Since 2023, market sentiment has shifted away from traditional Launchpads, where investors’ chances of winning tickets were based on their stake size. As the randomness factor became obsolete and investors prioritized certainty over mere capital gains, Launchpool has emerged as the preferred method for introducing new projects on exchanges. This report reviews the state of Initial Exchange Offering (IEO) activity on centralized exchanges (CEX).

Analysis

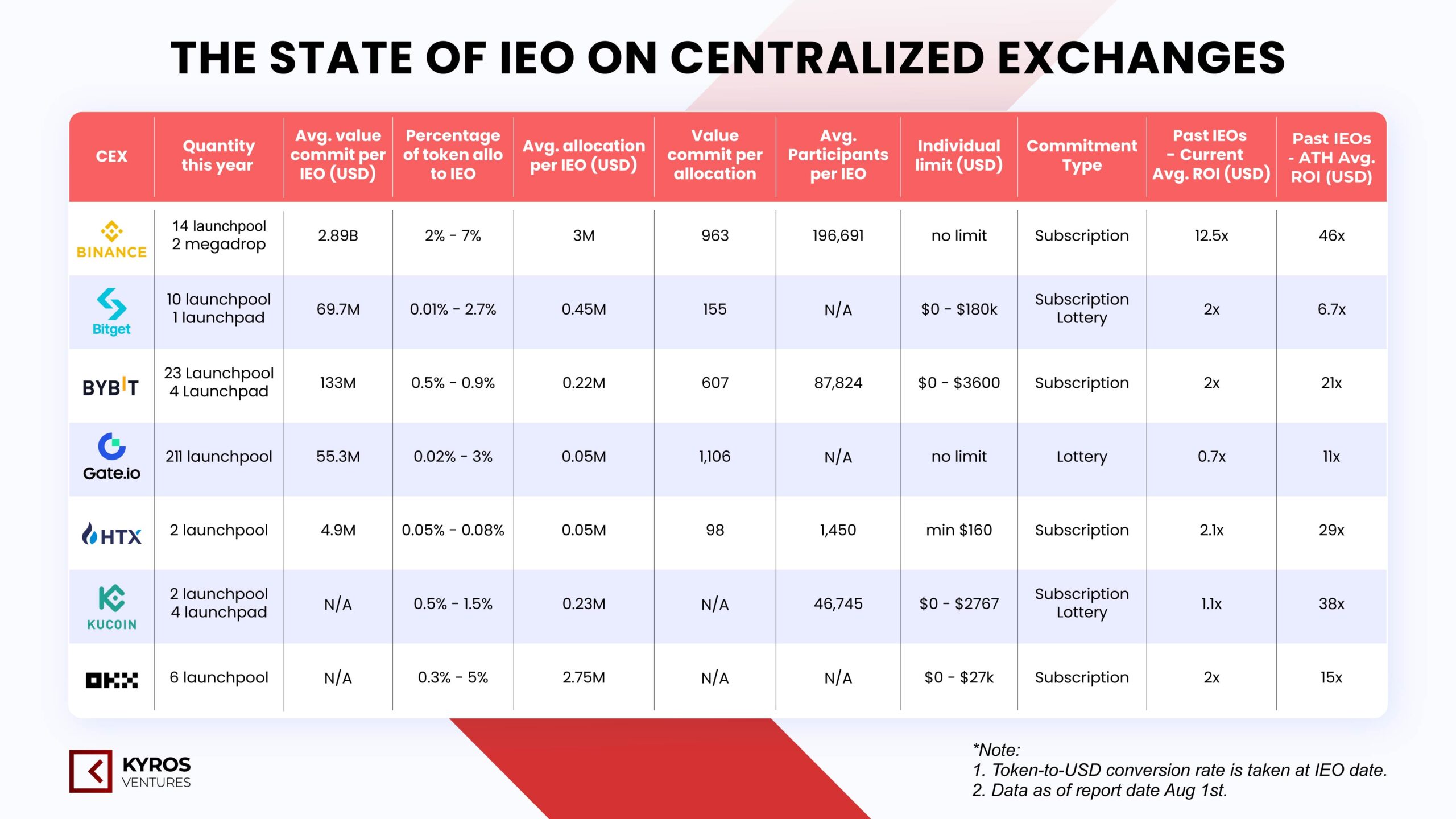

After analyzing a dozen CEXs, we shortlisted seven exchanges to report on their IEO activities based on community engagement and trading volume. These exchanges include Binance, Bitget, Bybit, Gate, HTX, Kucoin, and OKX.

Market size

At the time of writing, there have been over 250 IEO events so far this year. While a few exchanges go hyperactive on listing (211), others stay selective (2). With the median of 16 events, however, every exchange follows a pattern to launch IEOs during the bullish market sentiment.

Based on YTD data of total value committed, we estimate that the IEO market size will exceed 93 billion USD this year.

The dominant CEX – Binance has consistently performed well in IEOs and attracts the highest capital into its Launchpool. Over 2.89 billion USD committed on average to the exchange’s Launchpool year-to-date. That is 21 times more than the runner-up, and significantly higher than all others in the list combined, for an average IEO event.

Project allocation

As the market leader, Binance is privileged to request the largest proportion of tokens compared to other exchanges. Projects on Binance’s Launchpool usually allocate a higher proportion of their token supply to IEOs, varying from 2% to 7%. In comparison, the median token allocation to IEOs is between 0.3% and 2.7%.

Among the seven exchanges, OKX and Binance have the highest token allocation values in USD, with averages of $2.75 million and $3 million, respectively. However, smaller exchanges such as HTX and Bitget lead in value committed per allocation category.

User participation

The number of IEO participants indicates the popularity and growth of the Launchpool. Binance continues to attract the most attention due to its top-tier reputation, but the most impressive growth has been observed at Bybit. This year, Bybit has seen a substantial increase in user participation, with a 10.2x growth in Launchpool and a 2.5x growth in Launchpad.

Considering the barrier to entry, most CEXs have implemented a close-to-zero capital requirement policy to attract users. Nonetheless, the ceiling level has no limit or remains relatively high, indirectly allowing large investors to enter the retail pool.

Since the trend shifted from Launchpad to Launchpool, users can now join IEOs through subscriptions, which have become the most popular option. The lottery system still exists on a few CEXs but is limited to Launchpads.

Token performance

The most compelling reason to join an IEO is the return on investment. Binance sets the benchmark with the highest figures in both current and all-time high (ATH) ROI, at 12.5x and 46x, respectively. Other CEXs may be able to boost ATH, but none have matched Binance’s long-term performance.

Market sentiment

To gain further insights into market sentiment, we conducted a short survey on the Coin68 website, Vietnam’s leading crypto and blockchain news portal. A total of 571 people participated in the survey from August 6-9.

The survey reveals two key insights: the most favored exchange for IEOs and the amount our users are willing to invest in an IEO.

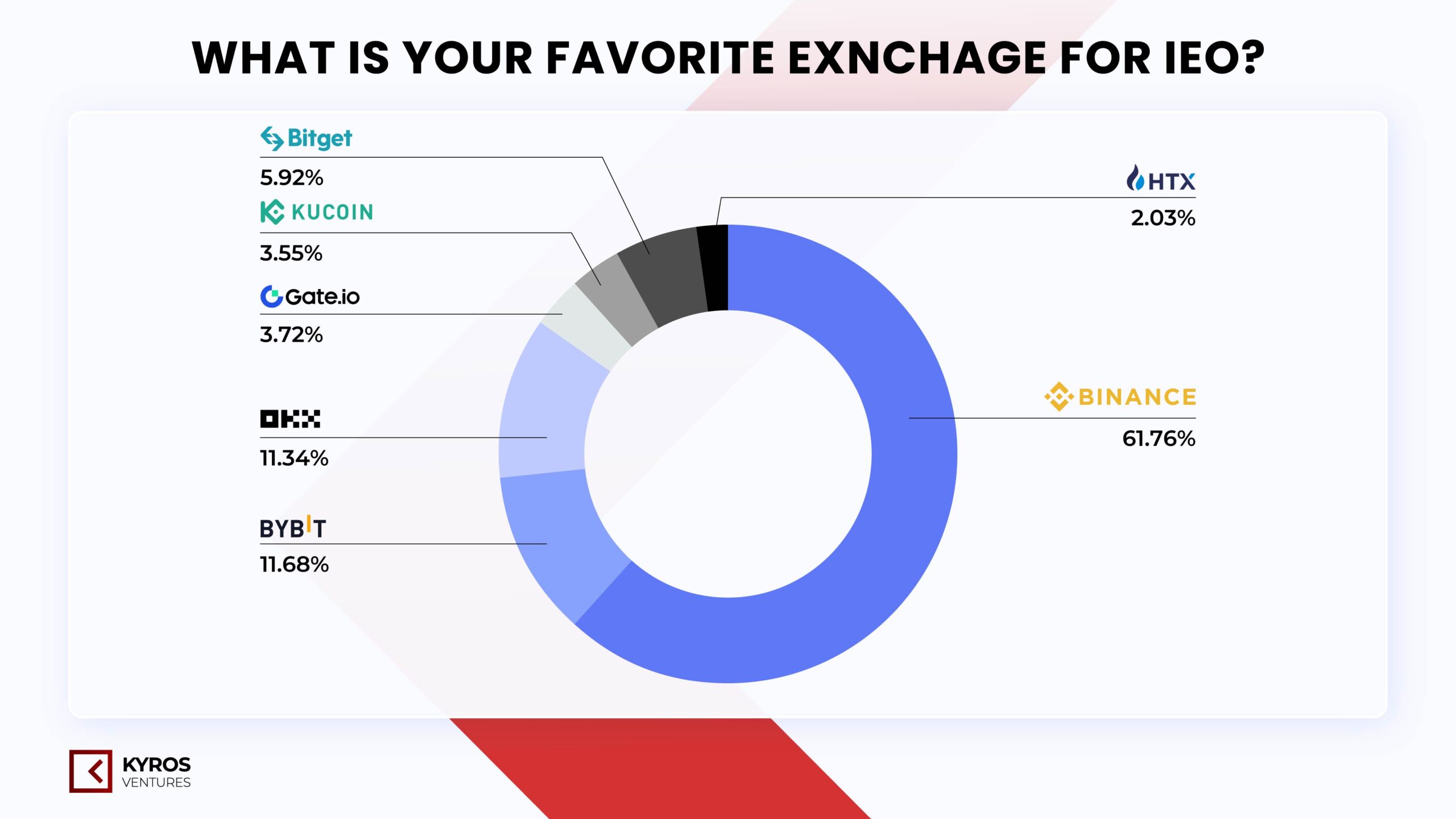

The results were unsurprising, with Binance, Bybit, and OKX being the most popular IEO platforms. Binance leads the segment, with 3 out of 5 users voting for the exchange. Despite being the most active exchange in terms of IEO numbers, Gate garnered relatively little interest.

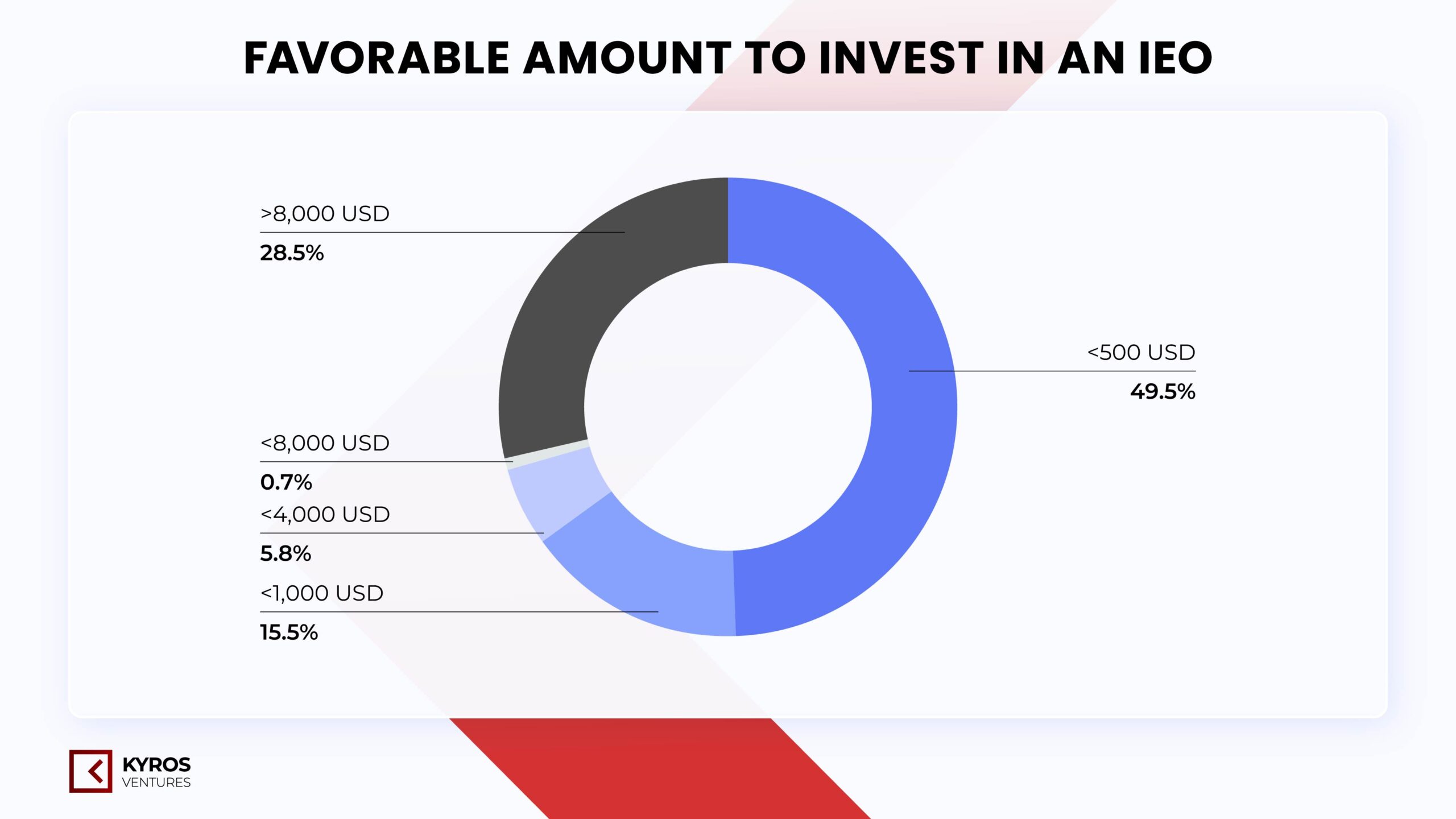

For the preferred investment amount, our users can be clearly divided into two segments, so-called the Fish and the Whale. Considering that the GDP per capita of Vietnam in 2023 is $4,200 (GSO), the Fish bet is relatively small, mostly under $500 on an IEO. Meanwhile, the Whale’s behavior leans toward the highest value options in the questionnaire i.e. >$8,000. The middle options are neglected to some extent showing a differentiation between the two groups of investor in Vietnam.

Epilogue

Through the assessment of IEO activity on seven major CEXs, we can outline a successful pattern: quality over quantity. Performance in the long run and strategic adaption to the market need can always outweigh short-term gains. The previous bull run used to observe the rise of IDO and various DEX launchpads, yet few have survived till now.

This time when the ETF big money plays more roles in the crypto market, let’s see who remains when the tide’s low.