Project Summary

Main Features of TomoChain

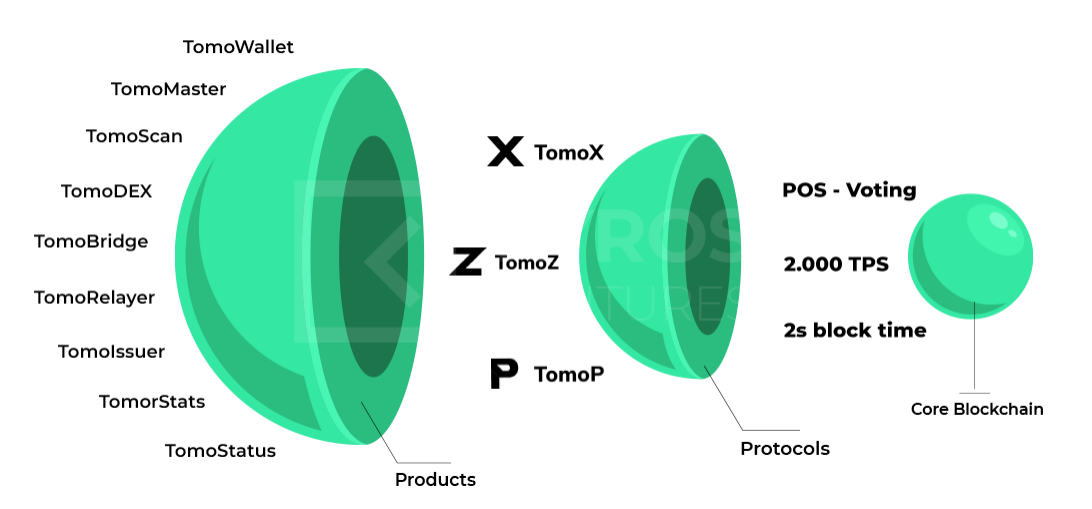

- TomoChain is an Ethereum Virtual Machine (EVM) compatible blockchain with Proof-of-Stake voting (PoSV) incentivizing TOMO holders to play an active role in staking while voting for validators; key performance metrics include 2000 transactions per second (TPS) and a 2-second block time

- TOMO token is the native asset of TomoChain utilized for network gas fees covering asset transfers, on-chain actions, and the deployment of smart contracts

- Different inbuilt protocols, namely TomoX, TomoP and TomoZ. TomoX represents the decentralized exchange protocol, TomoP the dedicated privacy protocol, whereas TomoZ is a unique token standard (TRC-21) used for transaction fees

- Products such as:

- TomoWallet – a convenient and secure wallet for TOMO holders

- TomoMaster – TOMO staking platform with 150 masternodes

- TomoScan – BlockExplorer for the TomoChain blockchain

- TomoDEX – the fastest decentralized exchange for trading directly from the wallet

- TomoBridge – a cross-chain swapping bridge for connecting TomoChain with other blockchains

- TomoRelayer – a dashboard to register and launch a DEX

- TomoIssuer – a dashboard on the TomoZ protocol for issuing TRC21 tokens

- TomoStats – a dashboard for the TomoChain network status

- TomoStatus – TomoChain system monitoring dashboard

Above mentioned features are summarized in Figure 1 below, whereby the whole TomoChain “planet” can be visualized.

At the time of writing, TOMO token specifications are as follows:

- Current market cap (MC): $57.9M

- Circulating supply (CS): 74M TOMO

- Total supply (TS): 100M TOMO

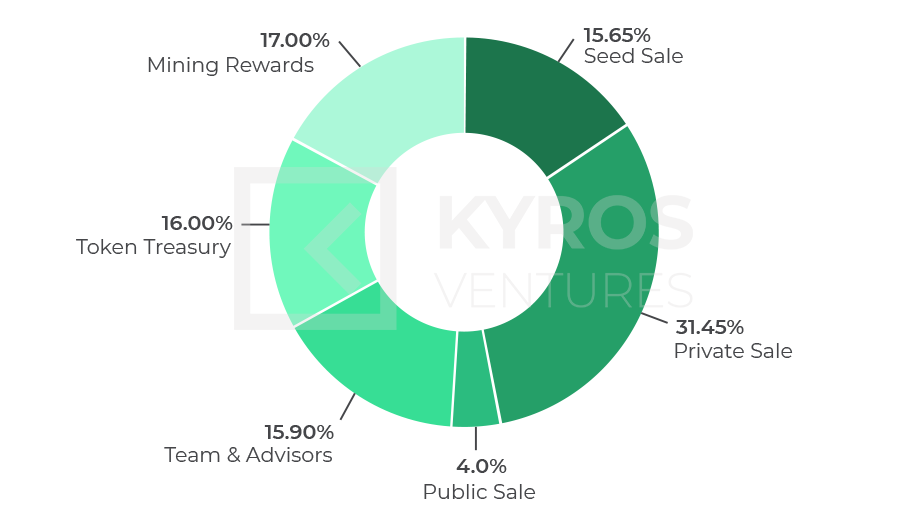

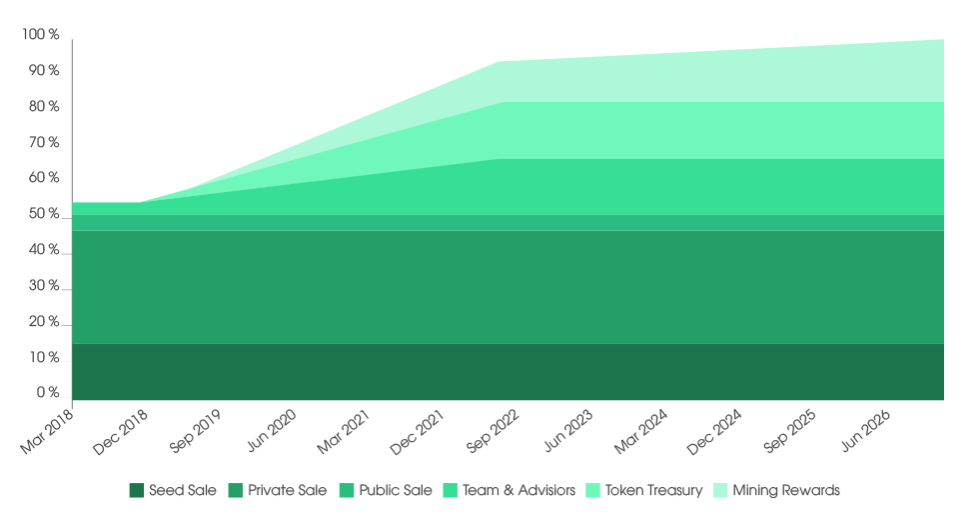

- Token distribution as illustrated (Figure 2)

- 150 masternodes worldwide

- 55% total supply staked in 2019

TomoChain Team

The founding members of TomoChain are:

Long Vuong – Co-founder & CEO of TomoChain and TomoChain project lead, co-founder and the former project lead of the prominent NEM (New Economy Movement) blockchain. Long holds a PhD in economics from the University of Massachusetts.

Le Ho – Co-founder & CFO, a CFA charter holder and a licensed fund manager in Vietnam with 10+ years of experience in investment and finance. Le is a Former Senior Investment Manager at BVIM and the Director of the Investment Banking Division at HSC securities company.

Son Nguyen – Co-founder & CTO, an experienced and accomplished engineer working in the IT field, former ToMoApp Director of Engineering, and the founder of the Blockchain Developer group with more than 800 active members. Son holds a Master’s degree in Engineering from the Hanoi University of Technology.

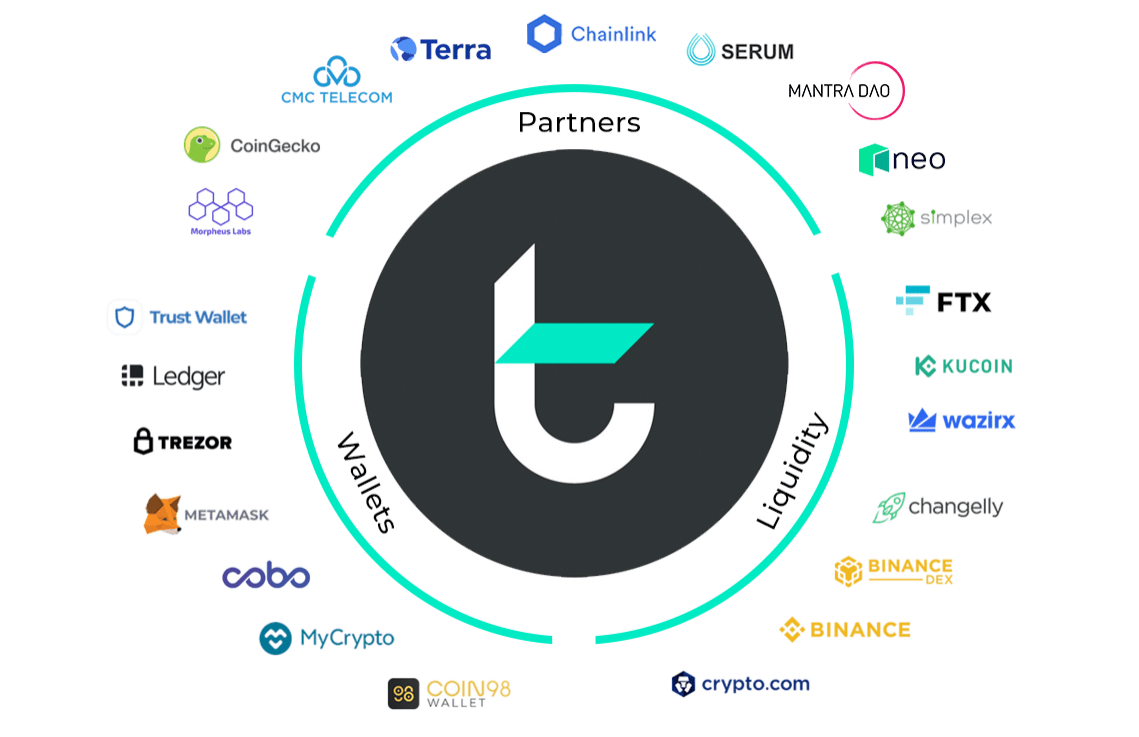

TomoChain Ecosystem

Integral parts of the TomoChain’s ecosystem are presented in Figure 3, namely the key partnerships, crypto wallets, and exchanges/liquidity providers for the TOMO token. Each of these plays a significant role in the overall success of the TomoChain platform.

A more exhaustive list of TomoChain’s commercial partnerships and dApps includes:

- Lition: a public-private blockchain infrastructure that is legally compliant with the GDPR. The solution is co-innovated with SAP, the world’s leading business software company

- Triip: a decentralized travel application (dApp) with Triip Protocol issued on the TomoChain blockchain

- Mantra DAO: a DeFi Platform serving as a masternode operator for TomoChain

- Coin98: a universal crypto mobile app powered by the TomoChain token “C98” which has accrued over 100K users. C98 is used to purchase products, play games, and can be redeemed in exchange for services

- Alternative Investment and Security Exchange (AIS): the first cryptocurrency exchange from Mongolia. AIS’ exchange token will be issued via TomoChain

- BitOrb: a crypto derivatives exchange issuing its exchange token on TomoChain

- TomoMaster: a staking governance dApp of TomoChain, which facilitates voting/staking by using Ledger, TomoWallet, Metamask, and TrustWallet

- TomoSwap: a decentralized exchange platform on TomoChain with the mission of increasing liquidity and usability for TomoChain based projects (powered by the Kyber Network Protocol)

- TomoPool: a service for users wishing to maximize their staking yield by mutualizing tokens to create a staking pool for TomoChain

- MaxBet: a transparent gambling game on TomoChain

- TomoStats: a dashboard showing on-chain metrics for the TomoChain network

- TomoWallet: the TomoChain’s official mobile wallet

Further partners and investors include:

- International partners – ChainLink, Morpheus Labs, Terra, Shift.network, Axel Infinity, Contentos, Movie Bloc, and Mantra DAO

- Vietnamese partners – CMC, Savvycom, Vnext, Senpoint, FuniX, and the Hanoi University

- Private sale investors – 1kx, Hashed, Signum Capital/HyperChain, One Block Capital, Coefficient Ventures, GBIC, Connect Capital, NGC Ventures

Comparable Projects

When evaluating TomoChain, similar blockchain projects should be considered in order to establish a comparative evaluation. Among these, Algorand seems to be the most closely related to TomoChain due to the similarities between the two projects in terms of their tokenomics/distribution and the stage of development.

Figure 4 summarizes and compares main metrics of Ethereum, Algorand and TomoChain blockchains with the emphasis on transactions per second, transaction fees, number of validators and the fully diluted market cap.

In terms of the consensus algorithm, Algorand employs a pure Proof-of-Stake (PPoS) protocol built on the Byzantine consensus whereby each user’s influence on the choice of a new block is proportional to his/her stake in the system. On the other hand, TomoChain uses an innovative consensus method called Proof-of-Stake Voting (PoSV) which provides an incentive to all TOMO holders to play an active part in staking across a network consisting of 150 masternodes.

TomoChain demonstrates superior performance with 2000 TPS vs 1000 TPS of Algorand, block time of 2s vs 4.3s and comparable transaction fees in the range of $0.001. Both projects have an active community and dedicated developers, with TomoChain eclipsing Algorand when it comes to GitHub activity over the last 12 months. Nonetheless, Algorand has a considerably larger fully diluted market cap (38.96x) which demonstrates the potential for TOMO token’s price appreciation.

Upcoming News and Development Progress

Token Release Schedule

TomoChain has a fixed cap of 100,000,000 TOMO on total supply. The tokens belonging to the team and the treasury tokens will be fully released in June 2022, while the full token supply will be unlocked in 2026 upon the completion of the release process for the mining rewards. Any potential surges in supply are scheduled appropriately as depicted in Figure 5, which is important considering the circumstances under which the team’s tokens and the treasury tokens will be unlocked at the same time.

Development Roadmap

As per the TomoChain’s official development roadmap, several updates have been completed during 2020, while further updates are expected toward the tail end of the year.

In particular, TomoScan – v1.6.0 has been released on January 5, 2020, while TomoMaster – v2.0.0 came out a day later, on January 6, introducing several API updates. Further completed updates include TomoIssuer – v1.0.0, Relayer Management – v1.2.0, TomoX-SDK – v1.2.0, and TomoChain – v2.2.0.

Upcoming updates include TomoScan – v1.8.0 (0% complete), TomoChain – v2.3.0 (25% complete), and TomoX-SDK- UI – v.1.2.0 (65% complete). The latter was scheduled for Aug 15, 2020, but has evidently been delayed.

Further milestones are expected to be achieved on TomoDEX with the upcoming listing of new Defi tokens. The growth in the daily trading volume on TomoDEX has been excellent YTD with “hot” DeFi tokens (i.e., SRM, FTT, YFI) resulting in a tripled daily trading volume in under 3 months (approximately $150k -> $500k).

The latest update is from TomoBridge, a cross-chain swapping bridge that realizes TomoChain’s vision to expand its utility to other blockchains such as Ethereum and Binance Chain. TOMOE, the 1:1 equivalent TOMO token on Ethereum, will be listed on Uniswap, the most prominent DEX.

Reasons to be Bullish

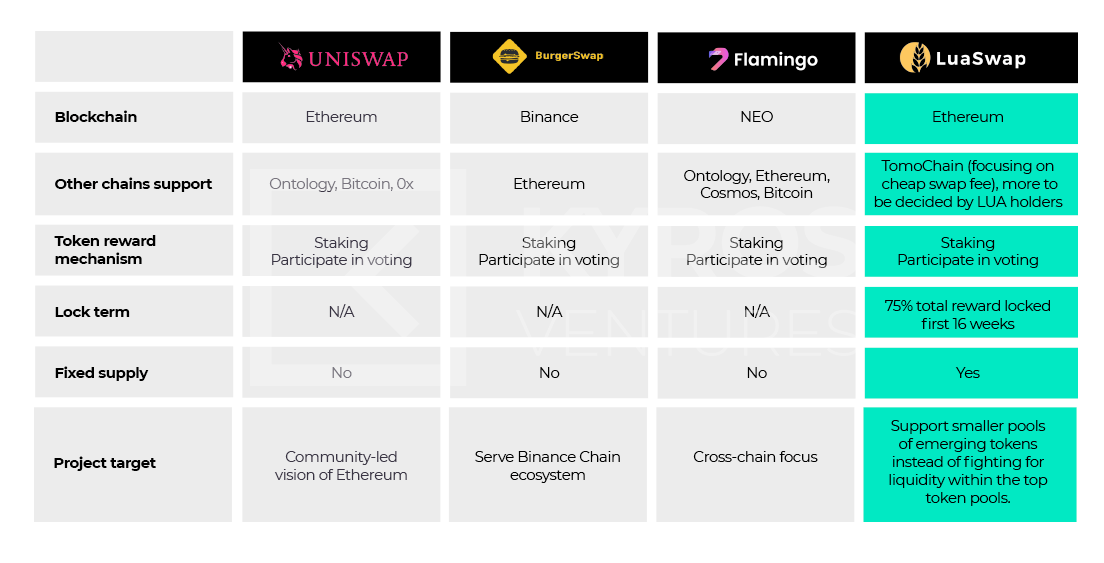

- The main reason to be bullish is the recent announcement of the LuaSwap yield farming protocol. Hereby, the “farming” of the TomoChain’s ERC-20 token (TOMOE) will commence on Monday (September 28, 2020) with the LUA tokens being “harvested”. Thereby, TomoChain joins force with Binance and NEO to realize the potential of the lucrative DeFi yield farming (Figure 6).

- Notably, LuaSwap will kickstart with an 8-week hyperinflation period, block rewards with a x128 multiplier in the first two weeks (halved every week afterward), yet keep a fair launch with no seed investment, founder’s fees, or pre-mine

- Enterprise partnerships such as Chainlink, Terra, AIS, and BitOrb accelerate the adoption of TomoChain products and, ultimately, TOMO token

- Novel DeFi apps built on top of the TomoChain blockchain or development of yield farming on TomoChain can drive the TOMO token price “to the moon”

- DEX industry growth drives TomoDEX (32x growth rate YTD)

Factors to Watch

- There is always a possibility of the sudden rise of higher-performing blockchain infrastructures with a faster transaction speed and lower transaction fees, thereby fiercer competition.

- Changes in key personnel may slow down the development

- Upcoming updates scheduled for late 2020 are running at a risk of being delayed (refer to the “Development roadmap” subsection)

Executive Summary

Projection Milestones

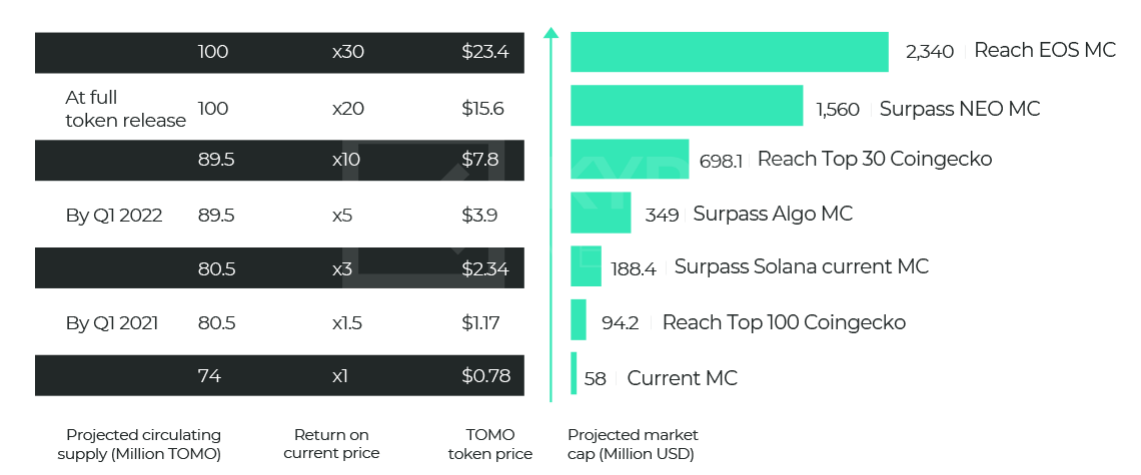

Note: This projection evaluation method considers both the TOMO token price and the TOMO circulating supply as variables. This is an accurate representation since both are subject to change over time.

Figure 7 presents the timeline for three possible scenarios determining the potential TOMO market cap in the future:

- By Q1 2021, projected CS will be around 80.5M TOMO (80.5% of total supply); TOMO price can potentially x1.5-3 (+50-200%) with the advent of yield farming

- By Q1 2022, projected CS will be around 89.5M TOMO (89.5% of total supply); TOMO price can x5-10 and surpass Algorand’s current market cap

- At full token release, CS will be 100M TOMO (100% of total supply); TOMO price may potentially reach new ATHs in the x20-30 range ($15-25 token price) assuming adherence to the development roadmap.

Concluding Remarks

The TomoChain platform has caught the eye of the Kyros Research team. We are bullish on this project and believe that the investors will also be able to see its potential. Taking into account the TomoChain’s favorable metrics versus comparable projects with a higher market cap (e.g. Algorand), we would be extremely surprised to see this token stay under $1 during the tail end of 2020.

While short term price estimates are difficult to establish due to the volatility of the crypto markets, we expect to see the TOMO token price soar to an ATH of $3-4 in the mid-to-long term, giving it a circulating market cap in the vicinity of $300M. Even higher token price milestones are feasible in the long term, with our most bullish prediction approaching $25 at full token release.