First appearing in Vietnam in the early 2010s, Bitcoin has weathered countless upheavals and been dogged by numerous accusations, from fraud to money laundering. Now, with the official promulgation of the Law on Digital Technology Industry and Resolution No. 5, Bitcoin and cryptocurrencies in general are standing on the threshold of broader, more formal recognition. Let’s walk through the path of crypto from a legal and popular nomenclature standpoint across different periods.

Part 1 — Key Legal Milestones

Overall, the legal development can be divided into two phases:

- Phase 1: Technology and Legal Research, focusing on Risk Control

- Phase 2: Designing the Legal Framework, laying the foundation for Future Development

Initially, regulatory bodies leaned toward risk control. However, in recent years, they have begun to shift gears toward designing the regulatory framework for “virtual assets” and “virtual asset service providers” (hereinafter referred to as VA/VASP), sandbox mechanisms, and the eventual legalization of “digital assets.” This shift mirrors the VASP/Travel Rule framework in South Korea, the PSA and AML/CFT in Singapore, and the MiCA regulation in the European Union. In short, the trend for our regulatory agencies is not unconditional legalization, but rather standardization for the purpose of effective management.

Phase 1

2017

- August 21, 2017 – Decision No. 1255/QD-TTg: The Prime Minister approved the Project on completing the legal framework for managing “virtual assets, electronic money, and virtual currency.” This “opened the door” for officially putting VA/VC on the path to legal codification.

- July 21, 2017 – Official Letter No. 5747/NHNN-PC: Confirmed that Bitcoin/virtual currency is neither a currency nor legal tender in Vietnam.

- October – November 2017 – Warnings & Penalties for Crypto Payments: The State Bank of Vietnam (SBV) and official press outlets stressed that using Bitcoin as a means of payment is illegal and may be penalized under Decree 96/2014 (and could lead to criminal prosecution under the Penal Code starting in 2018).

2018

- April 11, 2018 — Directive No. 10/CT-TTg: The Prime Minister required ministries/sectors to tighten control over activities related to Bitcoin & virtual currency (anti-money laundering, fraud, multi-level schemes, etc.).

2019

- Reaffirmation of “Illegal Means of Payment” Penalties: The SBV continued to issue warnings; the administrative penalty framework in the monetary–banking sector maintained its stance of not recognizing crypto as a means of payment.

2020

- The Ministry of Finance established a Research Team on virtual assets/virtual currency to propose a management framework.

2021

- June 15, 2021 — Decision No. 942/QD-TTg (E-Government Strategy 2021–2025): Assigned the SBV to research and pilot a “Central Bank Digital Currency (CBDC) on a blockchain platform” during the 2021–2023 period.

Phase 2

2022

- November 15, 2022 — Law on Anti-Money Laundering 2022 (No. 14/2022/QH15): Updated AML/CFT obligations in line with FATF standards; serves as the basis for including VASP/VA in the subsequent national action plan. (Effective March 1, 2023).

2023

- April 27, 2023 — Decision No. 11/2023/QD-TTg: Set the large transaction threshold for AML reporting at 400 million VND (this reflects a general trend of tightening AML, which is relevant when building the framework for VA/VASP).

2024

- February 23, 2024 — Decision No. 194/QD-TTg: Issued the national action plan to exit the FATF “Grey List.” The Prime Minister assigned the Ministry of Finance to take the lead in building the legal framework for VA/VASP—with a deadline of May 2025 (requiring the country to either “prohibit or regulate” and demonstrate implementation).

- May 15, 2024 — Decree No. 52/2024/ND-CP on non-cash payments, effective July 1, 2024: Continues to reject crypto as a means of payment; tightens control over illegal payment methods.

- October 22, 2024 — Decision No. 1236/QD-TTg: The Prime Minister issued the National Strategy on the Application and Development of Blockchain Technology until 2025, with a vision to 2030.

2025

- April 29, 2025 — Decree No. 94/2025/ND-CP (Fintech Sandbox): Established a pilot fintech sandbox for payments, P2P lending, Open API, etc.; created a mechanism for supervised testing—setting a “runway” for digital products/AML/KYC compliant operations, indirectly supporting the digital asset ecosystem, effective July 1, 2025.

- May 2025 — Proposed Resolution on piloting the “digital asset/crypto asset market”: Submitted to the National Assembly Standing Committee for permission to pilot within a specific timeframe and regulatory requirements (currently soliciting opinions).

- June 14, 2025 — The National Assembly passed the Law on Digital Technology Industry (effective January 1, 2026): For the first time, “digital assets/crypto assets” are formally defined in law, establishing principles for management, supervision, and investor protection; this creates the basis for subsequent decrees/specialized topics on taxation, accounting, disclosure… and ultimately resolves the identity of digital assets within the legal system.

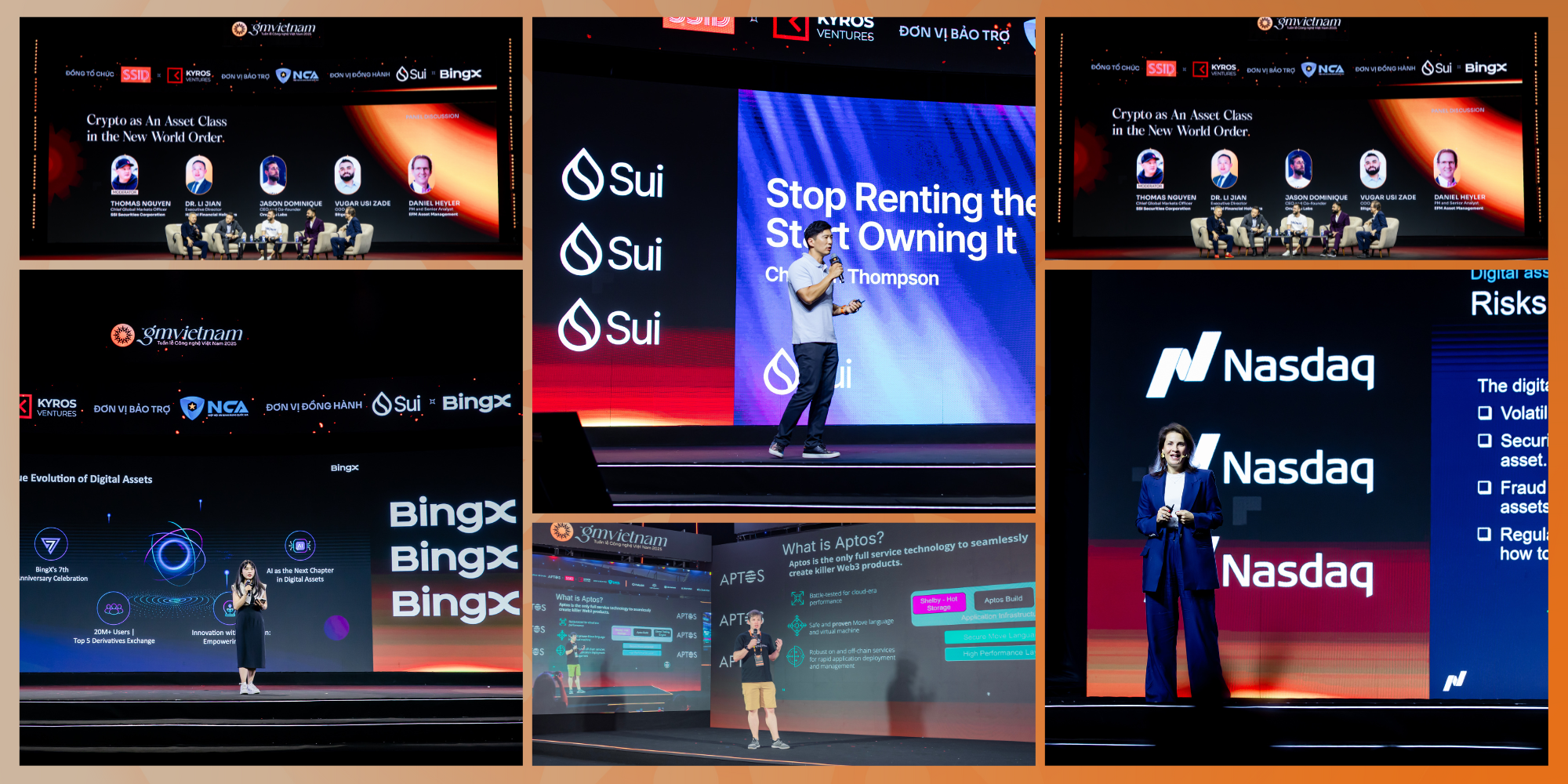

- August 1, 2025 — Deputy Governor of the SBV, Pham Tien Dung, announced at the GM Vietnam event that a pilot digital asset exchange would be established in Vietnam.

- August 28, 2025 — Da Nang, for the first time, licensed a pilot project for converting crypto assets to fiat currency and vice versa.

- September 9, 2025 — Resolution No. 5/2025/NQ-CP: Stipulated the implementation of a pilot crypto asset market in Vietnam, to be carried out over 5 years, based on the principles of caution, controlled supervision, an appropriate roadmap, safety, transparency, effectiveness, and the protection of the legitimate rights and interests of organizations and individuals participating in the crypto asset market.

Part 2 — Nomenclature Across Different Periods

Popularity of Crypto-Related Keywords

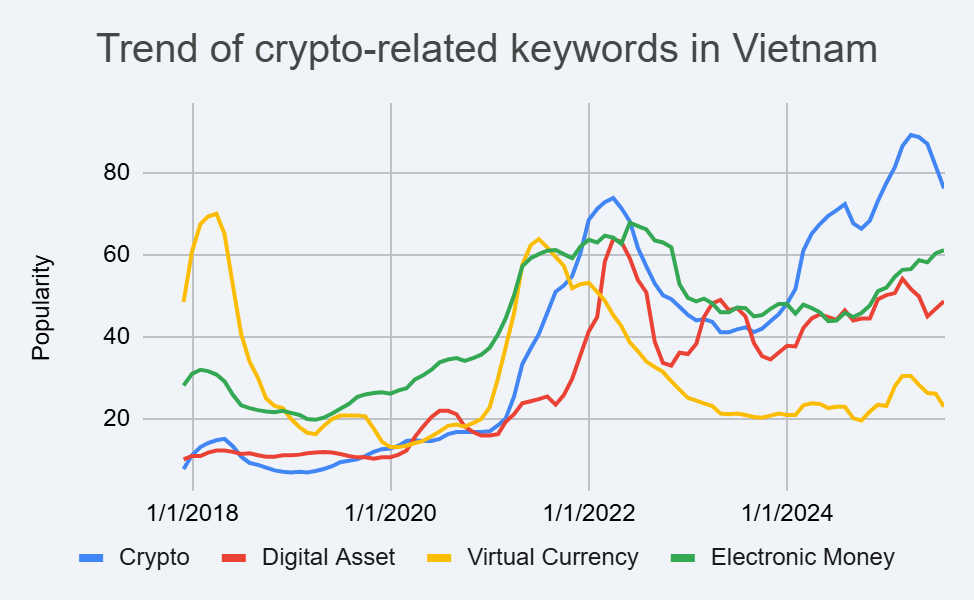

The measurement framework is based on Google Trends indices within Vietnam, covering the period from January 2017 to August 2025. The Trends index is used to compare the momentum of interest over time, while cross-comparison of terms indicates relative correlation. The data has been smoothed (Moving Average) for easier viewing by the reader.

The general trend can be interpreted as follows:

- 2017–2021: “Tiền ảo” – Virtual Currency and “Tiền điện tử” – Electronic Money took the lead, suggesting a generally lower level of public understanding.

- 2021–2023: “Crypto,” “Tiền điện tử,” and “Tài sản số” (Digital Asset) showed high levels of interest, while Virtual Currency began to sharply decline.

- 2023: Digital Asset first surged ahead, driven by news surrounding the completion of the legal framework for digital assets during the process of passing the Law on Digital Technology Industry.

- 2024 – Present: “Crypto” maintains the top spot, indicating a trend toward more substantive, fundamental searches compared to previous years.

Notably, the keyword “Tài sản mã hóa” (Crypto Asset) is on an upward trajectory as it appears in Resolution No. 5 regarding the 5-year pilot implementation of the crypto asset market, effective September 9, 2025.

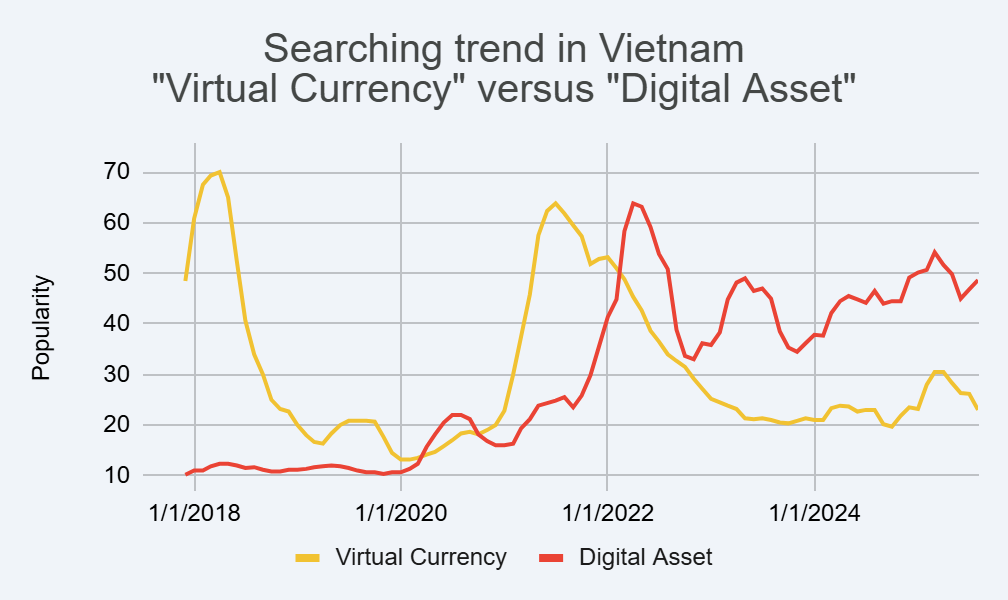

Direct Comparison: “Virtual Currency” vs. “Digital Asset”

During the 2017–2019 period, state documents used the phrases “tiền ảo/tiền điện tử/tài sản ảo” (virtual currency/electronic money/virtual asset), such as in Decision 1255, Directive 10, and warnings from the SBV. The keyword “Tiền ảo” peaked during the 2021 cycle but saw a relative decline after 2022.

In the later phase, a conceptual shift toward “tài sản số” (Digital Asset) emerged in high-level documents, such as Decision 194 requiring a framework for VA/VASP; and especially the 2025 Law on Digital Technology Industry officially defines “digital asset” in law. As a result, the keyword Digital Asset starting from a low base before 2021, has rapidly broken out, rising to become one of the top financial topics searched.

Part 3 — The Path Ahead

Market Perspective

From a policy standpoint, the shift by regulatory agencies and mass media from a term with “alternative currency” connotations (tiền ảo / virtual currency) to an asset-based approach (tài sản số/tài sản mã hoá / digital asset/crypto asset) is absolutely crucial.

On one hand, this opens the door to mechanisms for taxation, accounting, disclosure, and investor protection—an approach similar to developed markets like the EU, Singapore, or South Korea. This step is also appropriate as Vietnam seeks deeper global integration by adhering to common FATF standards.

On the other hand, this transformation clearly demonstrates a more progressive and open spirit for the coming period, as the Vietnamese economy demands a higher degree of innovation.

From the perspective of individual investors, the surge in search demand for the keywords “tài sản số” (digital asset) or “crypto” increasingly affirms the recognition and maturity of the market.

With a comprehensive legal framework in the future, investors will receive greater protection from authorities, establishing a safe and sustainable foundation. This foundation will not only encourage a large inflow of capital from traditional financial institutions alongside the expected legalization of funds. Furthermore, compliant products such as custody, tokenization, Real World Assets (RWA), and regulated stablecoins will be fully unleashed with clear mechanisms, simultaneously mitigating risks stemming from opaque operations.

This change in perspective is a watershed moment, opening up tremendous opportunities for one of the world’s fastest-growing markets to integrate into the existing financial market framework.

Exchanges – The Core Product

As the gateway for the public to access a new market, exchanges are the minimum requirement for long-term development.

Following the deployment of International Financial Centers in Da Nang and Ho Chi Minh City, the digital asset market is also being urgently developed by authorities. Recently, media outlets have reported information about piloting digital asset exchanges in Vietnam. Below is a summary of the information regarding these exchanges:

- TCEX: Techcombank’s digital asset exchange, established in May, recently increased its capital from 3 billion to 101 billion VND on August 8.

- MB Bank: Partnered with Dunamu Group (parent company of the Upbit exchange) on August 13 to develop a digital asset exchange in Vietnam.

- VIXEX: Established on August 26 with a charter capital of 1,000 billion VND. Founding shareholders include VIX Securities, FTG Vietnam, and 3C.

- SSI Digital (SSID): A subsidiary of SSI Securities, established in 2022. On August 28, SSID signed a Memorandum of Understanding (MOU) with the Da Nang City People’s Committee to accompany the city in developing its international financial center.

- CAEX: VPBankS (a subsidiary of VPBank) established a crypto asset exchange in September with an initial chartered capital of 25 billion VND.

According to Resolution No. 5, licensed exchanges must be Vietnamese enterprises with a minimum capital of 10,000 billion VND, of which 35% of the charter capital must be held by at least two organizations (bank, securities company, investment fund, insurance company, or technology company). Additionally, there are many other regulations to ensure the safety and credibility of an exchange.

Conclusion

We have come quite a long way, from the nascent stage to the early adoption phase of a core technology in the 4.0 revolutionary era. The next phase will be pivotal, opening the door for widespread popularization and application within a transparent and standardized legal framework. Pioneering this market now requires not only the path-clearing efforts of regulatory bodies but also the ambitious efforts of each individual among us to build and generate positive value for the community as a whole.