This was a sad week for the crypto community. So we’ll keep this piece short and share more of our thoughts on what happened and what might change.

Chin up. Keep moving forward.

We still have each other.

$UST depeg incident and the revival plan

Saving the burning house, or the people?

The crisis wiped out 40 billion USD market capitalization, for the LUNA token alone.

Long story short, UST lost peg, and LUNA tanked. LFG trying to save UST over LUNA at the first attempt. This is no different from a man choosing to save his house, instead of his people. Of course, the community was angry so there is a second plan – a hard fork to pre-depeg, reverting the first attempt. Both received criticism from CZ.

Personal opinion. NFA.

This won't work.

– forking does not give the new fork any value. That's wishful thinking.

– one cannot void all transactions after an old snapshot, both on-chain and off-chain (exchanges).Where is all the BTC that was supposed to be used as reserves? https://t.co/9pvLOTlCYf

— CZ 🔶 Binance (@cz_binance) May 14, 2022

The money is gone. How we treat each other is potent.

Contrary to how Terra handled the crisis, Axie Infinity showed us a more effective way to deal with this type of situation. Sky Mavis immediately suspended the Ronin blockchain, preventing everyone from depositing or withdrawing funds, and pledged to reimburse player losses when the hack was discovered. In the eight day aftermath, Axie Infinity had secured $150 million to pay users, accepting a down round. It is worth mentioning that the team admitted their fault and came up with urgent action to prioritize users’ benefit.

Although, some of you may argue that Axie’s size is not size.

Impact of UST collapse

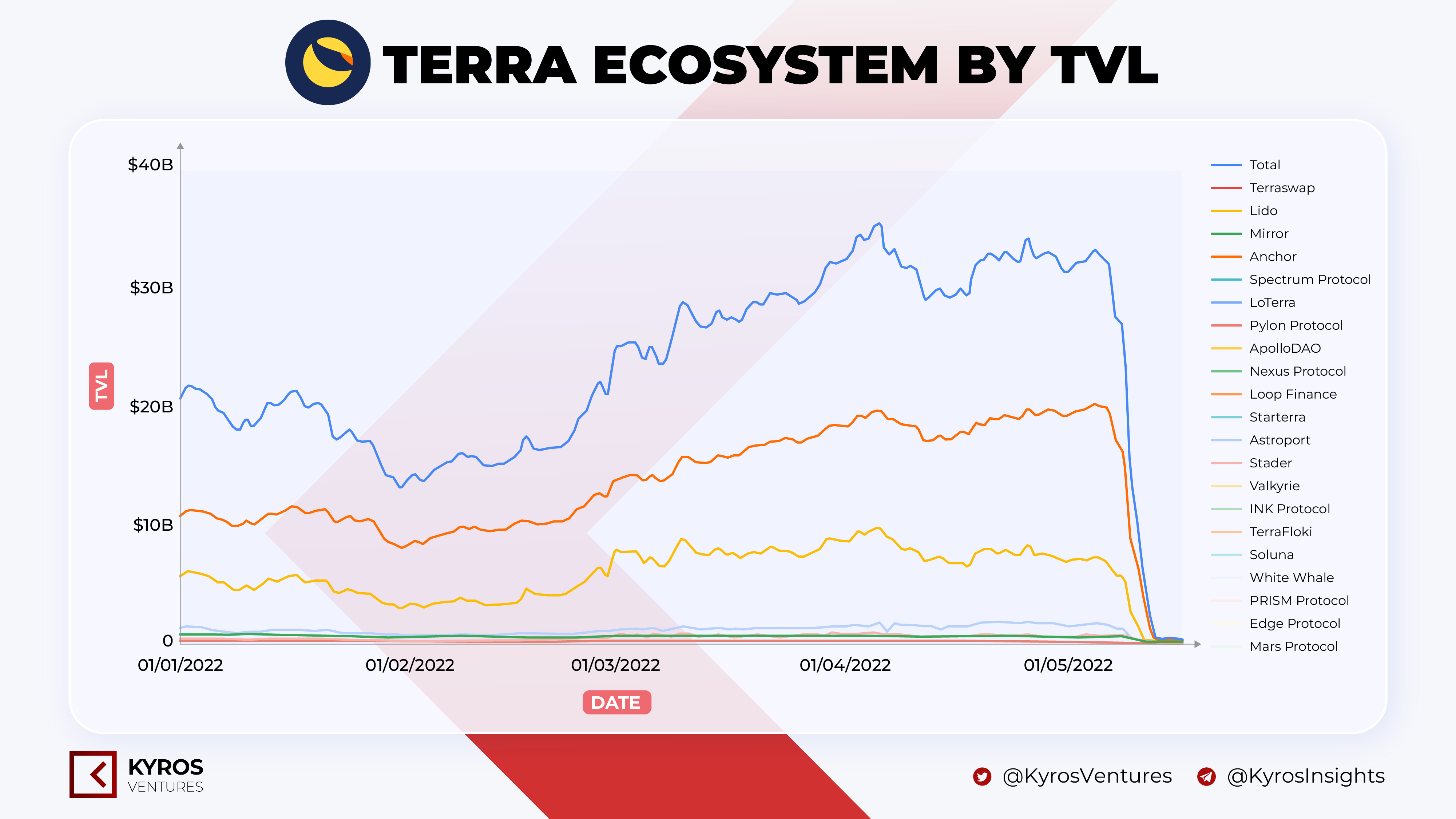

98% of the total locked assets on the Terra ecosystem have evaporated in 9 days, namely the top DeFi protocols on Terra, such as Anchor and Mirror.

The collapse of the UST has had a domino effect on the crypto market. USDX, USDN, USDC, and USDT have also experienced peg loss as holders panicked after this disaster. Several DeFi projects integrated with LUNA or UST were affected by the price errors from Oracle, causing multi-million dollars losses.

The collapse of the UST has had a domino effect on the crypto market. USDX, USDN, USDC, and USDT have also experienced peg loss as holders panicked after this disaster. Several DeFi projects integrated with LUNA or UST were affected by the price errors from Oracle, causing multi-million dollars losses.

This disaster has revealed the downside of the current infrastructure. Vulnerabilities in algorithmic stablecoins need to be addressed as soon as possible to grow the market. Collateral assets and stable mechanisms need to be carefully calculated to minimize the impact of market factors as much as possible but still guarantee a better capital efficiency than over collateral stablecoins.

Many open questions are still being asked will users continue to trust Do Kwon and a new folk of Terra?

stETH-ETH Depeg

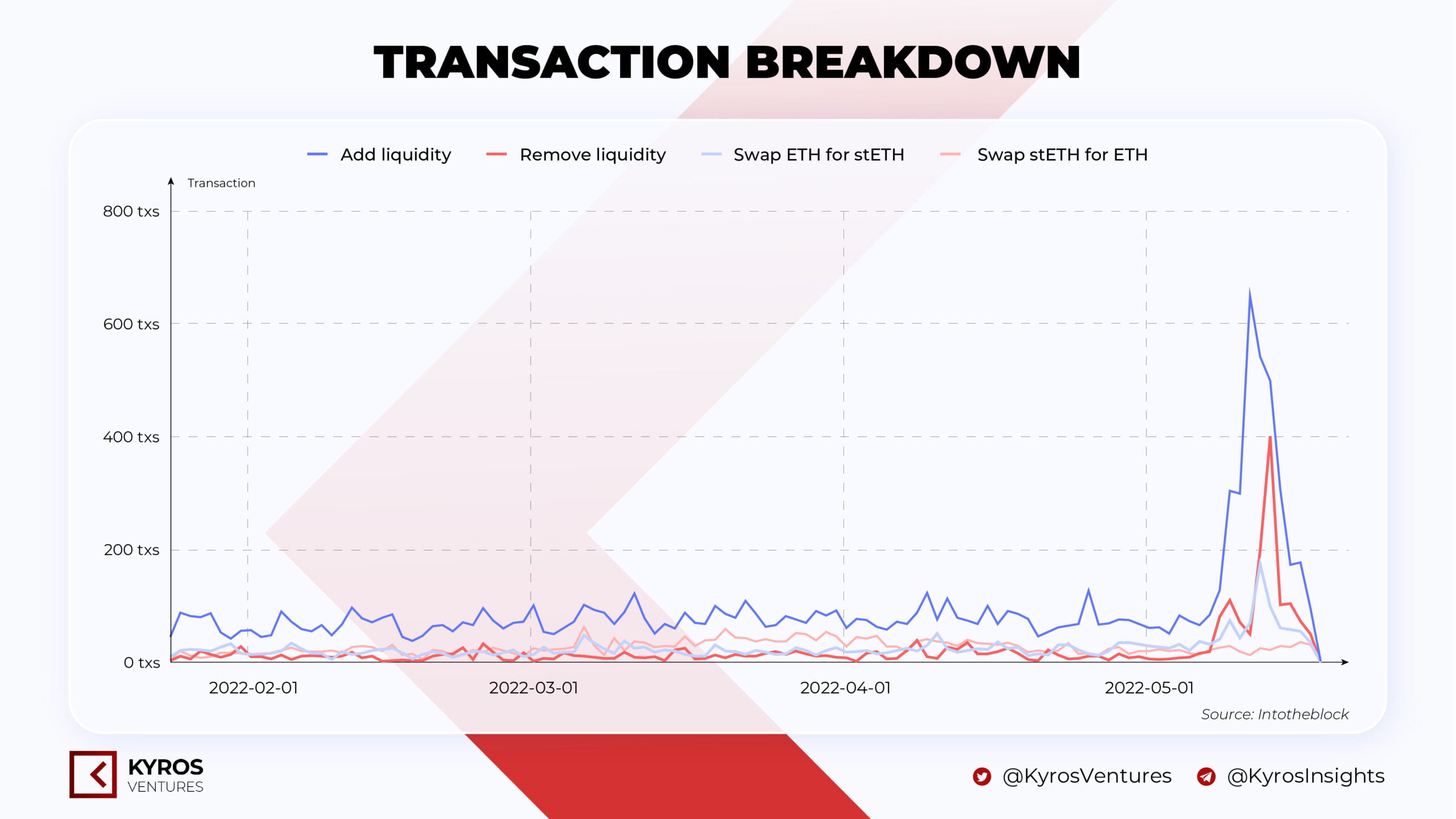

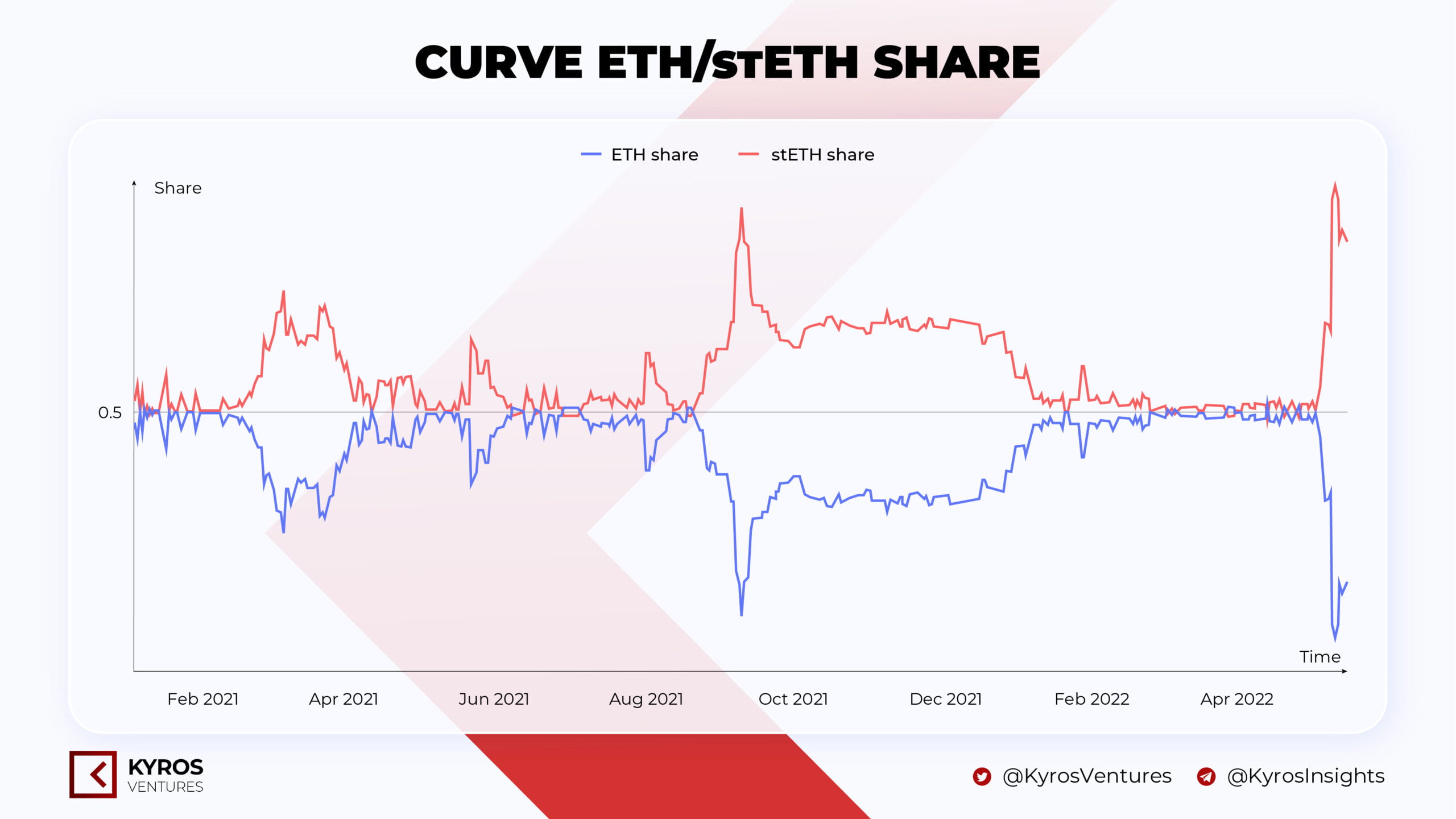

Following the resumption of the Terra blockchain for the second time on May 11, Lido announced that users could bridge bETH — a representation of stETH on Terra’s Anchor protocol — back to Ethereum. As holders flee Anchor and retrieve stETH when cashing out to fiat currency, they must first sell stETH for ETH. Thus, much of the stETH was swapped in Curve on that day.

If the stETH/ETH price peg fails for a time, then liquidations could trigger more volatility in the markets. Curve and Balancer pool for stETH:ETH has been again unbalanced, putting the stETH peg at 0.987 ETH per stETH on May 12.

If the stETH/ETH price peg fails for a time, then liquidations could trigger more volatility in the markets. Curve and Balancer pool for stETH:ETH has been again unbalanced, putting the stETH peg at 0.987 ETH per stETH on May 12.

The leverage situation results from yield farmers folding: deposit stETH as collateral, borrow ETH against it, then stake that ETH to get more stETH, and repeat to maximize the yield.

The leverage situation results from yield farmers folding: deposit stETH as collateral, borrow ETH against it, then stake that ETH to get more stETH, and repeat to maximize the yield.

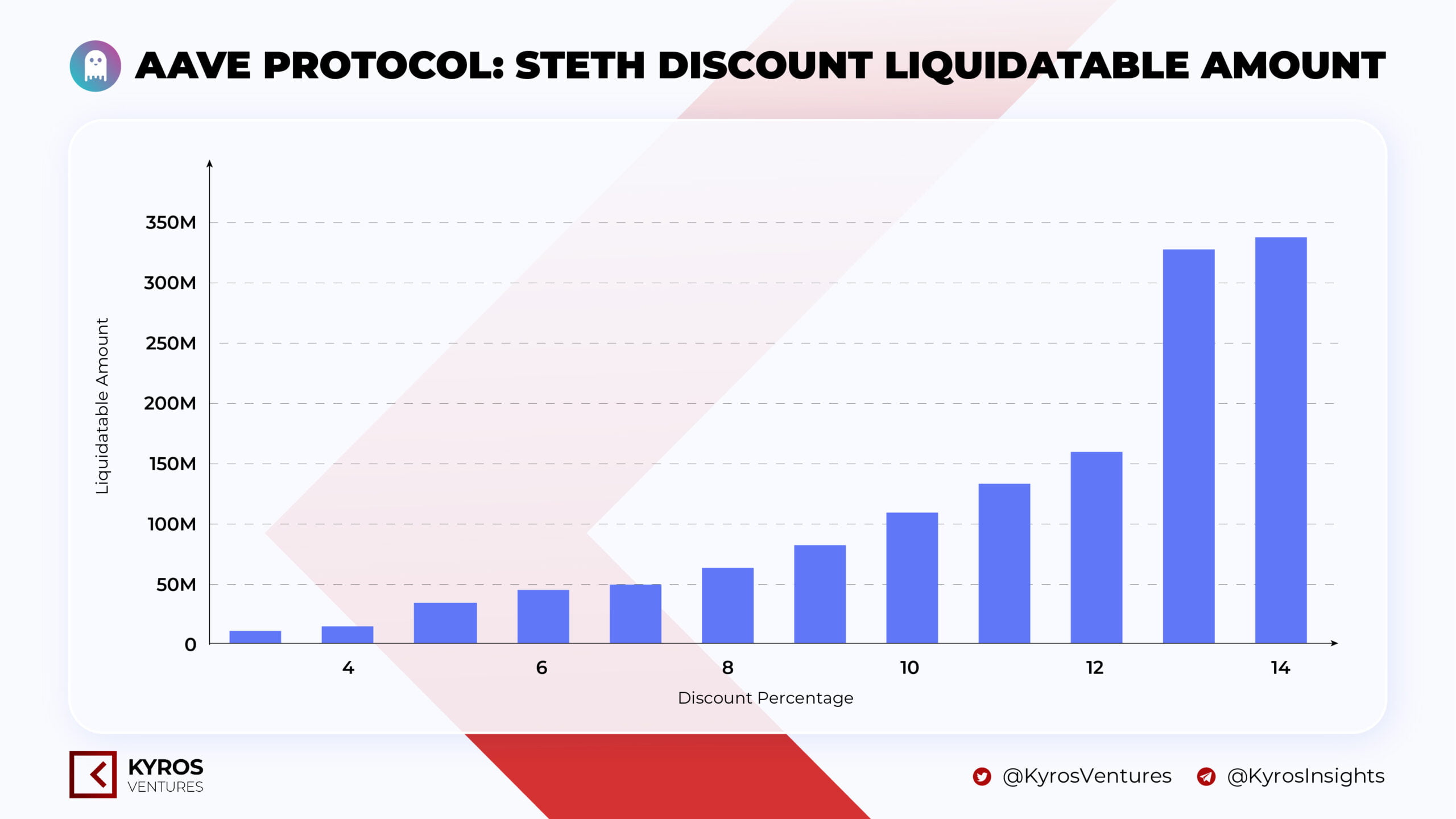

Leverage is most significant at Aave. ETH is the most borrowed asset from stETH for about $800m. Even if stETH depegs 10%, $100M would get liquidated on Aave, and users who are close to the liquidation threshold of 75% could deleverage or exit altogether. The most significant risk is if these liquidations result in bad debt for Aave, but this is extremely unlikely.

Since potential liquidations are an outcome of using leverage, this has always been a known risk. As mentioned by Lido, stETH does not need to be pegged to ETH to work correctly, and stETH will always reflect a 1:1 claim for ETH on the beacon chain after the ETH 2.0 merge. As a result, a decrease in the price of stETH could potentially be a great chance for long-term holders to buy ETH at a discounted price, as long as they are not facing potential liquidation. On the other hand, leveraged users need to maintain their positions at a safe level to avoid short-term liquidation due to market fluctuations.

Since potential liquidations are an outcome of using leverage, this has always been a known risk. As mentioned by Lido, stETH does not need to be pegged to ETH to work correctly, and stETH will always reflect a 1:1 claim for ETH on the beacon chain after the ETH 2.0 merge. As a result, a decrease in the price of stETH could potentially be a great chance for long-term holders to buy ETH at a discounted price, as long as they are not facing potential liquidation. On the other hand, leveraged users need to maintain their positions at a safe level to avoid short-term liquidation due to market fluctuations.

NFT

AZUKI IS UNDER FIRE. GUESS WHO LIT IT

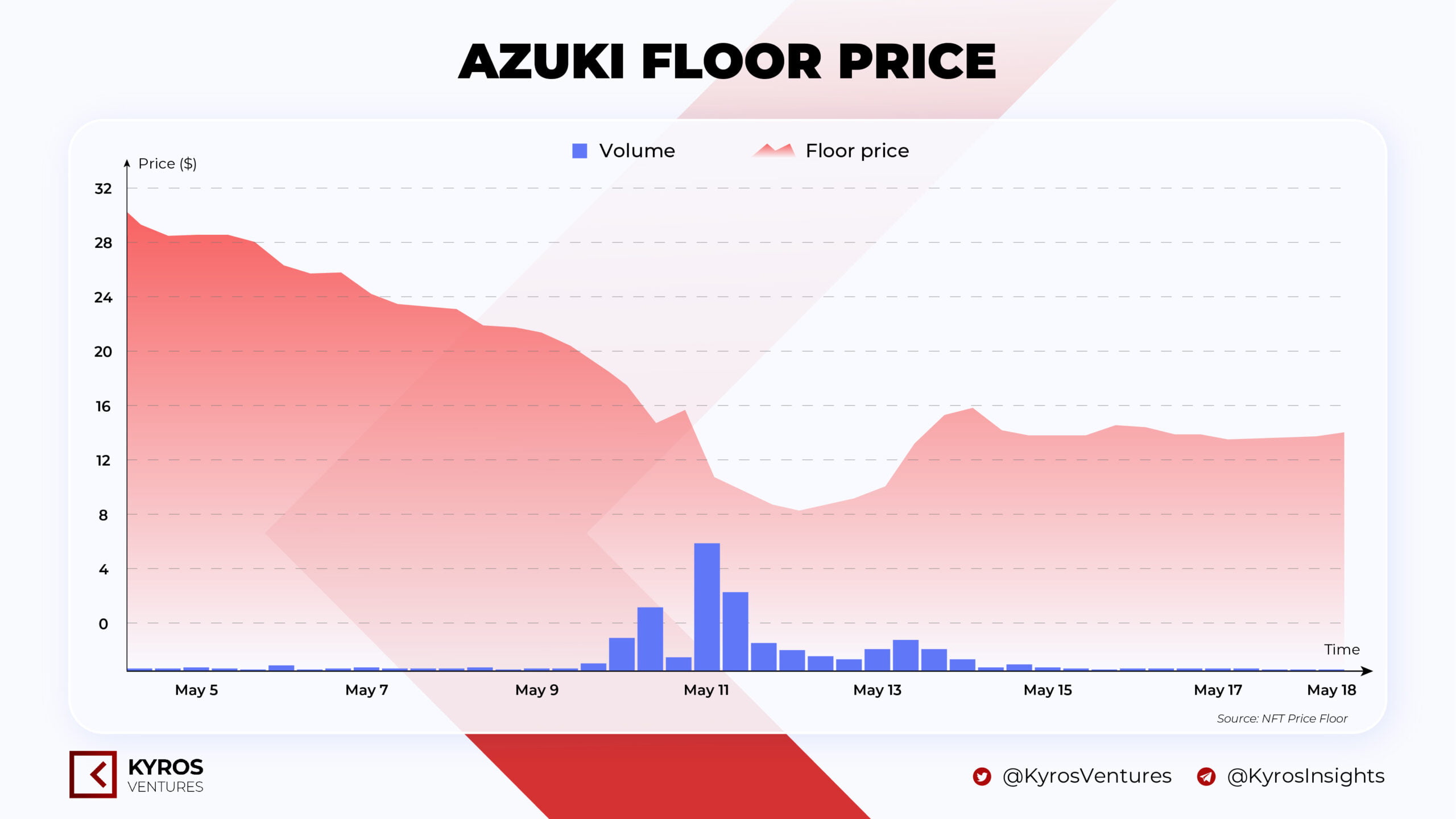

A small part of the Azuki universe – Beanz revealed on May 06, receiving much traction from the community. Also on that day, Azuki announced to welcome Rehito Hatoyama (Ray), a man behind famous brands such as Hello Kitty and Human Made, as an advisor.

However, fresh Beanz turned stale when Zagabond, founder of Chiru Labs, posted “A builder’s Journey” article sharing his path from zero to hero in NFT. In this post, Zagabond revealed that he had been behind the NFT projects CryptoPhunks, Tendies, and CryptoZunks. Those projects have been criticized for rug pulls.

These allegations put Azuki in hot water and shocked the community. Shortly after the collection witnessed a big sell-off, the floor price dropped 50% to the 7 ETH range. On May 11, Zagabond admitted his faults and promised to communicate clearly with everyone and solve the issues.

In our opinion, Zagabond has been involved in the development of 3 NFTs projects only proving his know-how in operating NFT projects and communities. Thus, Zagabond acknowledged his impact on the NFT market while Azuki took the lead. After Zagabond’s confession, we have seen an increase in the price and volume of the CryptoPhunk, and CryptoZunks collections.

In our opinion, Zagabond has been involved in the development of 3 NFTs projects only proving his know-how in operating NFT projects and communities. Thus, Zagabond acknowledged his impact on the NFT market while Azuki took the lead. After Zagabond’s confession, we have seen an increase in the price and volume of the CryptoPhunk, and CryptoZunks collections.

The incident is maybe intentional. Data from Nansen indicated that there was plenty of sell-off due to the news, while smart buyers were accumulating, at a discounted price.

TLDR:

– 16 🤓 Smart buys vs. 11 🤓 Smart Sells

– Increase in overall listings + sales in the last 24h

– Plenty of sell-off due to the news, while *some* smart buyers are accumulating

– Azuki's floor price is currently sitting at around 14-15 ETH pic.twitter.com/lo8KY9KYoT— Nansen Alphα 🧭 (@nansen_alpha) May 10, 2022

TRADITIONAL COMPANIES INTEGRATED NFTs

More from the NFT space, Spotify, Nomura, and China Computer Industry Association are web2 firms joining the NFT space this week.

As we all see, more and more traditional companies are realizing the potential of NFT’s and are already pioneering this innovation. The question that we need to address here is how this adaptation of traditional enterprises affects the current market?

Web2 companies has a very high take rate for creators. In the world of web2, power will be concentrated in the hands of a few industry leaders, thereby influencing the source of income for creators. In a recent report from a16z, web3 creators earn nearly 2 million times higher than what they earn with Meta, or nearly 300 times more than Spotify, etc. Web3 creates an open marketplace for small-scale creators to be able to bring their work to the masses more easily and without the burden of revenue from a handful of web2 publishers.

Web2 companies are highly dependent on taking control of the market, and from there providing domination and then optimizing profits. Even when there are positives with web2 companies entering the market, allowing the market to expand, from another perspective, this participation of web2 companies only helps to extend their pie and will probably increase their dominance to the masses.

CRYPTO TAX AND REGULATION

Since Luna’s event, global financial regulators are paying more attention to the cryptocurrency sector after this incident. Do more regulations mean good things?

SEC: The Securities and Exchange Commission has asked for additional comments on issuer WisdomTree’s proposal to list a spot bitcoin exchange-traded fund (ETF).

El Salvador: El Salvador’s president, Nayib Bukele was in a meeting of 44 countries in El Salvador on Monday to discuss bitcoin and other topics.

Central Africa: Just weeks after the Central African Republic (CAR) made bitcoin legal tender, they also reminded member states of its ban on cryptocurrencies on Friday.

Australia: For the first time, Bitcoin and Ethereum ETFs are offered for Australian investors. Securities and derivatives exchange Cboe Australia introduced the ETFS 21Shares Bitcoin ETF and the ETFS 21Shares Ethereum ETF on May 12.

Portugal: During a working session on Friday, Finance Minister Fernando Medina affirmed that crypto assets will be taxed in the near future.

Brazil: In the last few days, the CEOs of Binance and Coinbase were slated to meet with Brazil’s Central Bank president Roberto Campos Neto, signalling that talks between the industry and the government are continuing.

European: Grayscale Investments announced on May 16 that it is set to make a play for Europe, with its first exchange-traded fund (ETF) in the region.

Nigeria: Last week, Nigeria’s markets regulator published 54 pages of regulations for digital assets, as the country may be stepping back from an earlier ban on cryptocurrencies.

We hope to bring a more #BUIDL vibe (and less drama) to you soon. Until then, see you next week.