Kyros Ventures is pleased to announce our strategic partnership with Aura Network, an unparalleled scalable Layer 1 blockchain solution designed for NFT adoption. We are excited to help the Aura Network team realize its vision as the epicenter of the NFT ecosystem development.

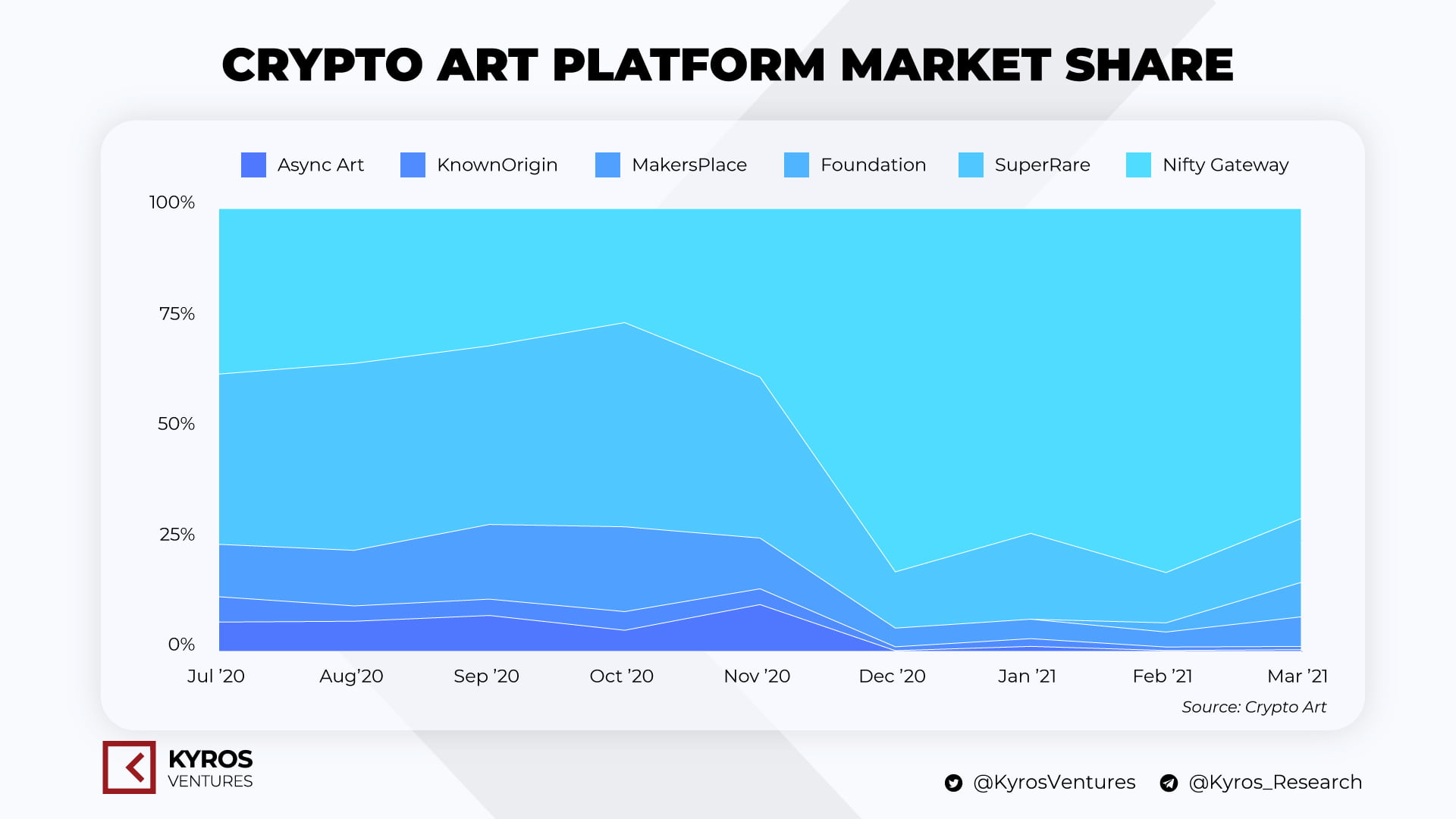

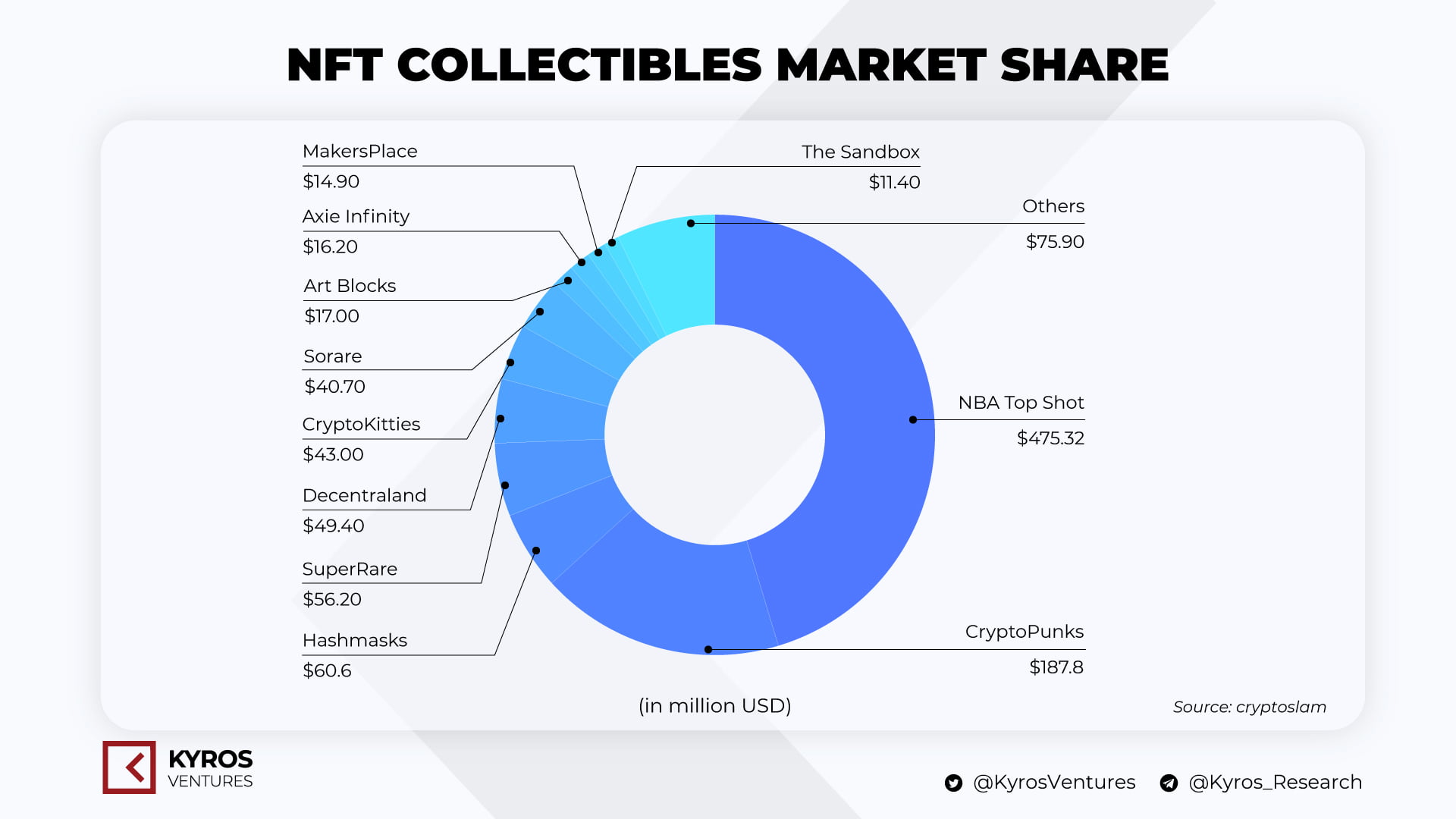

Aura Network is a Layer 1 blockchain with the main focus of popularizing NFTs across various industries. As a pioneer in NFT infrastructure, its vision is to create a one-stop destination for minting, evaluating, querying, and transacting NFTs.

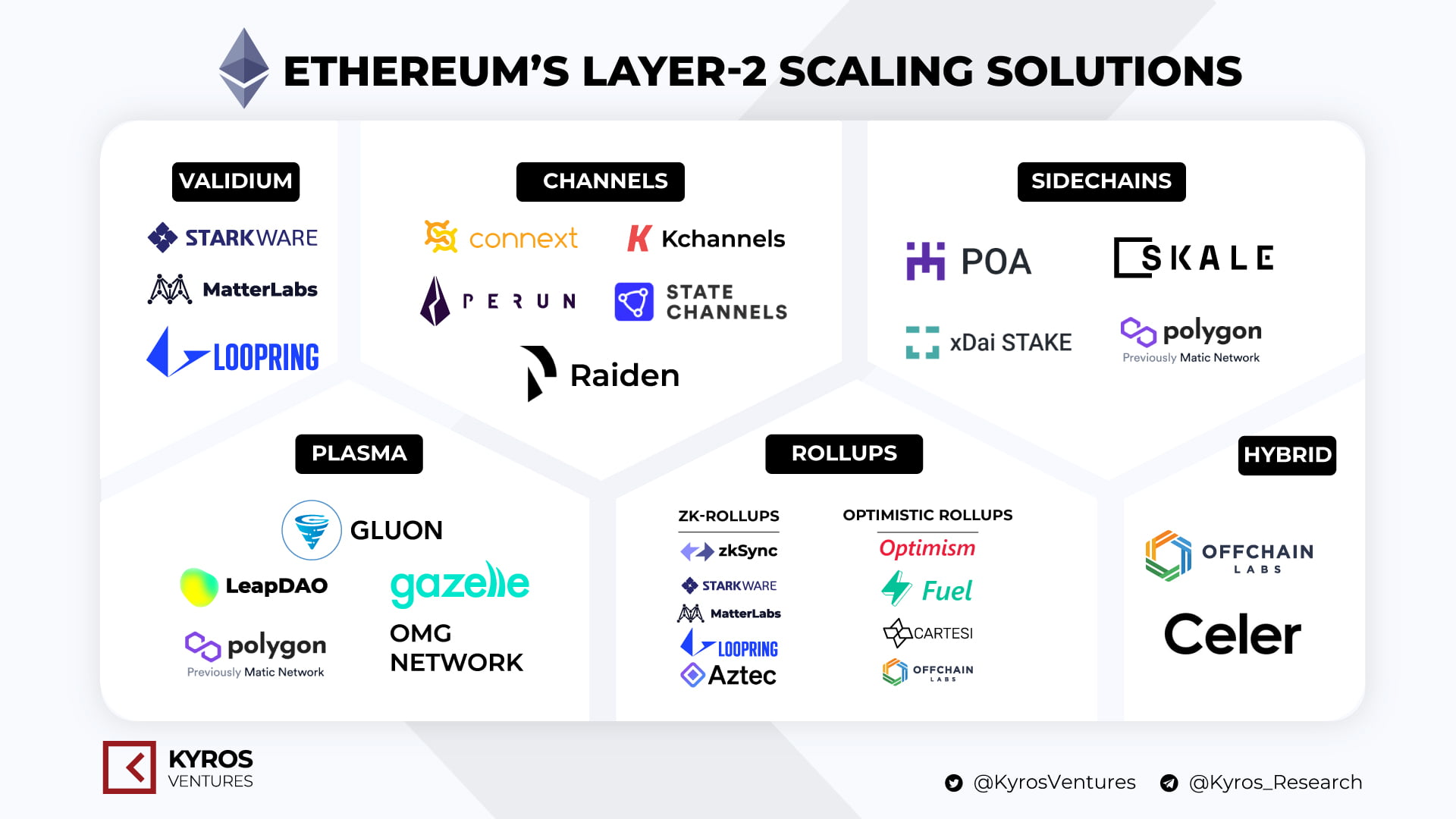

Aura Network has three primary features as a universal framework: a one-stop destination for developing new NFT use cases, a multi-chain platform supporting both crypto and traditional businesses, and an infrastructure layer to integrate metaverse applications. With four core layers of infrastructure, currency, dApps and OpenAPI, the Aura ecosystem promises to enhance efficiency by solving the scalability problem without compromising security.

Riding on the NFT adoption waves, Kyros shares the same vision with Aura Network to build an NFT-centric infrastructure that promotes developers, while at the same time, break through to reach a more mainstream set of end users. Kyros will be supporting Aura Network in educating users on this new applicable technology and looking forward to expanding Aura Network’s presence in the Vietnam market as a pioneer builder in the Internet of NFT.

__***__

About Kyros Ventures

Kyros Ventures is the investment branch of Coin68 Media, the leading cryptocurrency entity in Vietnam. Specializing in incubation and investment, Kyros Ventures is the gateway for international cryptocurrency projects to enter the Vietnamese market, helping them to achieve greater awareness and adoption thanks to its extensive network of partners and communities.

For further information, please visit Kyros Ventures

About Aura Network

Aura Network is a layer-1, NFT-centric blockchain that focuses on expanding the use of NFTs across various industries. Our vision is to create a one-stop destination for minting, evaluating, querying, and transacting NFTs, to become a pioneer NFT infrastructure for the future. Aura Network focuses on building a sovereign blockchain that is optimized for NFT use cases.

For further information, please visit Aura Network