What is UpBots

UpBots is an all-in-one platform that allows users to apply algorithmic bots, copy trade influential traders, earn badges and rewards, and many more. The UpBots platform, in partnership with Dex.ag will also seek to be an aggregator for both Decentralized and Centralized Exchanges. UpBot’s mission is to take over retail trading from exchanges, acting as a layer 2 on top of the backend infrastructure built by existing exchanges.

The team at UpBots is well familiar with the retail trading landscape. Having formed 4C trading, one of the largest bot trading platforms, Benjamin Duval and Julien Quertain have embarked on a more ambitious mission – to create the ultimate destination for retail trading.

The native token of the UpBots platform – UBXT – is a utility token and will have a myriad of use cases such as:

- Buy and Burn of up to 15% net revenue

- Purchases of Bots and Algorithms

- Subscriptions to KOL Copy trading

- Purchases of Educational Content

- Staking

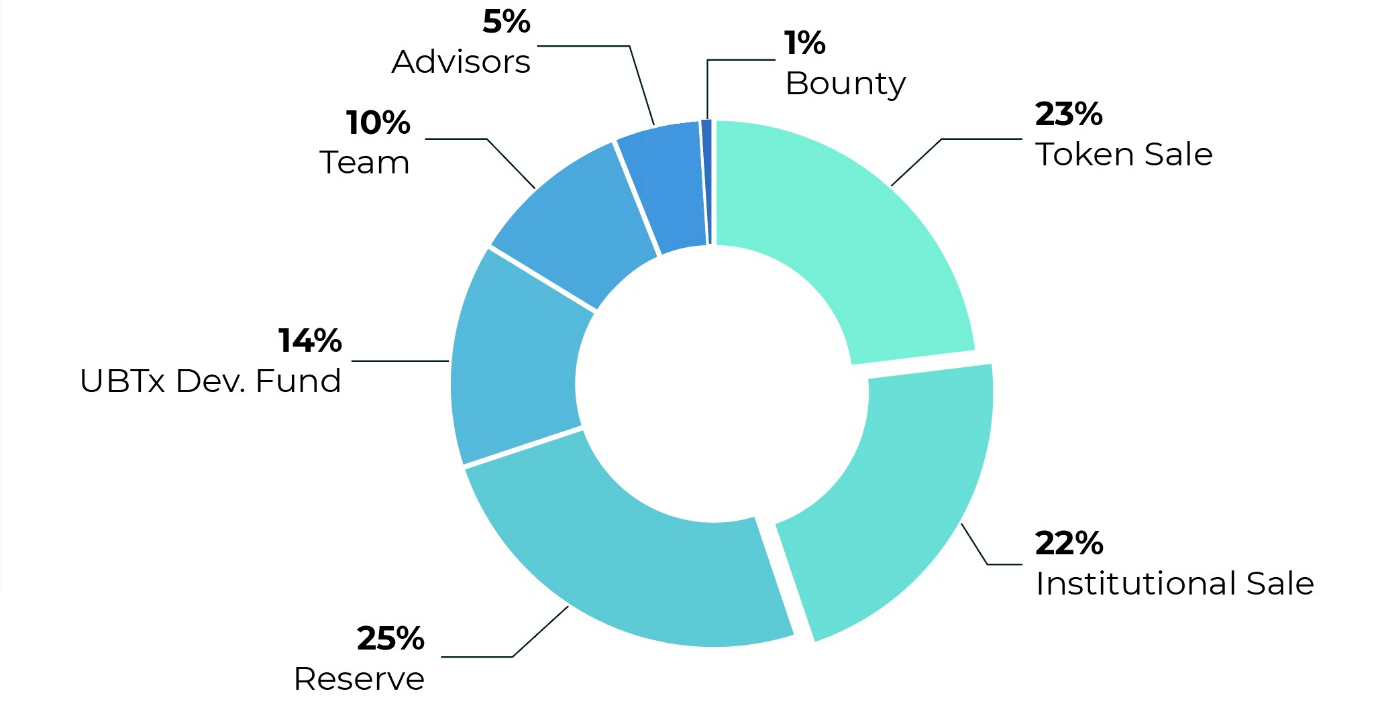

UpBots Token Distribution

UpBots has a total fixed supply of 500M UBXT. UBXT allocated to FTX IEO includes in 23% of its token supply as Token Sale. Figure 1 below illustrates UBXT token distribution.

Partners & Investors

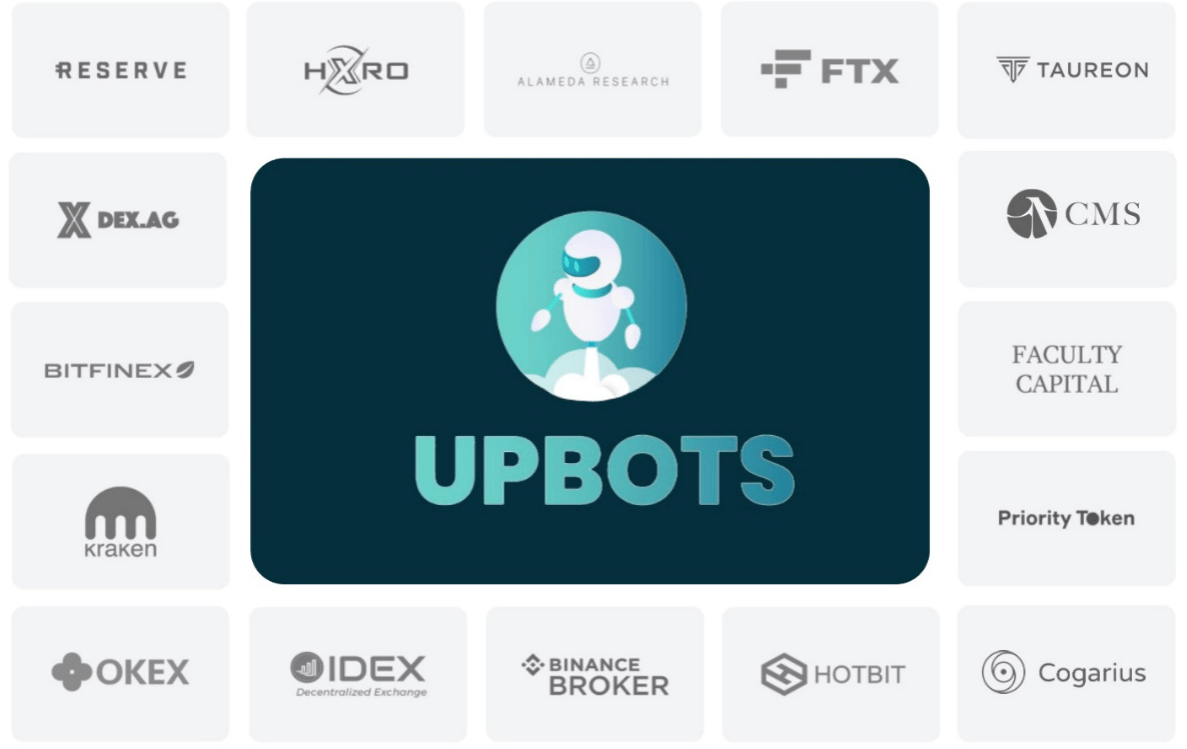

UpBots established a strategic partnership with Alameda Research, alongside other investment funds such as CMS, Taureon, and several angel investors. Those investors funded $1.1M in the latest round, altogether with $500,000 from previous private round this March, to sum up $1.6M investment capital for the Swiss startup. Investors from both rounds have accumulated UBXT at $0.01, which is expected to be the token’s price floor.

Prior to the launch, UpBots has connected to some crucial joints that allow the project to scale up quickly and capture market share. Having a partnership with DEX.ag, Reserve, and HXRO, UpBots targets to go DeFi and to provide derivatives products right from the start. The project also established its footprint on several most popular exchanges like FTX, BitFinex, OKEX, KRAKEN, IDEX, and Binance (Figure 2). Also, UpBots is a part of the Solfin ecosystem alongside 4C-trading, high-performing bots signal channels and an active online community of 600+ customers, 10 000+ members, and 10+ strategic partners.

With existing connections, we expect a high readiness level of the UpBots product at its foundation, which allows the team to focus on adoption to lead a new retail trading trend.

Comparable Projects

UpBots token versus Exchange Tokens (BNB/FTT/HT/OKB)

UpBots token works in ways similar to exchange tokens with the Buy and Burn and Utility models.

Theoretically, UpBots will earn a referral fee of 30-40% per exchange. The advantage of UBXT over exchange tokens, in this case, is that it can combine exchanges and be operating on many exchanges.

Consider the case where UpBots manages to be the provider for 5% of exchange volume for each exchange. Combining this across 10-20 exchanges, the UBXT token becomes nearly as valuable as other exchange tokens on just the Buy and Burn model alone. These exchange tokens have fully diluted valuations that are in excess of 1 Billion. Given the fully diluted market cap of UBXT will be between $5 – 10M at launch, this leaves an upside of close to 100x, not even factoring in the other avenues of utility.

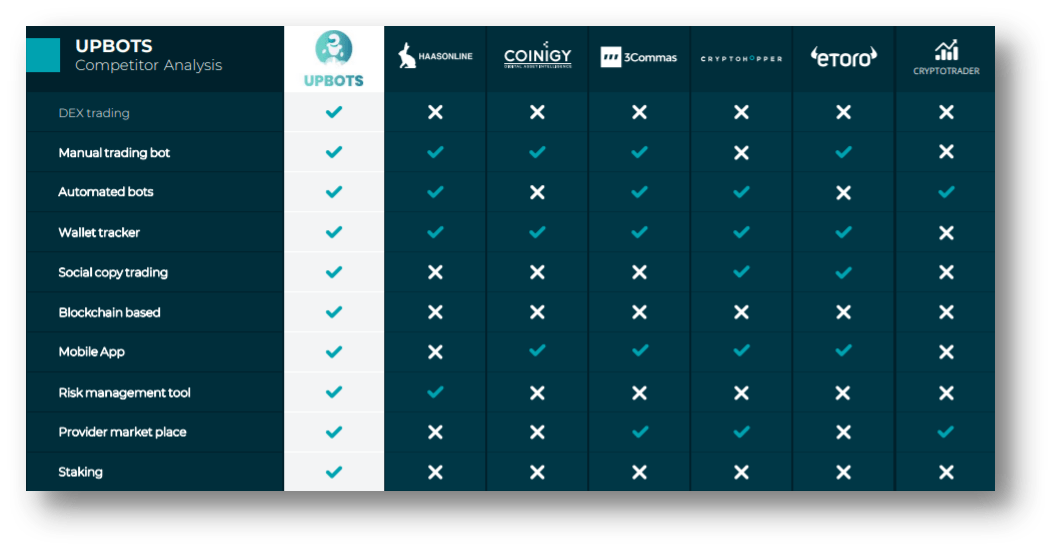

Comparison Table

Among bot trading service provider and social trading platform, UpBots stands out for a more innovative and functional product. UpBots product is superior in many aspects, even when comparing with a 20M+ monthly traffic exchange, Etoro. Figure 3 demonstrates the vital advantages of UpBots in comparison with its competitors.

UpBots’ advantages over these competitors are:

- DEX trading and staking right from UpBots

- Blockchain transparency for fee and transaction payments

- Exchange token incentive for trading and staking.

Upcoming News

Development progress

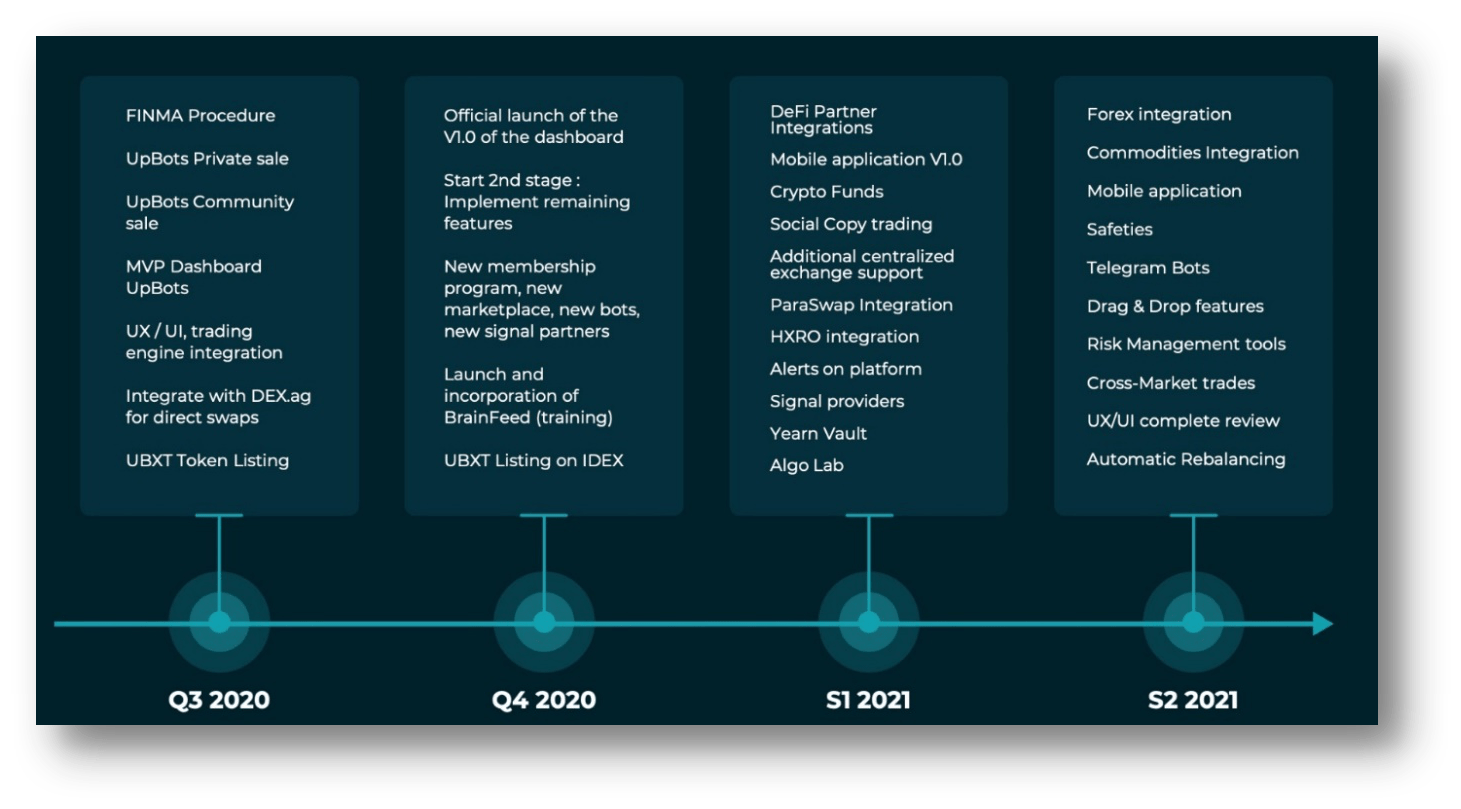

Some of the notable milestones for UpBots in 2020 are the Public Sale, version 1.0 launch, FINMA license application, and integration to critical partners like DEX.ag, BrainFeed. Crucial plan for the first half of 2021 includes DeFi integration and mobile app launch, while UpBots focus to add Forex and commodities and cross-market trades in the second half. Figure 4 lists out crucial milestones UpBots need to achieve for 2020 and 2021 in order to realize market leader target.

UBXT Token Burning Schedule

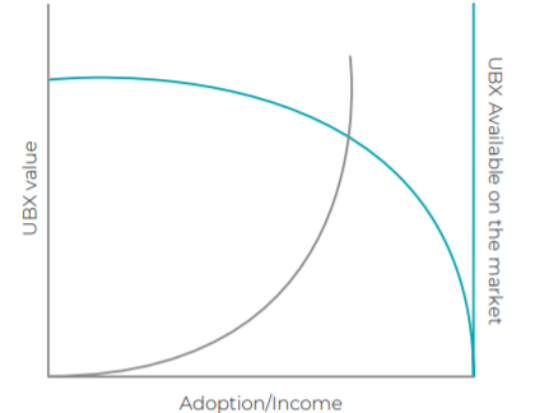

The burning activity for UBXT token will start as soon as Q1 2021, with 15% of the platform’s net income to be used to burn an equivalent amount of UBXT token. The ratio for the next phase is 10% for Q1 2022, 5% for Q1 2023, and 2% for 2024 (Figure 5). Burning token events will boost UBXT demand for the next four years.

We highly appreciate tokenomics with a burning schedule that stick to future revenue/income. Such a burning model shows the creator’s long-term commitment toward future adoption and success of the project, not for short-term profit.

Reasons to be Optimistic

- FTX has chosen UpBots to be one of its first IEOs. FTX and Alameda Research are well known for backing great projects and have a good history with investments and IEOs.

- The UpBots mission is a highly optimistic one. If they are to succeed, this could revolutionize the way retail trades. If this leads to a new wave of retail trading platforms, the UBXT token should be one of the strongest, given its market leader status

- The UpBots market cap is minuscule compared to comparable projects – a success for UpBots would lead to huge token appreciation. This is drastically different from other tokens that already have larger valuations where the upside is quite small.

Factors to Watch

- The UpBots platform is yet to have any real users. Whilst the idea is one of prominence, the success of the platform, and hence the success of the token relies on users using the platform.

- The date of launch is expected in December; markets can be volatile with investors not wanting to hold tokens for too long. Having a late launch could have investors not wanting to purchase the token until the launch date with others potentially selling at that time.

Executive Summary

The UpBots platform and UBXT token have definitely captured the imagination of the Kyros team. We are extremely bullish on the product and think that investors will be able to see the potential in this as well. The IEO on FTX and future FTX listing make us even more excited for the future.

With extremely favorable tokenomics, we’d be very surprised to see this token at under $0.05 within the first week of listing. A realistic short term price target would be $0.1 to $0.15, giving it a circulating market cap of $10M – $15M. The Kyros team will be hoping to accumulate cheaply on UBXT before the big listing on FTX. The success of the UpBots platform in December could see this token rise to the vicinity of $0.5 – our most bullish estimation.