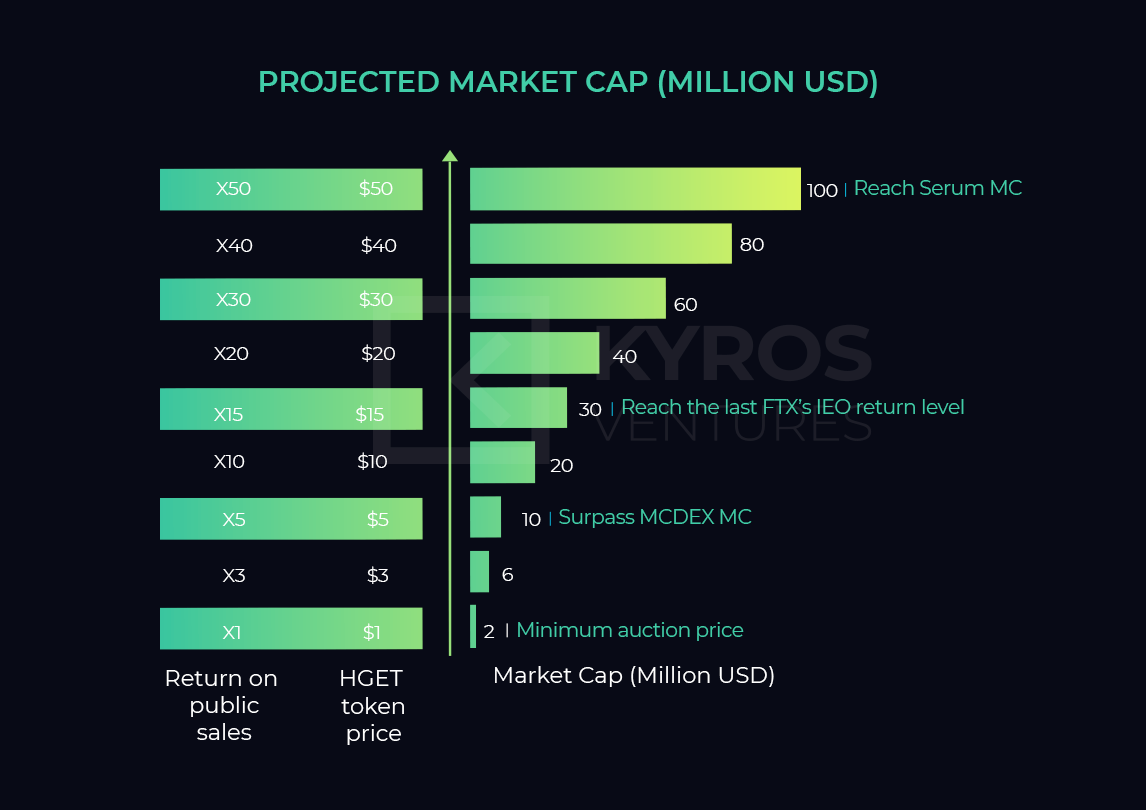

The fully diluted market cap of HGET can be estimated at around $5.7M before its public sales and liquidity round, relatively small compared to the Serum project at a similar fundraising phase. This estimate is based on the $500,000 raised for 8.77% of the total HGET supply during the latest private sales round.

The market caps of SRM and MCB tokens can be used as the milestones for HGET public sales, and a relative valuation methodology is appropriate in this case thanks to a considerable similarity between MCB and HGET tokenomics (Figure 9).

By default, Hedget locks 50% of its tokens for liquidity mining, 20% for Reserve Fund, and 10% for its team with a 2-year vetting schedule. Based on information from FTX’s announcement [25], we project that the circulating supply of HGET will be 2,000,000 HGET after public sales.

- Assuming all auction tokens are allocated at the minimum price of $1, the projected project’s market cap will be $2M.

- From a relative valuation (RV) perspective, we consider the total token value locked by Hedget to project its market cap via the Price-to-Book method.

- Assuming the rest of HGET tokens is locked (80%), we have $8M in TVL at $1 per HGET

- Assuming HGET has the same P/B ratio as MCB (0.57 as calculated above), its market cap is around $4.57M.

References

- Total Market Cap, DeFi Market Cap, viewed 1 Sep 2020, <https://defimarketcap.io>

- Token Distribution, Hedget Whitepaper, viewed 1 Sep 2020, <https://www.hedget.com/papers/hedget_whitepaper_eng.pdf>

- How to Participate in the Hedget IEO, FTX, viewed 1 Sep 2020, <https://help.ftx.com/hc/en-us/articles/360048927331>

- Hedget, viewed 1 Sep 2020, <https://www.hedget.com>

- Seed Round – Hedget, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/funding_round/hedget-seed–15a833fe>

- How to Participate in the Hedget IEO, FTX, viewed 1 Sep 2020, <https://help.ftx.com/hc/en-us/articles/360048927331>

- FBG Capital, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/organization/fbg-capital/recent_investments>

- Venture Round – Cartesi, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/funding_round/cartesi-series-unknown–85e59e5c>

- Binance Launchpad, Binance, viewed 1 Sep 2020, <https://launchpad.binance.com>

- Seed Round – FTX Exchange, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/funding_round/ftx-exchange-seed–9894efed>

- NGC Ventures, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/organization/ngc-ventures/recent_investments>

- Initial Coin Offering – AVA Labs, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/funding_round/ava-labs-initial-coin-offering–0f92ed48>

- Venture Round – CoinFLEX, Crunchbase, viewed 1 Sep 2020, <https://www.crunchbase.com/funding_round/coinflex-series-unknown–6361b63a>

- Total Value Locked (USD) in DeFi, DeFi Pulse, viewed 1 Sep 2020, <https://defipulse.com/>

- DEX metrics, Dune Analytics, viewed 1 Sep 2020, <https://explore.duneanalytics.com/public/dashboards/c87JEtVi2GlyIZHQOR02NsfyJV48eaKEQSiKplJ7>

- Bitcoin options growth outpaces futures swaps, CoinDesk, viewed 1 Sep 2020, <https://www.coindesk.com>

- Deribit Bitcoin options traded biggest day, CoinDesk, viewed 1 Sep 2020, <https://www.coindesk.com>

- Product roadmap update, Synthetix, viewed 1 Sep 2020, <https://blog.synthetix.io>

- Total Value Locked (USD) in MCDEX, DeFi Pulse, viewed 1 Sep 2020, <https://defipulse.com/mcdex>

- MCDex (MCB), CoinGecko, viewed 1 Sep 2020, <https://www.coingecko.com/en/coins/mcdex>

- OPYN: Notional Volume Graph, Dune Analytics, viewed 1 Sep 2020, <https://explore.duneanalytics.com/dashboard/opyn_3>

- Why crypto options explaining growth and anticipating trillions, Deribit, viewed 1 Sep 2020, <https://insights.deribit.com/market-research/>

- Pre Sales, Project Serum, viewed 1 Sep 2020, <https://projectserum.com/srm-faq>

- MCDEX is now listed on Poloniex, The Poloniex Blog, viewed 1 Sep 2020, <https://medium.com/poloniex>

- How to Participate in the Hedget IEO, FTX, viewed 1 Sep 2020, <https://help.ftx.com/hc/en-us/articles/360048927331>