Project Summary

Main Features of Alpha Finance Lab

- Alpha Finance Lab aims to research and solve major problems in decentralized finance (DeFi), including sustainable yield-generation, impermanent loss, privacy-preserving token swaps, cross-chain interoperability, and fixed lending interest rates

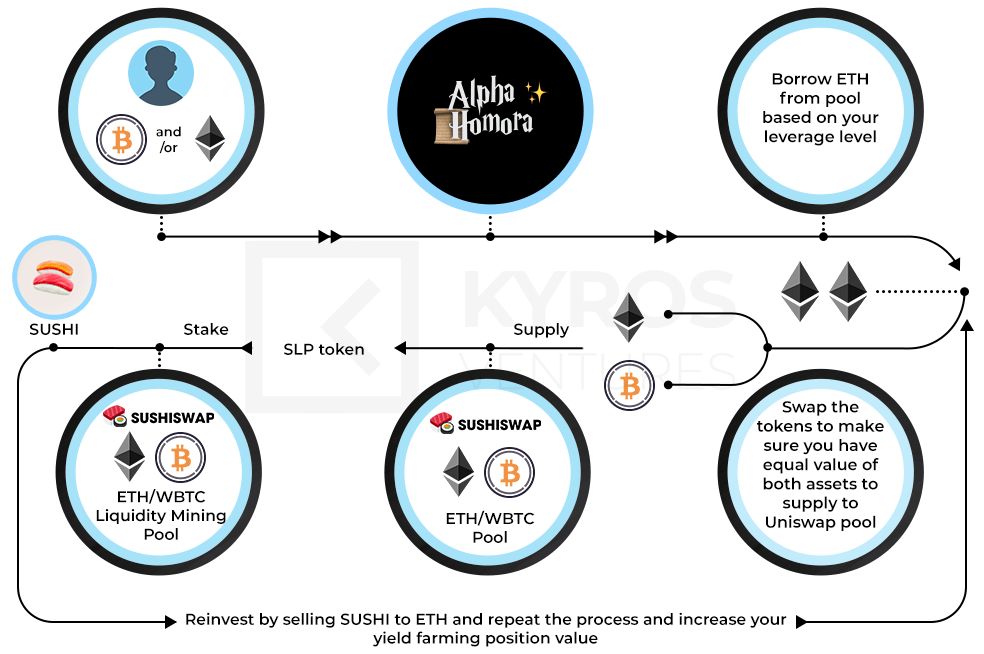

- Alpha Finance Lab is the first organization to provide a leveraged yield-farming protocol – Alpha Homora. The protocol allows users to gain higher returns (up to 2.5x) on liquidity mining aggregated from other prominent yield-farming pools

- Alpha Finance Lab’s vision is to build an ecosystem of cross-chain DeFi products and integrate Alpha products seamlessly with traditional finance, such that anyone and everyone can use traditional finance and Alpha decentralized finance products interchangeably

Alpha Finance Lab Product Suite

- Alpha Homora – Leveraged yield farming on Ethereum (Figure 1). The innovation is also called “dYdX for yield farming”, audited by PeckShield. In Alpha Homora, users can participate as yield farmers, ETH lenders, liquidators, and bounty hunters. The platform’s Total Value Locked (TVL) has surpassed $12 million at the time of writing.

- Alpha Lending (Mainnet launch currently paused) – a decentralized lending protocol with an algorithmic, autonomous interest rate. Alpha Lending is one of the first lending protocols available on Binance Smart Chain (BSC), leveraging BSC’s fast transaction processing time and cheap transaction fees. The protocol also supports cross-chain assets and perpetual lending.

- Perpetual swap protocol is in active development. In the latest regular update, the team announced that it would prioritize perpetual swap in the current context of a bullish Bitcoin and crypto market.

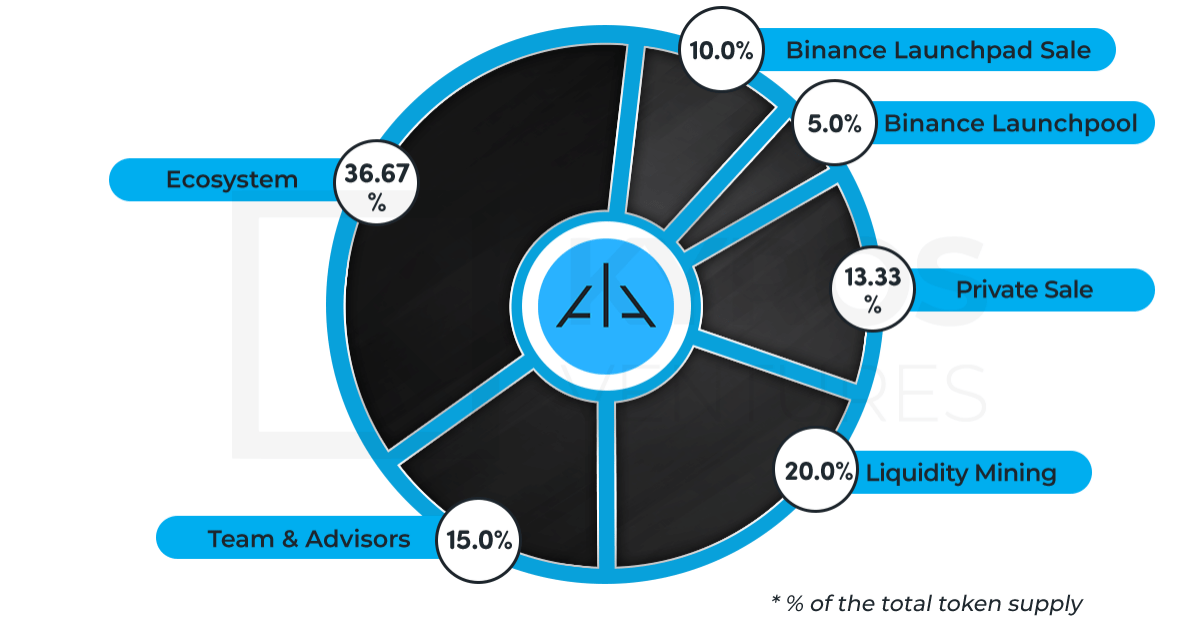

ALPHA Token Distribution

ALPHA token specifications are as follows:

- Initial valuation / market cap (MC): $27.4M

- Total supply (TS): 1 billion ALPHA

- Initial circulating supply (CS): 174 million ALPHA

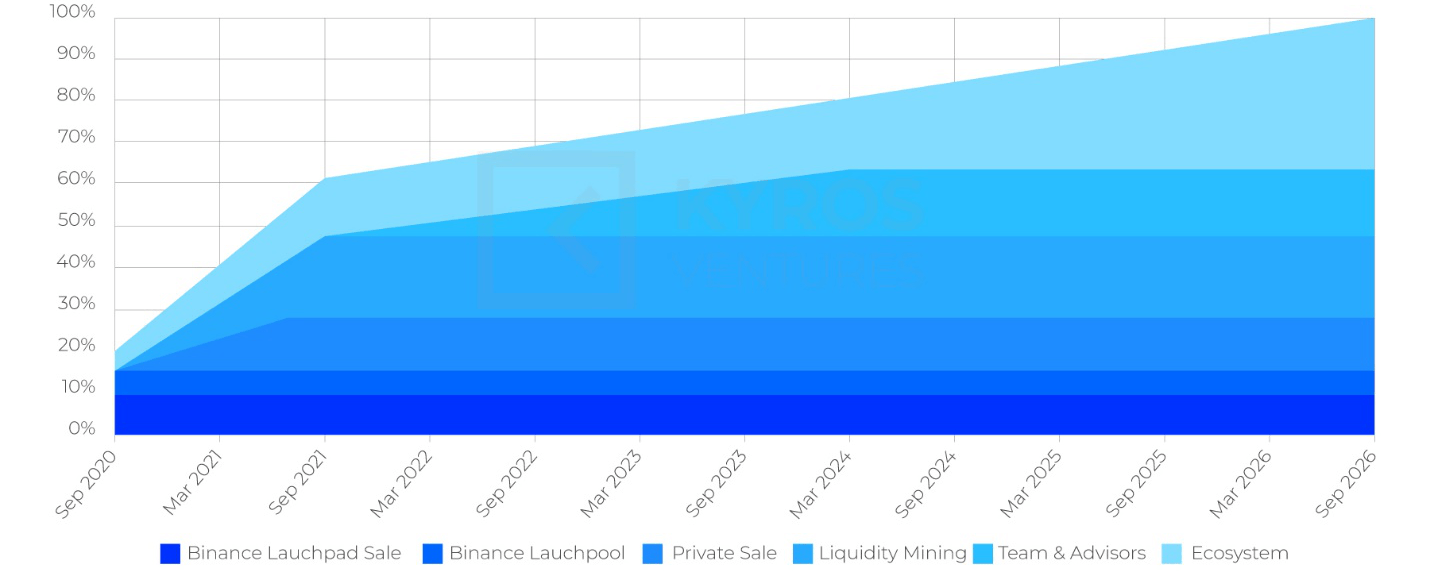

- Token distribution as illustrated (Figure 2)

Alpha Finance Lab Team

- Tascha Punyaneramitdee– Project Lead. Former Head of Strategy at Band Protocol and Former Product Manager at Tencent. Before that, the Berkeley alumna was an Investment Banking Analyst at Jefferies.

- Nipun Pitimanaaree– Lead Engineer and Blockchain Researcher. Former Chief Research Officer at OZT Robotics. He holds a Master of Engineering degree from MIT.

- Thara Malaimarn– Blockchain Developer. Former blockchain developer at Band Protocol and Loom Network.

- Pitchanai Thitipakorn– Software Engineer. Former Full-stack Developer at GIS Company.

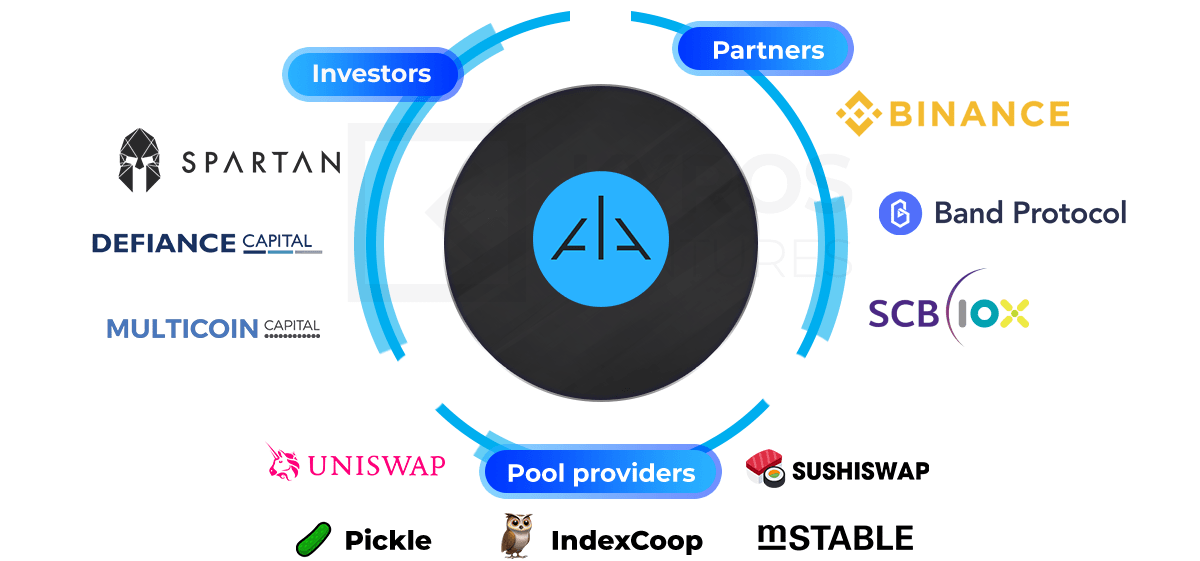

Alpha Finance Ecosystem

Integral parts of the Alpha Finance ecosystem are presented in Figure 3, namely the strategic investors, prominent industry partners, and yield farming pools. Each of these plays a significant role in the overall success of the Alpha Finance platform

Alpha Finance Lab’s strategic investors include:

- The Spartan Group – Spartan Group is a boutique financial advisory and digital asset management firm specializing in blockchain, cryptography, and other digitization technology. Spartan Advisory clients include IBM, Dapper, Blockstack, Deribit, Solana, and Blockfolio. Its investment team has over 20 years of experience serving world-class financial groups such as Goldman Sachs and Indus Capital.

- Multicoin Capital – Multicoin Capital is a thesis-driven investment firm that invests in cryptocurrencies, tokens, and blockchain companies reshaping trillion-dollar markets. The venture has raised a total of $75M and invested in 26 deals so far, including Solana, Dune Analytics, Braintrust, and SKALE Labs.

- DeFiance Capital – DeFiance Capital is a DeFi focused crypto-asset fund that combines fundamental research with an activist investment approach.

Alpha Finance Lab’s ecosystem partners are:

- Binance– the top-notch exchange is not just a launchpad partner but also a blockchain operator where Alpha finance protocol runs upon

- SCB10X– The venture arm of Siam Commercial Bank, one of the largest commercial banks in Thailand. SCB10X is an early investor in international payments giant Ripple and leading cryptocurrency lending platform, BlockFi. The partnership with SCB10X will provide Alpha with traditional banking expertise and an avenue to onboard retail customers to DeFi.

- Band Protocol –Alpha Finance uses the Price Oracle feature for its infrastructure. The oracle is responsible for querying the latest price of an asset from BandChain.

Finally, ALPHA token’s liquidity pool providers include Uniswap, Sushiswap, Pickle, IndexCoop, and mStable.

ALPHA Tokenomics

- Public token offering on Binance Smart Chain on 10 October 2020

- Revenue from Alpha products will be used to buyback and burn ALPHA tokens

- Additionally, the burning parameter will be configurable through token-based governance in the future

Token Utility

- Staking – Users can deposit ALPHA tokens into a smart contract, which utilizes them to cover any default loans. Users can then receive a portion of the platform’s revenue.

- Liquidity mining

- Critical to bootstrap liquidity, distribute governance rights to invested users and create a strong community of DeFi enthusiasts who will help propel the protocol forward

- Featured in Binance Launchpad. In Oct 2020, the opportunity existed to stake BNB, BUSD, and BAND to earn ALPHA

- Deflationary economy –all Alpha Finance products will tie back to ALPHA and reward users for using their products as revenues from the products will be used to buyback or burn ALPHA tokens. Additionally, the burning parameter will be configurable through token-based governance in the future.

- Governance procedures

- Alpha will implement governance on two levels via DAO mechanism – product-level governance and Alpha Finance-level governance

- Product-level governance will allow ALPHA token holders to govern key protocol parameters of specific Alpha products

- Alpha Finance-level governance will allow ALPHA token holders to govern how the portfolio of Alpha products interoperate

Comparable Projects

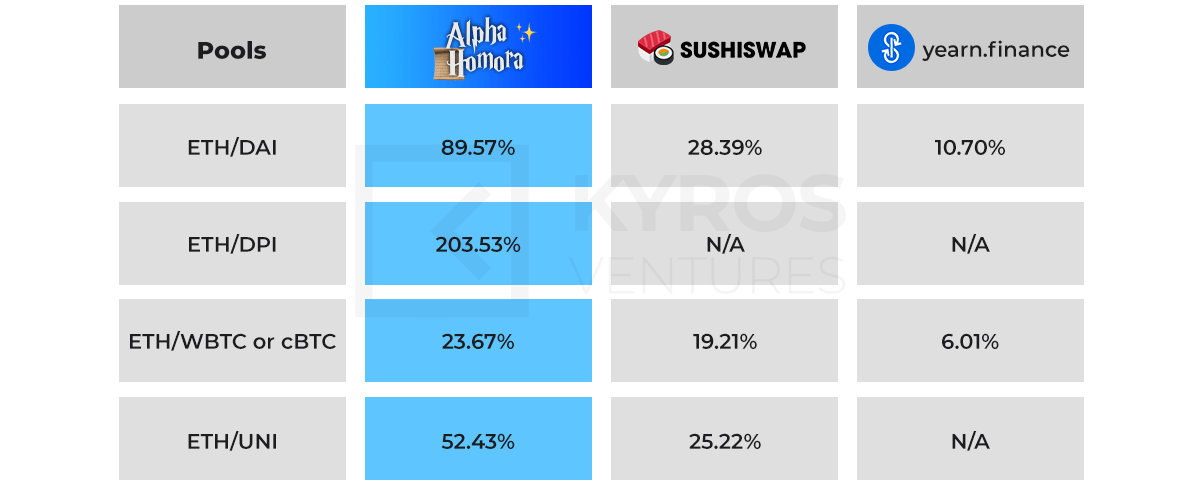

Alpha Finance competes directly with strong projects such as SushiSwap and yearn.finance in the yield farming segment and AAVE and Compound in the lending segment. Alpha Finance has established 21 yield farming pools (both leveraged and non-leveraged) while its lending product is still in the Testnet phase. Figure 4 below demonstrates Alpha Homora’s competitively higher yield returns compared to that of SushiSwap and yearn.finance.

Alpha Finance Lab is the first and currently only platform providing leveraged yield farming products with Alpha Homora. Such innovative product provides a competitive edge to Alpha Finance in the popular DeFi yield farming field.

For non-leveraged yield farmers, Alpha Homora acts as an efficient liquidity aggregator with unique features, such as loss-minimizing/gas-saving, optimal swap, and automatic reinvest-ment.

Ultimately, Alpha Homora offers a high lending rate for ALPHA. The product’s Testnet on Binance Smart Chain is ready, but the final launch is currently paused as the team awaits better timing.

Upcoming News and Development Progress

Token Release Schedule

Alpha Finance Lab team will unlock a large number of ALPHA tokens by September 2021, releasing 60% of its total supply into the circulation, approximately 600M ALPHA (Figure 5). From now to the first anniversary of Binance Launchpad, the team must prove their capability to deliver market-fit DeFi products, i.e., the liquidity mining aggregator, leveraged yield-farming pools, perpetual swap, and the lending feature.

Development Roadmap

- Alphaperpetual swap protocol is in active development as the team’s key focus for the rest of 2020. The product is expected to carry on Alpha Homora’s momentum, capturing unaddressed demand in DeFi in an innovative and user-friendly way.

- Alpha Lending product launched its Testnet on Binance Smart Chain (announced in late September). Yet, the final product release is now paused for better timing as auditing has been completed.

- Alpha Homora product development – more educational resources on Alpha Homora, additional yield farming pools, more marketing through various channels, expanded liquidity mining program, and a referral program

Reasons to be Bullish

- Despite the recent correction of the DeFi bubble, total value locked (TVL) in DeFi protocols steadily grew from USD 700 million at the start of 2020 to USD 12.93 billion as of 27 November 2020 (Defipulse). Alpha Finance Lab is looking to deliver the next stage of DeFi through building interoperability among Alpha products and integrating with leading ecosystem partners

- Backed by strong investors and industry partnerships (especially Binance and SCB10X) who are well-positioned to support Alpha Finance Lab’s growth

- The team made the right move when branching out into the perpetual swap segment, which has a great demand with no clear major player yet.

- Highly active community growth campaign including regular technical updates and educational sessions via blog posts, online and face-to-face sessions, and social media engagement

Factors to Watch

- The liquidity aggregator field is booming as the second wave of the DeFi industry. Several projects are in fierce competition to capture the market share.

- ETH is the core asset in the Alpha Finance ecosystem since pools and products are all based around Ethereum. The team needs to expand its product suite to more blockchains and deliver a better asset coverage to reduce its dependency on Ethereum in case of adverse market movements.

Executive Summary

Projection Milestones

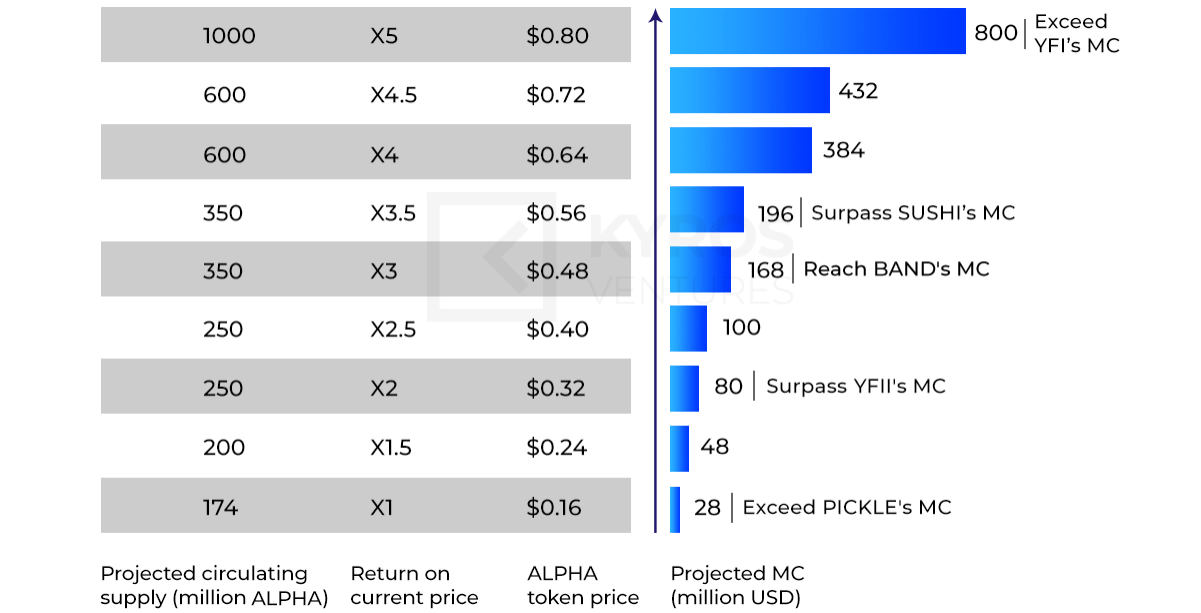

Note: This projection evaluation method considers both the ALPHA token price and the ALPHA circulating supply as variables, which is an accurate representation since both are subject to change over time.

- At the time of writing, the circulating supply (CS) is 174M ALPHA, and the market cap (MC) reaches $27.4M. The token has an initial offering price on Binance Launchpad at $0.02 / ALPHA. At the time of writing, the token price had passed the $0.28 mark (its new ATH since inception) before retracing to $0.22.

- One year after the launch, the leveraged yield-farming pools concept pioneered by Alpha Homora would be popularized, and Alpha Finance Labs is expected to gain the first-mover advantage. ALPHA CS will be around 600M ALPHA. ALPHA then has a chance to surpass SUSHI’s MC.

- At full token release, the CS will be 1B ALPHA. ALPHA token price may potentially reach $0.8 per token, giving it a circulating market cap in line with YFI’s MC and in the vicinity of $800M.

Figure 6 presents the different possible scenarios determining the potential ALPHA MC and the associated return on investment (ROI) in the future.

Concluding Remarks

Alpha Finance’s leveraged yield-farming solution seems necessary if the yield farming industry is to grow and lead to DeFi adoption. The Kyros Research team is bullish on this project, and we believe that crypto enthusiasts and investors alike will also be able to understand its potential.

Considering Alpha Finance’s favorable metrics versus comparable projects with a higher market cap (e.g., SushiSwap, yearn.finance), we would be extremely surprised to see this token stay under $0.2 in the first half of 2021.

Due to the volatile nature of the crypto markets, accurate short term price estimates are difficult to establish. However, we expect to see the ALPHA token price soar to $0.4 – $0.6 in the mid-to-long term, giving it a circulating market cap in the vicinity of $200M.

Even higher token price milestones are feasible in the long term, our most bullish prediction envisaging ALPHA potentially reaching the yearn.finance’s market cap in the future. Taking into account that Alpha Homora has the first-mover advantage in the leveraged yield-farming field, Alpha Finance Lab definitely has plenty of potential.