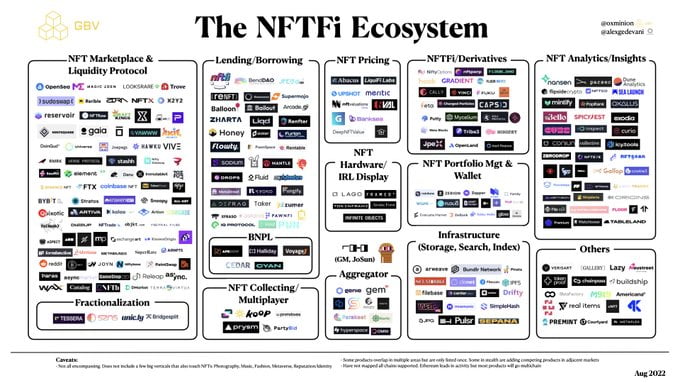

The keyword NFTFi is becoming increasingly popular; will this be the next new trend that combines the best of the two previous trends, DeFi and NFT?

What is NFTFi?

NFTFi, as the name implies, is a combination of NFT and Finance.

The protocols in the NFTFi array were created primarily to increase liquidity for NFTs, an asset class that has previously been considered illiquid due to market volatility as well as their uniqueness – a barrier to price discovery.

Projects in NFTFi will also aid in cash flow optimization for NFT collectors, providing more incentive for them to buy and hoard NFT as an asset class with long-term value rather than a means of speculative facilities as it is now.

Basically, NFTFi projects convert NFTs into fungible tokens with ERC-20 standard, similar to yield-bearing tokens of DeFi projects like AAVE’s aTokens or SushiSwap’s xTokens.

Main sections in NFTFi

Provide liquidity

The Marketplace model – NFT floor – is the most popular today because it connects NFT buyers and sellers and serves as a source of liquidity for the entire market. The price formation process is based on the bid and ask prices that are arbitrarily set between two parties.

| Ecosystem | Notable NFT exchanges |

| Ethereum | OpenSea, LooksRare |

| Solana | Magic Eden |

| Polygon | OpenSea |

| Flow | Flowverse |

| Avalanche | Joepegs, NFTrade, Chikn |

However, as a result of the aforementioned bid-ask mechanism, NFT has become a less liquid asset than other investment channels such as stocks or cryptocurrencies because NFTs in the same collection are sold at a low price. The rarity or attractiveness of some of their characteristics determines their value. The use of various valuation methods, including emotional pricing, has widened the spread between the bid and ask prices for most NFTs on the market today.

Several liquidity solutions were developed to solve this problem, most notably fractionalized NFT (fragmented NFT) and AMM (Automated Market Maker).

Fractionalization is a solution that allows ordinary users to access blue-chip NFT collections, which have a very high floor price – potentially ranging from a few tens to millions of dollars. Some protocols, such as Unic.ly or Fractional.art, provide this solution by converting NFTs into fungible tokens compliant with ERC-20 standards (similar to yield-bearing tokens from DeFi projects such as AAVE’s aToken or SushiSwap’s xToken). Through speculators specializing in arbitrage, the price of these ERC-20 tokens will move according to the floor price of collections on the traditional NFT market, allowing users to profit when investing in a highly volatile asset like NFT but without the huge risk of putting up a large amount of capital at an early stage.

AMM is also a solution born to solve NFT’s liquidity problem. Still, it targets the disadvantage of the bid-ask mechanism when buying and selling NFT on traditional exchanges by allowing users to buy/sell NFT via instant liquidity pools. For example, one of the recent AMM for NFT projects is sudoswap/sudoAMM. If the formula x*y = k is applied to the valuation of pool assets like DeFi’s AMMs, slippage will be high because NFTs are inherently indivisible, unlike ERC-20 tokens. Therefore, the sudoswap project has applied the bonding curve model to determine the price increase/decrease every time an NFT in the pool is bought/sold to ETH.

Credit

Credit segment projects are divided into two types: Lending and pre-paid post-purchases (BNPL).

Lending in NFT works similarly to DeFi, except the collateral is NFTs (usually blue-chip NFTs because they are more liquid) rather than ERC-20 tokens. To protect lenders, the project may devise a formula for calculating an appropriate liquidation price threshold when the floor price of the NFT collection begins to fall. Some projects, such as JPEG’d, also allow NFT collateral to be used to mint stablecoins, using a mechanism similar to the Collateral debt positions (CDPs) used for MakerDAO’s DAI.

For BNPL projects, the buyer must place a down payment in order to receive or gain access to some of the NFT’s existing benefits, and the balance must be paid back within a short period of time (depending on the project’s regulations). This service is supported by platforms such as Cyan, ApeNow, and BendDAO.

Valuation Tool

Valuation is critical for NFT investors because the current state of speculation and flash inflation makes it difficult for them to make independent investment decisions.

Most NFT pricing platforms today use AI technology, such as NFTvaluations or Upshot, while others use crowd-sourcing price formation such as Abascus and PawnHouse.

Derivatives

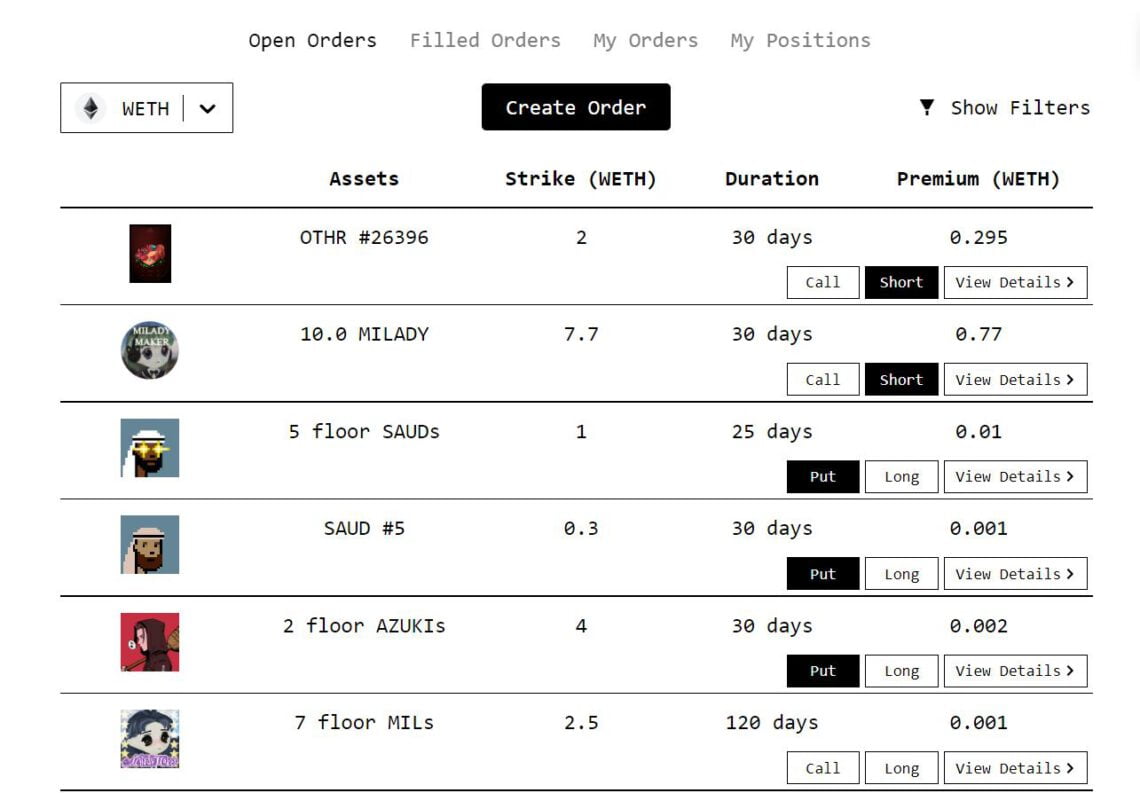

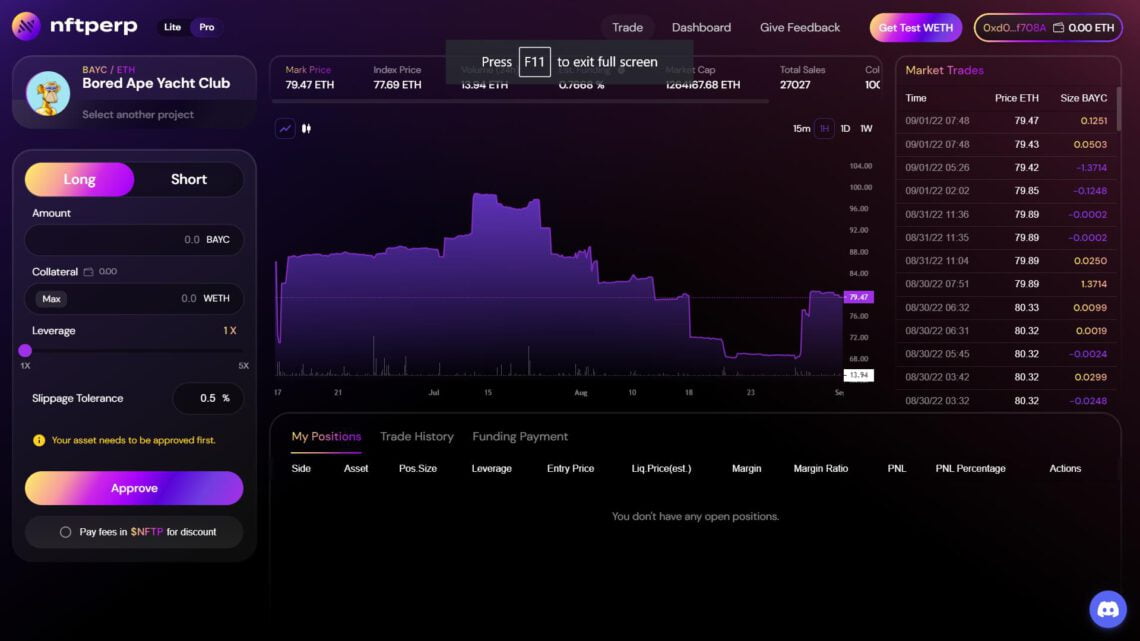

NFT derivatives platforms function similarly to DeFi derivatives platforms. Users can buy and sell options contracts to hedge risk or optimize cash flow from their assets, depending on their investment strategy and market forecast.

The majority of NFT’s derivative projects are starting to take shape, demo, or launch. Among these are nftperp, Mimicry (the NFT prediction market), and Hook (which is in the testing phase on the testnet).

Liquidity Aggregator

An aggregator is a solution that aggregates prices from various NFT exchanges in order to provide users with an “all-in-one” data source when purchasing or selling NFTs. Gem.xyz (acquired by OpenSea) and Genie (acquired by Uniswap) are two prominent platforms in this segment. According to Dune Analytics data, even though the number of transactions on these two platforms has decreased significantly since the beginning of June 2022, Gem continues to outperform and outnumber its competitors. While on Solana, Hyperspace is the popular NFT liquidity aggregator.

Epilogue

As mentioned above, NFTFi projects have not received much attention yet and are still in the finishing stage. Therefore, the explosion of NFTFi until now is still a big unknown to many people.

In the following parts of this series, each piece of the NFTFi puzzle will be dissected and analyzed so that you can have more precise judgments about the potential of NFTFi in the near future.

Sudoswap has just announced the preparation of an airdrop of SUDO tokens for users. Is this the first light of the NFTFi summer day?