Project Summary

APY.Finance automates yield farming to get users the best, risk-adjusted returns in DeFi. APY.Finance smart contracts continuously route user’s funds to the latest-and-greatest yield farming strategies. The project aims to democratize yield farming by making it accessible to the average user and not just the DeFi experts.

The project uses the technology previously developed by DALP, which won the second place at the HackMoney 2020 hackathon hosted by ETHGlobal.

Main Features of APY.Finance

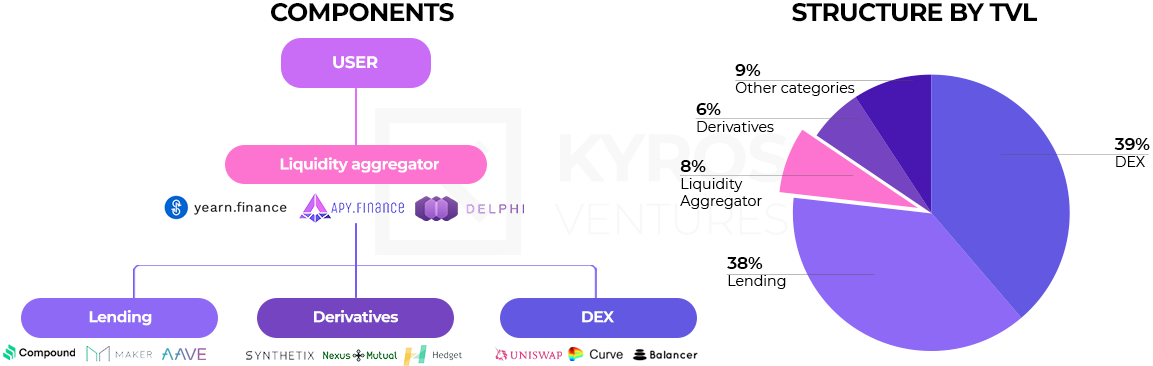

APY.Finance is a liquidity aggregator with 3 main features:

- Pooled liquidity: save gas fee by economies of scale

- Funds are deposited to APY.Finance thus adding to the liquidity pool. APT tokens then represent an individual’s share of the pool. APY.Finance can achieve economies of scale by collectively routing funds together in a single transaction

- Massive gas savings in excess of 99% are expected as the system’s TVL increases. This innovation alone could revolutionize the accessibility of yield farming. Added to user experience, token redemption can be applied anytime, allowing one to withdraw yield farming profits from the liquidity pool easily

- Smart routing

- After the initial deposit, APY.Finance will then automatically route funds to the most optimal yield farming strategies, optimized not only for profit but also risk level

- In particular, capital is spread across multiple strategies, depending on each strategy’s risk score. Taking a risk-averse case as an example, a small proportion of capital is allocated into high-risk high-return pools, whereas the remaining capital is to be assigned to low risk pools

- Community-owned

- Security is APY.Finance’s primary concern so strategies will be rolled out carefully and slowly. At first, the platform will be run by DeFi experts that codify yield farming strategies and monitor for time-sensitive incidents

- Concurrently, a liquidity mining rewards program will run in order to get the APY token into the hands of real users. APY governance token holders will be able to propose and vote on easily verifiable changes to the DeFi landscape, such as strategy risk score changes or even yield allocation

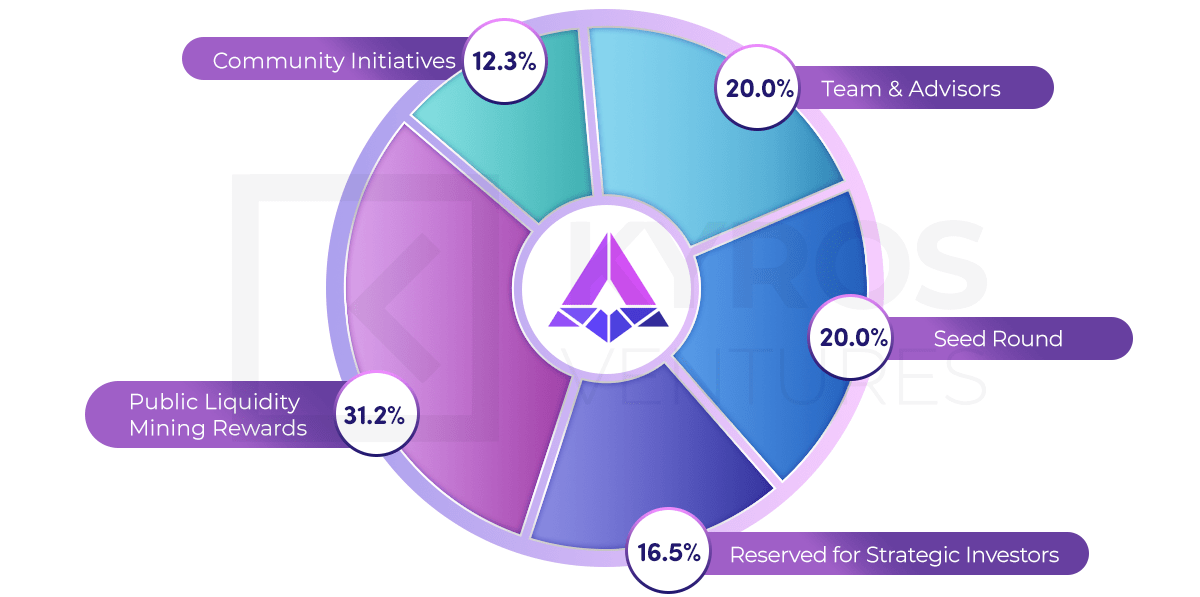

APY token specifications are as follows:

- Initial valuation / market cap (MC): $13.5M

- Total supply (TS): 100M APY

- Initial circulating supply (CS): 8M APY

- Token distribution as illustrated (Figure 1)

APY token holders will be able to vote and change system-wide parameters such as fees, risk score, and rebalance thresholds. However, this is just the first of three distinct phases of the project’s roadmap and APY token functionality.

In the second stage, APY holders can propose changes to existing strategies simply by drag-and-drop, without the need for Solidity engineering knowledge.

In the final stage, APY token holders will be able to propose entirely new strategies and influence the deployment of billions of dollars into various DeFi protocols.

APY.Finance Team

The founding members of APY.Finance are:

- Will Shahda, CEO & Solidity engineer

- Partner at Wired Capital which develops algorithmic cryptocurrency trading bots that use arbitrage strategies and machine learning techniques

- After founding WP-Science, a small business developing, marketing, and distributing WordPress plugins, Will wrote and audited Solidity smart contracts for companies such as Jarvis Network and Squarelink

- He organized and lead teams competing in blockchain hackathons, frequently placing and winning sponsorship prizes. Furthermore, Will handled Solidity development, project management, and pitch presentations for hackathon projects

- Prior to focusing on blockchain technology, Will led development and delivered flagship products for international brands including Kraft, Mondelēz International, Green Mountain Coffee and Spin Galactic international franchise when working for Blue World Inc and Arana Interactive

- Chan-Ho Suh, Smart contract developer at APY.Finance

- Backend developer with 6+ years of experience spanning across structured and unstructured environments, small and large teams, and rigorously tested production code and ad-hoc rapid application development.

- Currently working as a smart contract developer at APY.Finance and Tech Lead for Capital One

- Prior to that, the Cornell alumnus was a senior software engineer for a loan syndication platform (LoanStreet Inc.), a quant developer leading development of the trading desk for volatility derivatives at MIO Partners, an application developer at JPMorgan Chase & Co and an electronic trading developer at Nomura

- Jonathan Viray, Full stack engineer at APY.Finance

- Jonathan is a self-taught freelance software developer and a licensed contract attorney

- Jonathan served as an associate attorney for Zhang & Associates and Special Counsel, and as a contract attorney for Epiq and TransPerfect Legal Solutions.

- He used to work at the Earl Carl Institute for Legal and Social Policy and U.S. Attorney’s Office early in his career

APY.Finance advisors include:

- Sunil Srivatsa, DeFi strategy advisor and co-founder of Urza DAO

- 8 years of experience in Uber, Square, Cultivation Capital as a software engineer and analyst

- Pascal Tallarida, advisor, founder of Jarvis

- prop trader with 12 years of experience, founder and trainer at Diabolo Menthe Trading SAS

APY.Finance Ecosystem

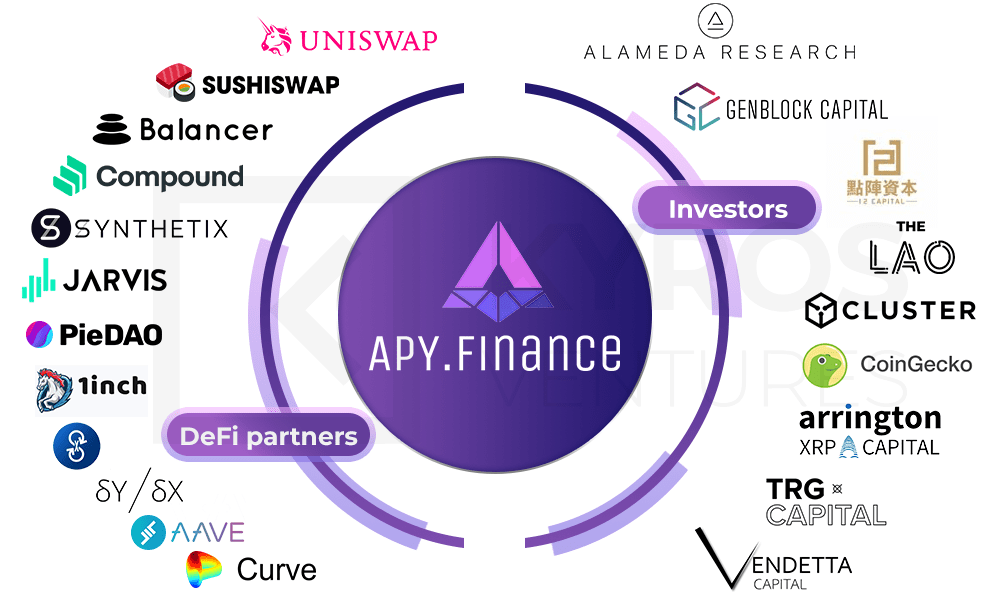

Integral parts of the APY.Finance ecosystem are presented in Figure 2, namely the key investors and DeFi partners and networks. Each of these plays a significant role in the overall success of the APY.Finance platform.

APY.Finance’s DeFi industry network encompasses well-established brands such as Uniswap, Sushiswap, Balancer, Compound, Synthetix, Jarvis, PieDAO, 1inch, Yearn.finance, dY/dX, Aave, and Curve.

APY.Finance’s investors enable its long term vision to become reality. The key investors include Alameda Research, Arrington XRP Capital, Cluster Capital, CoinGecko, Genblock Capital, TRG Capital, The LAO, 12 Capital, and Vendetta Capital.

Comparable Projects

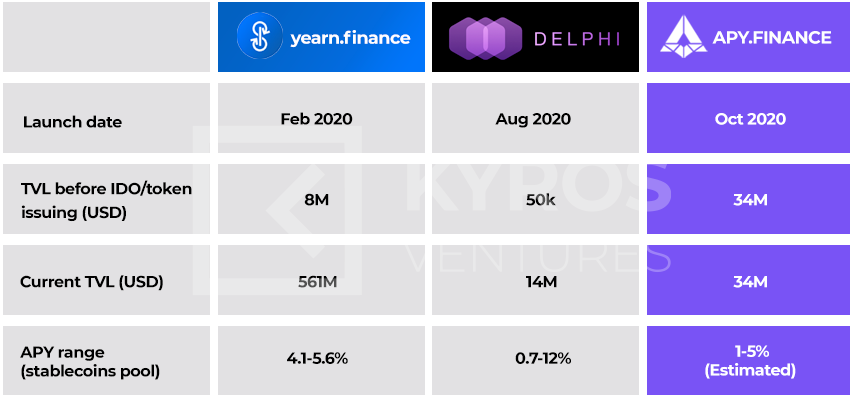

APY.Finance is one of the three most popular liquidity aggregators, including yearn.finance and Delphi from Akropolis. All three of them have already attracted funding into their pools prior to their IDO launches. Here APY stands out with the highest TVL prior to IDO/token issuance as compared to the other two, with around $34 million locked into the smart contract thus far. Meanwhile the APY range is similar across platforms as shown in Figure 3.

Upcoming News and Development Progress

APY.Finance Token Generation Event

Around 2.6M APY tokens will be available for sale on Balancer’s liquidity bootstrapping pool (LBP) on November 5, 2020 at 14:00 UTC.

The LBP will run for 48 hours on a fair Dutch auction format, ending on an exact block number to be announced.

The token will be released on a declining price mechanism, which effectively wipes out all front-running bot attempts. For instance, if a bot snips all APY tokens in the very first seconds, the changing pool weights will cause the APY token price to drop below the initial acquisition price as confirmed by the project’s CEO.

Such a mechanism and commitment will truly provide fair chances for those with real needs and interests in the token governance, rather than allow speculation and whale manipulation.

Token Release Schedule

APY.Finance has a fixed cap of 100M APY on total supply. The token release schedule has lengthy lock up terms, indicating long-term commitment from both the team and its investors:

- Around 7.5M APY tokens in circulation at the IDO event

- The team has adopted a 4-year vesting schedule (1-year cliff, 3-year linearly vested)

- All seed and strategic investors are also aligned on a 1-year vesting schedule with 9c and 13.5c cost basis, respectively

Development Roadmap

Completed milestones and the plan for the rest of 2020:

- Launch of the liquidity mining program with more than 1,500 unique addresses participating, locking a round of $40 million in liquidity mining smart contracts

- Updates to the liquidity mining user interface to make it more intuitive

- Preparation for IDO strategy

- Alpha product development

Reasons to be Bullish

- Impressive growth in the DeFi industry boosts project confidence:

- DEX volume skyrocketed 80x from the beginning of this year until October

- TVL in smart contracts for DeFi projects exceeds $12B at the time of writing, reaching the 20x YTD growth rate milestone

- However, liquidity aggregator TVL market share is still only 8%, relatively small compared to DEX and lending protocols (Figure 4)

- Green field in the liquidity aggregator niche – there is a small number of projects participating. Thus, APY.Finance has a higher chance to capture market share at this early stage

Factors to Watch

- Potential emergence of new liquidity aggregator projects with more competitive advantages, especially ones developed and supported by popular DEXs or pools like Uniswap, Curve.fi, etc. The development from Yearn.finance is also a factor to watch since they are currently the market leader in the liquidity aggregator niche market.

- Annual percentage yield (APY) is the key reason that attracts individual investors (based on the CoinGecko survey), who tend not to be loyal to any platform unless it provides most benefits to them. The SushiSwap $800M liquidity “steal” from Uniswap always remains a practical case study for the DeFi industry.

Executive Summary

Projection Milestones

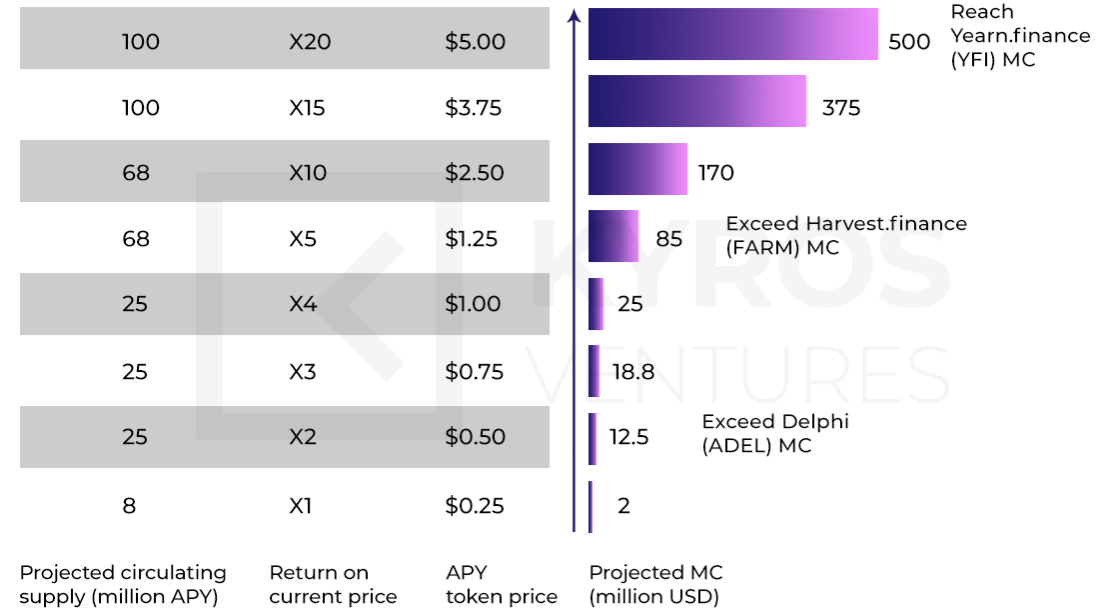

Note: This projection evaluation method considers both the APY token price and the APY circulating supply as variables. This is an accurate representation since both are subject to change over time.

- At the time of writing, the circulating supply (CS) is 8M APY, and the market cap (MC) reaches $2M

- Right after the IDO, we expect 25M APY tokens will be in circulation. Considering the price may rise modestly due to the current hype (x2-4), MC could be in the range of $12.5M to $25M

- One year after the launch, when strategic and seed round investors’ tokens are fully released, APY CS will be around 68M APY. APY then has a chance to surpass FARM’s MC

- At full token release, the CS will be 100M APY. APY token price may potentially reach $5 per token, giving it a circulating market cap in line with YFI’s MC and in the vicinity of $500M

Figure 5 presents the different possible scenarios determining the potential APY market cap and the associated return on investment (ROI) in the future.

Concluding Remarks

The APY.Finance’s advanced solution seems like a necessity if the yield farming industry is to grow and lead the DeFi adoption trend. The Kyros Research team is bullish on this project, and we believe that the crypto enthusiasts and investors alike will also be able to understand its potential.

Taking into account APY.Finance’s favorable metrics versus comparable projects with a higher market cap (e.g. Yearn.finance), we would be extremely surprised to see this token stay under $0.5 at the IDO in the tail end of 2020.

Due to the volatile nature of the crypto markets, short term price estimates are difficult to establish. We, however, expect to see the APY token price soar to $2 – $2.5 in the mid-to-long term, giving it a circulating market cap in the vicinity of $170M.

Even higher token price milestones are feasible in the long term, our most bullish prediction envisaging APY potentially reaching the Yearn.finance’s market cap in the future. Taking into account that the total market capitalization of the liquidity aggregator segment of the crypto market is relatively small compared to that of the DEX and lending segments, APY.Finance definitely has a promising future ahead.